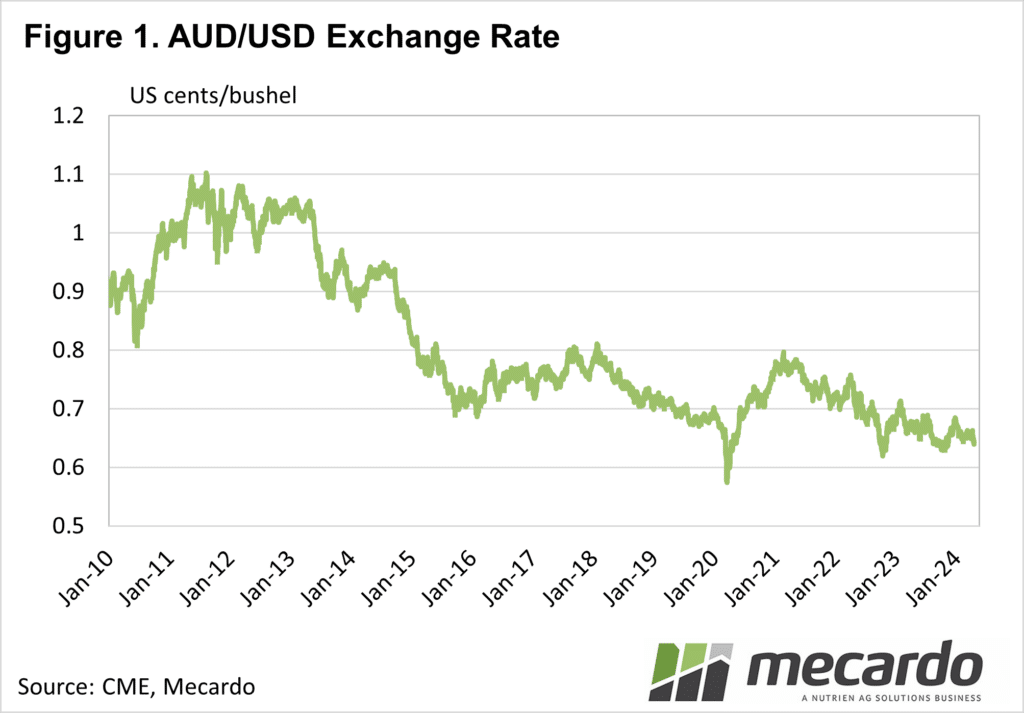

The exchange rate has been in the news lately, with the Australian dollar falling to a six-month low last week. Given this, we thought it was time to revisit how exchange rates can impact the price of grain commodities here.

Figure 1

shows the Aussie dollar has steadied in 2024, but broadly continues the

downward trend that started early in 2021.

Apart from a couple of dips, the under 64US¢ levels reached last week are

about as low as the exchange rate has been since the early 2000s.

The dips in

the AUD/USD exchange rates were due to the Global Financial Crisis in late

2008, and COVID in 2020. The current

decline is due to more economic factors like trade and interest rates. Exchange rate analysis is not typically a

focus of our analysts but we do know that a weak exchange rate is good for our

commodity prices.

As

Australia produces an exportable surplus of its major commodities, it competes

with other major producers for business.

The USA is a major exporter of wheat and oilseeds, and as such our

exchange rate against the US can be a major driver of prices.

All else

being equal, the 1.5US¢ fall in our exchange rate last week added $7 to the

wheat price here, while it was still the same price for our customers. The lower exchange rate is one of the reasons

wheat has found a little strength in the last week.

