Meat & Livestock Australia’s (MLA) industry projections were released this week, and there was no improvement to supply outlooks. In fact, slaughter rates and flock numbers that have come to light so far this year, will see supply stripped back further for the next couple of years.

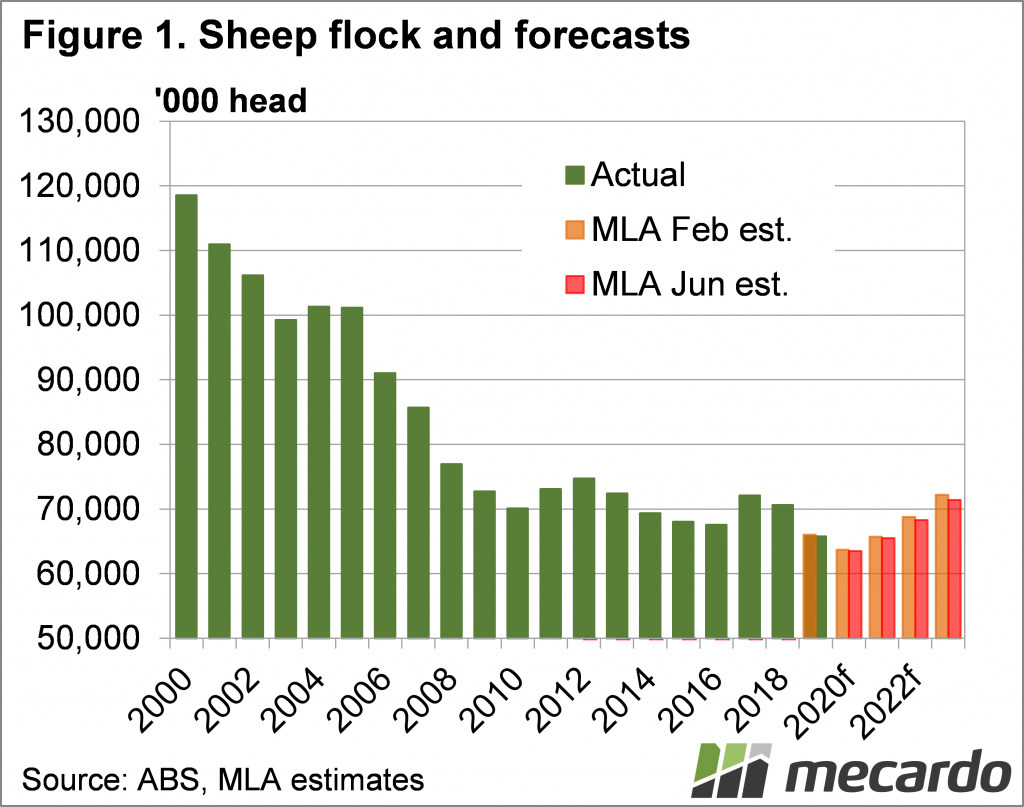

The National Sheep flock was already forecast to hit a low not seen in over 100 years and the Australian Bureau of Statistic (ABS) official number for June 30 2019 came in at 259,000 head, or 0.4%, lower than the February estimate. As such MLA stripped another 200,000 head out of the 2020 forecast it made in February.

MLA now expect the flock to hit 63.5 million head on June 30, down 3.5% on 2019. Last year was the lowest flock in over 100 years, but 2020 is going to better it, so to speak.

MLA’s flock estimates were decreased by similar amounts out to the 2023 flock. By 2023 the flock is expected to have recovered back to 2017-18 levels. We can see in figure 1 that the flock can rebound sharply. From 2016 to 2017 the flock gained 4.6 million head or nearly 7%. The forecasts are putting flock growth at 3 to 5%.

