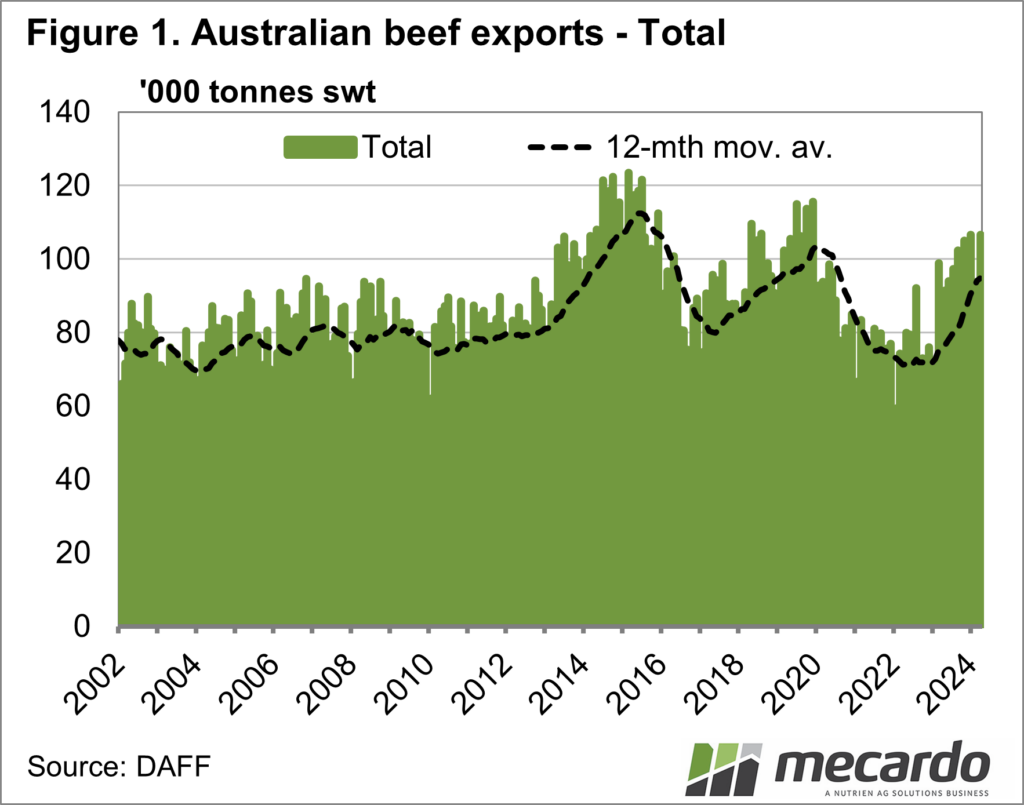

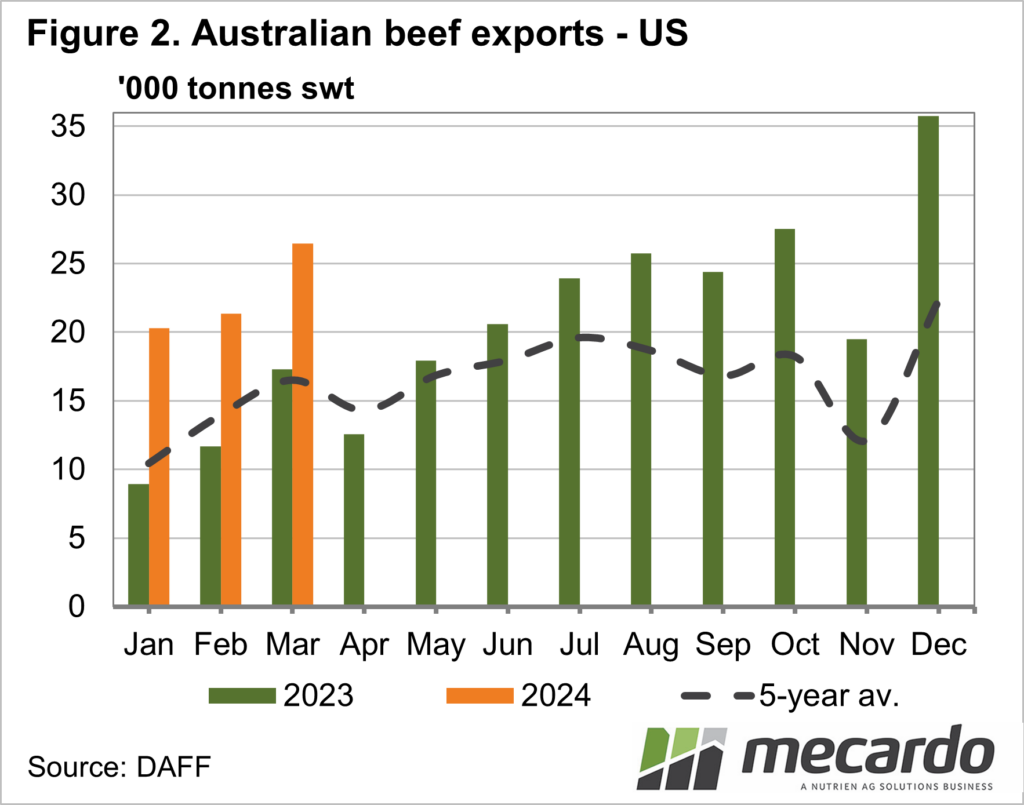

The long-predicted slowdown in US beef production has seemingly come into play this year, and Australian beef is filling some of the production gaps. Total Australian beef exports for the first quarter of 2024 are up 25% year-on-year, and exports to the US are up 80% for that same period. We have to go back nearly a decade to 2015 to find beef export figures higher for the month of March, and that was also the last time volumes for the first quarter were higher.

The US is currently

taking up just shy of one-quarter of the market share of all Australian beef

exports, and again this is the largest this figure has been since 2015. Total

Australian beef exports only lifted 8% year-on-year for the month of March, but

volume to the US was up 53% compared to March 2023. With more than 26,000

tonnes headed to the US in March, this was 38% above the five-year average for

the month.

Falling cow slaughter

and therefore beef production – specifically lean beef production – is behind

the extra demand, Again we have to go back a full decade to 2014 to see a time

when US total beef inventory was lower than it was at the end of January,

according to the Steiner Consulting Group. US cow slaughter fell 15%

year-on-year for the month of March, and there is no indication this will turn

around in the near future.

After lifting 10% in

2023, Steiner estimates total US beef imports will increase a further 8% this

year, and they expect imports for Australia will be up 20%. Also assisting

Australian access to the US market is Brazilian beef having run out of quota,

