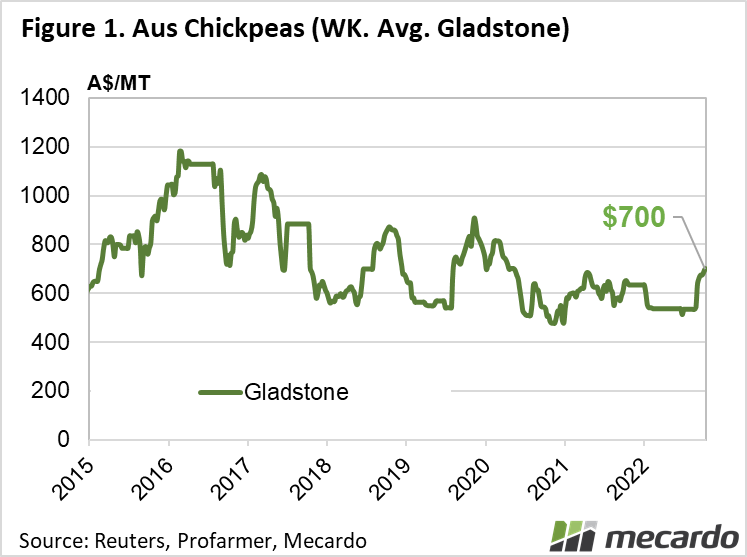

Australian desi chickpea prices, ex Gladstone have risen $144(26%) in the last month. What has caused this rise, and what is the outlook for the 2022/23 season?

Gladstone Desi CHP1 prices are currently bid at $700/ton. (figure 1) Further south, in Brisbane however, prices are trading at around $600/ton. The reason for this apparent location premium is, in fact more likely to be due to the predominant variety grown around Gladstone, Kiabra, which is generally more visually appealing, and therefore more suitable for the Bangladeshi marketplace. Bangladeshi buyers are generally highly discerning, and demand detailed photos and samples because while shipments may technically meet CHKP1 grade, some Australian shipments have not met the expectations of Banglaseshi end consumers.

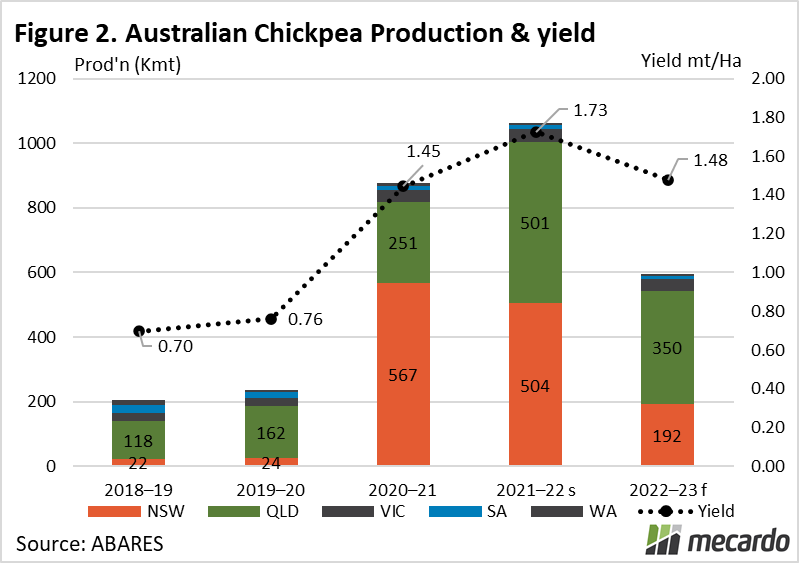

The latest December ABARES crop outlook predicts that Australian production of chickpeas will reach 595kt for the 2022/23 marketing year; over 40% down from 2021/22 production of 1.06mmt. (figure 2) Compared to the September estimate of 616kt, the production forecast has been reduced 21kt; or 3.5%. Reports on the harvest indicate that yields have been reaching up to 4t/ha; but mould ha been an issue with quality downgrades in potentially 60% of the crop to CHKP2 and below; as opposed to the premium CHKP1 grade. ABARES downgraded the NSW crop estimate 60kt(24%) to 192kt, however widespread floods in the Naomi and Gwydir valleys, the states two largest chickpea growing regions raise questions about whether that estimate is on optimistic side. Adding to the supply side though; is a big carryover of old crop estimated by the trade at 150-250kt.

However, to determine the outlook for the 2022/23 marketing season, we need to look towards India, which is the worlds largest producer and consumer of desi chickpeas; and; judging by their solid planting numbers alone, they are looking set up to potentially harvest a much larger crop than last year.

Data from the Indian department of Agriculture and Farmers welfare indicates that that Indian farmers have sowed 880,000 hectares of pulses for the rabi crop; up 48.7% from the same time last year. The majority of the pulse planted area is chickpeas, at 696,000 hectares, or 79%. To put this in context, this year’s Indian chickpea harvestable area is 69% higher than in the 2021/22 year.

The minimum support price for Indian gram; aka. Chana (chickpeas) 2022/23 has been set at 52300Rs /ton, which translates to around $1,005 AUD/ton; while the 2023/24 price was announced to be 53350/ton ($AU 1,026/ton)

As a result of the solid crop expectations in India, it is unlikely that the Indian government will lift the existing 66% tariff on imports of Australian chickpeas, which has the impact of constraining demand.