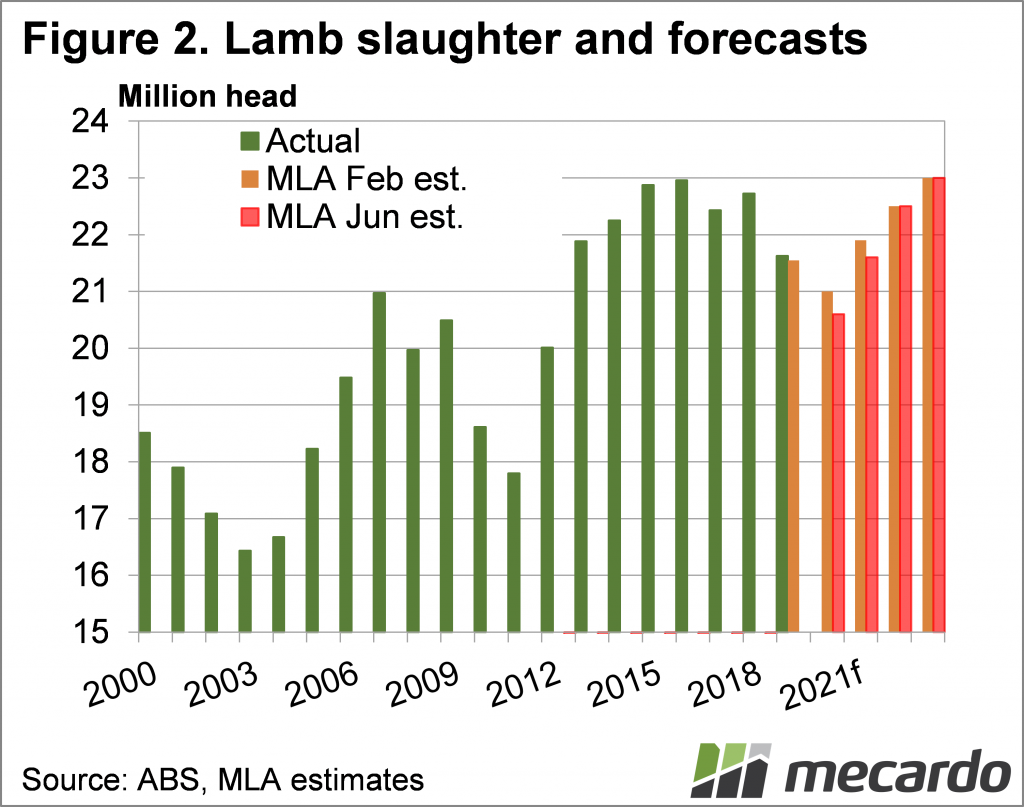

The lower flock and the very tight lamb slaughter rates for the year to date, saw slaughter estimates also adjusted down for the June projections. Figure 2 shows lamb slaughter is still set for an 8 year low in 2020, but it is 2% lower than the previous forecast.

After close to a 5% fall in 2020, lamb slaughter is expected to bounce back to 2019 levels in 2021 and reach record levels in 2023 of 23 million head.

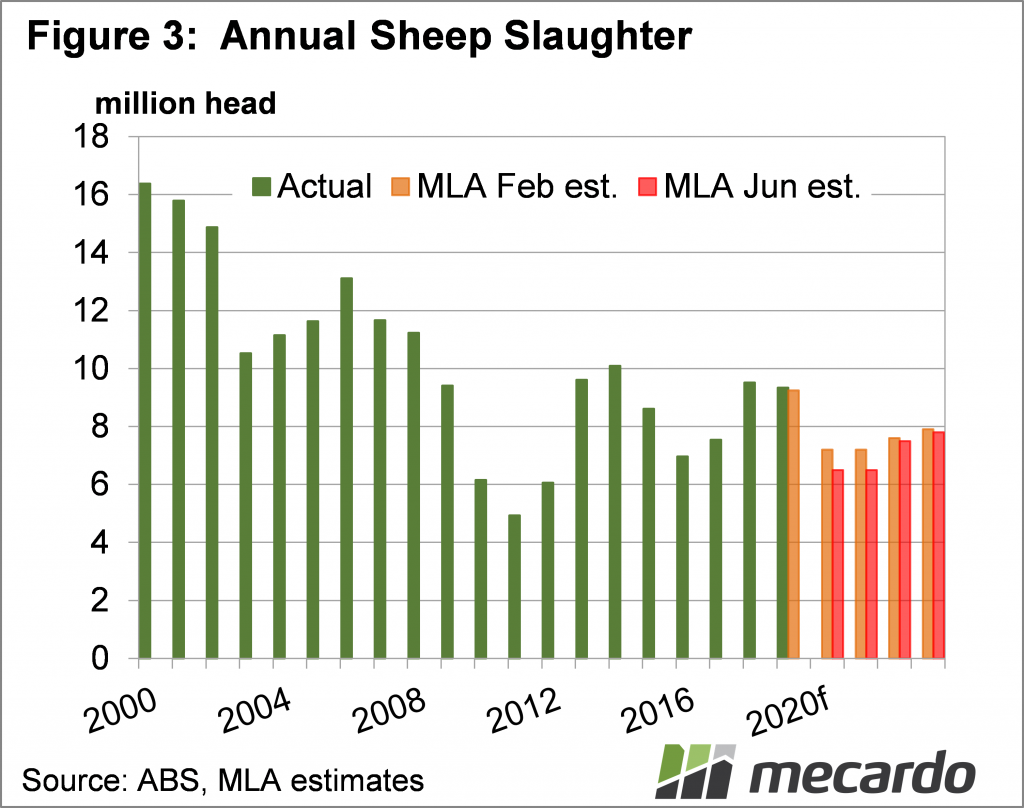

With the rain and subsequent lower sheep supply for the year to date, it is sheep slaughter forecasts which have taken the biggest hit. Sheep slaughter for 2020 and 2021 was decreased by 10%, both to eight year lows of 6.5 million head. An extra million head is expected to go over the hooks in 2022 and 2023, but it is hard to see sheep slaughter getting back to the highs of 2018 and 2019.

What does it mean?

Much of the decrease in lamb supply this year has already been accounted for, and MLA expects strong growth in 2021. This suggests we might be seeing the last of lower year on year lamb slaughter, and as such, the growth in prices.

On the other side of the coin, we have sheep slaughter which is expected to be very low for two years, and won’t recover to the levels of recent years for at least four years. This will no doubt support sheep prices in general, as will the flock rebuild.

Have any questions or comments?

Key Points

- MLA’s sheep industry projections have wiped more supply from the coming years.

- Lamb slaughter and the flock is expected to recover in 2021, but sheep slaughter will take longer.

- Supply driven price rises for lamb are likely to ease, but sheep supply will support the complex.

Click on graph to expand

Click on graph to expand

Data sources: MLA, Mecardo