with the higher tariffs meaning Brazil exported 14% less beef to the US in

March than in 2023.

Plenty of Australian

supply – and this US demand – means total beef exports are tracking at 18%

above the five-year average for the first quarter of 2024, but the other major

markets were actually below average for the month of March. Still tracking

better year-on-year in Japan, however, up 3% from 2023 in March, and 25% for

the year-to-date. China took 17% less Australian beef in March but remains

higher for the January-March period. South Korea, however, received 25% less

Australian beef in March, which has taken 7% less since the start of the year.

What does it mean?

A herd rebuild and subsequent cow slaughter dip has long been on the cards for the US, and it looks to have finally arrived. Having come at a time when Australia has plenty of supply is a boon for our beef exports and we can clearly see the positive impact it is having on volume throughput. The US imported beef price is also strong – at a four and half-year high – which is no doubt encouraging as much product as they will take in that direction and might go some way to explain the lull in other major markets.

Have any questions or comments?

Key Points

- Australian beef exports rose 25% year-on-year in the first quarter and were 18% above the five-year average.

- US imports of Australian beef rose 58% for the month of March as their domestic production dips.

- Beef exports to the South Korean and Chinese markets were below average for March.

Click on figure to expand

Click on figure to expand

Data sources: Meat and Livestock Australia; Steiner Consulting Group, Mecardo