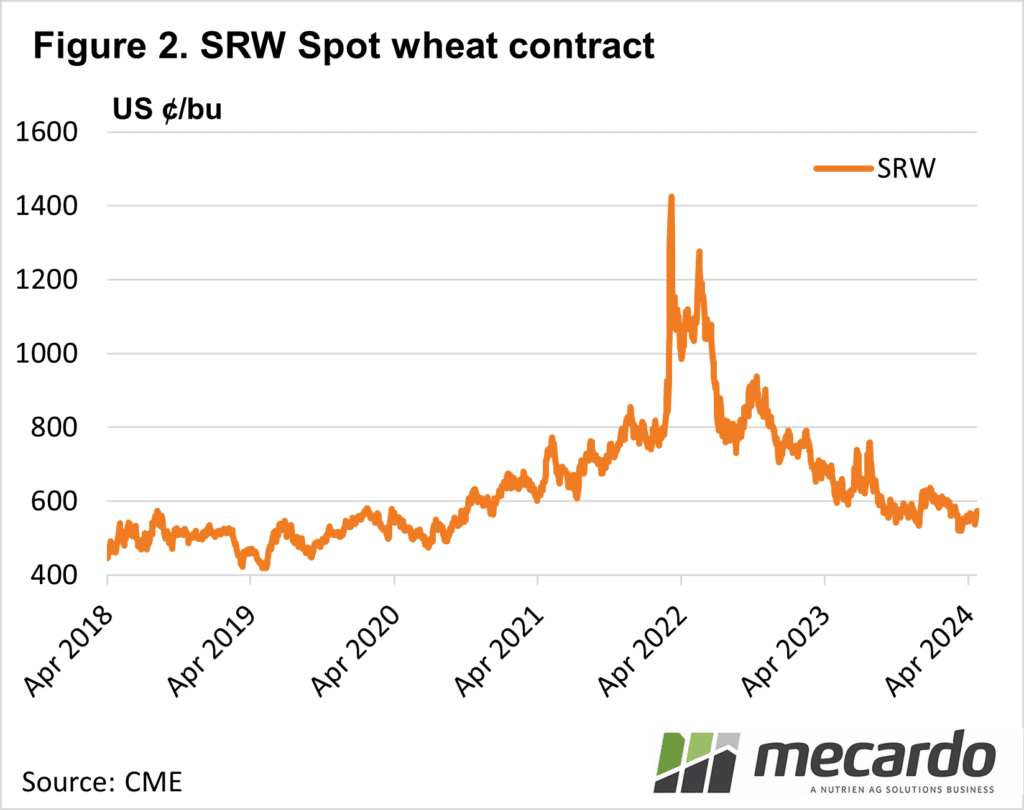

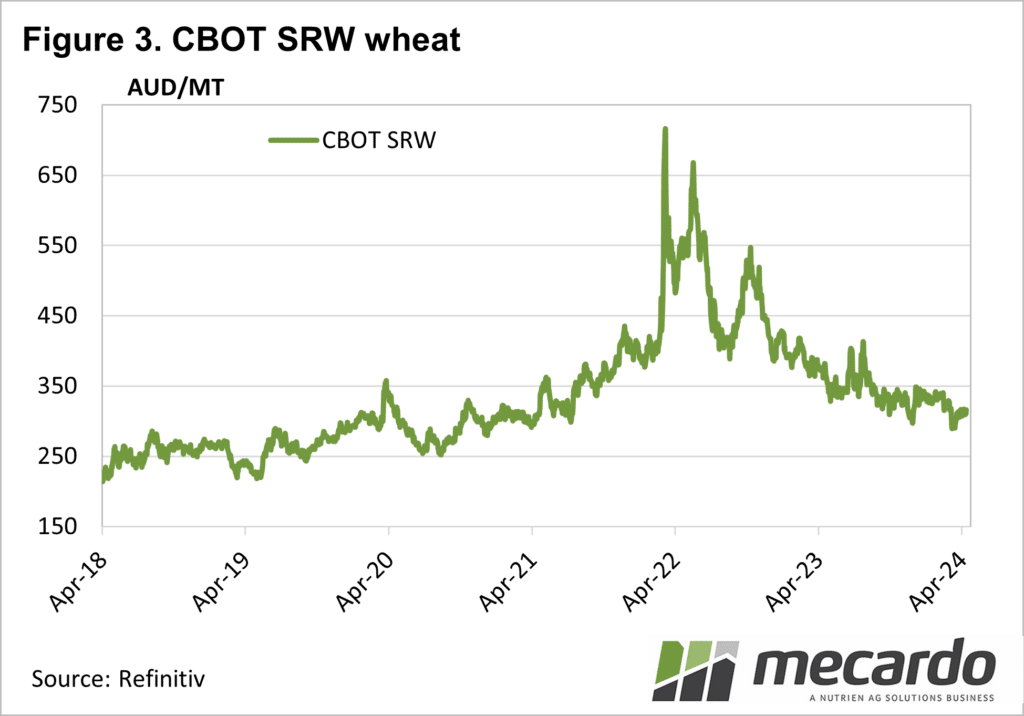

The lower

exchange rate is currently making prices which in US terms (Figure 2) are at four-year

lows, at just two-and-a-half-year lows in our terms (Figure 3).

Lower

exchange rates are not all good news. With

machinery, diesel and fertilizer all largely imported, a weaker exchange rate

means we pay more for these inputs. All

are historically expensive at the moment, and the exchange rate is not helping.

What does it mean?

Unless you are heading on a holiday to the US, crop producers should be welcoming lower exchange rates, as it will generally add to the bottom line. Any increases in exchange rates would be of concern however, as we can see that any significant movement would quickly push wheat prices below $300/t and into what is now marginally profitable territory.

Have any questions or comments?

Key Points

- The Australian dollar fell last week, which added some strength to local grain prices.

- With the Aussie dollar at close to 20-year lows, it is propping up commodity prices.

- The lower Aussie dollar also makes inputs more expensive but is largely positive for grain growers.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: Refinitiv, CME, Mecardo