According to Ag Pulse Analytica; USA 8mm chickpea prices are sitting at US$1,137/ton ($1,682 AU / ton); while in Canada, the FOB Vancouver price is at US$689/ton. (AU $1,020/ton)

Australian Desi chickpeas, ex SYD/Brisbane are quoted at US$450/ton ($AU662/ton) while the price of desi chickpeas in Mumbai, India sit at 45580RS/ton (AU$873/ton)

Import Demand for chickpea imports exists within the UAE and Egypt- earlier in the yar, India achieved several new monthly records for chickpea exports; shifting 49kt in June 2022- ten times that of June 2021. Indian exports have typically been of the large Kabuli type, but that has changed; with activity in the desi variety also.

Container freight rates are relevant to the competitiveness of Australian desi chickpeas- earlier in the year, costs were prohibitive, however, the situation has improved since, with rates reportedly dropping in the region of 40%, which has been driven by reduced freight volumes being shipped from China to the EU and US, increasing capacity on secondary routes covering south east Asia and the middle east. Robert Ayre, of Peters commodities commented that container rates were operating as high as the US$250/ton mark ($372 AUD/ton), which was triple the rate exporters were used to, but have since fallen to around US$150/ton ($225 AUD/ton). Other traders have commented that some destinations like Yemen have become extremely expensive however, hitting up to $600 AUD / ton. In addition, road freight costs from up country to port have in many cases risen up to 70%, leading to costs of up to $100/ton to get freight to port in some cases. Umang Bagaria, Director at Mandala trading, stated that a trend toward 5-8% lower test weights this season have not helped, as less tonnage is able to be loaded into containers and trucks.

Container packers are paying around $550/ton for No. 1 grade desi chickpeas delivered Darling Downs, with less than a $15 spread between new and old crop. For downgraded chickpeas impacted by moulds, over a $100 discount is applicable, with prices dipping as low as $400/ton at some upcountry sites.

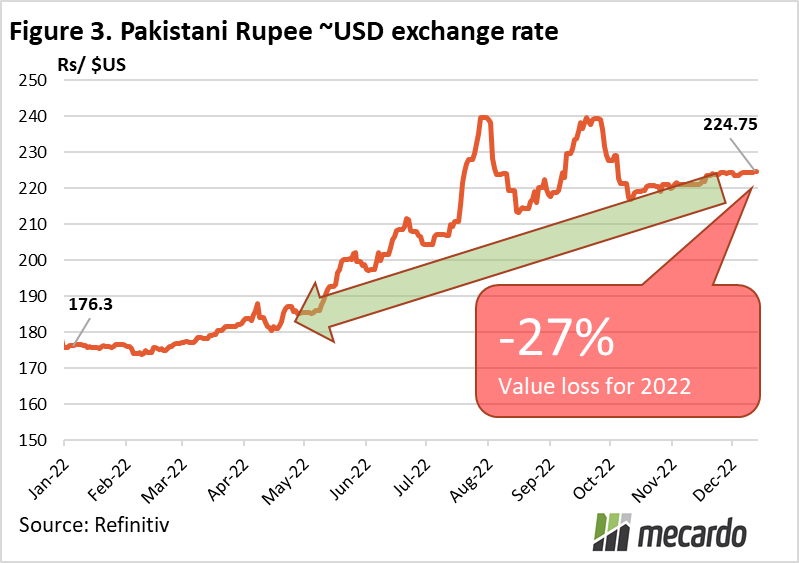

Flood events in Pakistan from June onwards which displaced over 8 million people have created a source of demand as the Pakistan government works to provide emergency support to its affected people, as food agricultural land in affected areas remains inundated; and many livestock have perished. It is estimated that 14.6 million people will require emergency food assistance in the December 2022 and March 2023 period. However; there have been reports that payment defaults by Pakistani buyers have become an increasing problem in recent times; meaning that many Australian traders are more reluctant to transact, and Pakistani’s unable to buy. According to Umang Bagaria, Director at Mandala trading, many defaults can be traced back to technical banking problems because of a shortage of US dollars within the Pakistani monetary system. Compounding the problems, the Pakistani government has specifically restricted overseas payments. Accepting the Pakistani rupee instead is risky, as it’s value is unstable, and has fallen 27% just in the last year. (figure 3) The foreign exchange issues are known to be widespread across many countries in the developing world, including Egypt and Bangladesh, where banks are struggling to issue letters of credit required to support imports; with the problems stemming from rising trade deficits caused by high crude oil and bulk commodity prices.

What does it mean?

Overall, the outlook for the desi Chickpea market is fairly flat for this season for several reasons; constrained demand coming out of developing countries such as Pakistan and Bangladesh due to a severe shortage of US dollars; India unlikely to drop its high import tariffs, and a significant carryover of old crop, mostly downgraded chickpeas from last year estimated between 150kt and 250kt. Expect a solid premium for top CHKP1 quality, particularly Kiabra varieties, as it’s estimated that 60% or more of the crop is likely to be downgraded. Elevated road freight rates are also driving a premium for delivery to port, so if you have your own truck, it’s worth doing the sums on transporting it further.

Have any questions or comments?

Key Points

- CHKP1 Chickpea prices now quoted at $700/ton; ex gladstone, but quality and location is king, with upcountry prices for downgraded product as low as $400/ton

- Container freight costs have reduced, but hikes of up to 70% in road freight costs have been consistently reported driving premiums at port.

- A sizable Indian crop makes it unlikely that the Indian government will lift steep 66% tariffs that protect their domestic farmers from Australian imports.

- US dollar shortages in developing economies like Pakistan and Bangladesh are causing technical creditworthiness problems, putting a brake on both demand, and Aussie traders’ willingness to supply to these countries.

Click on figure to expand

Click on figure to expand

Data sources: ABARES, Refinitv, Mecardo