The news regarding the Chinese barley tariff moved off the regional channels this week and made it into the mainstream, such was the political significance. For barley producers and consumers, it’s much more important, here we take a look at what it could mean for prices.

Back in March 2020, China imposed prohibitive tariffs on Australian barley imports supposedly in response to our Government calling for an investigation into COVID’s origins. The tariffs were so extreme they halted the trade and caused barley prices to fall $70 per tonne overnight.

After bouncing along the bottom for a while barley prices started to recover, with the war in Ukraine giving them a massive boost. Since the harvest of 2022-23, Australian Barley (BAR) prices have largely moved sideways.

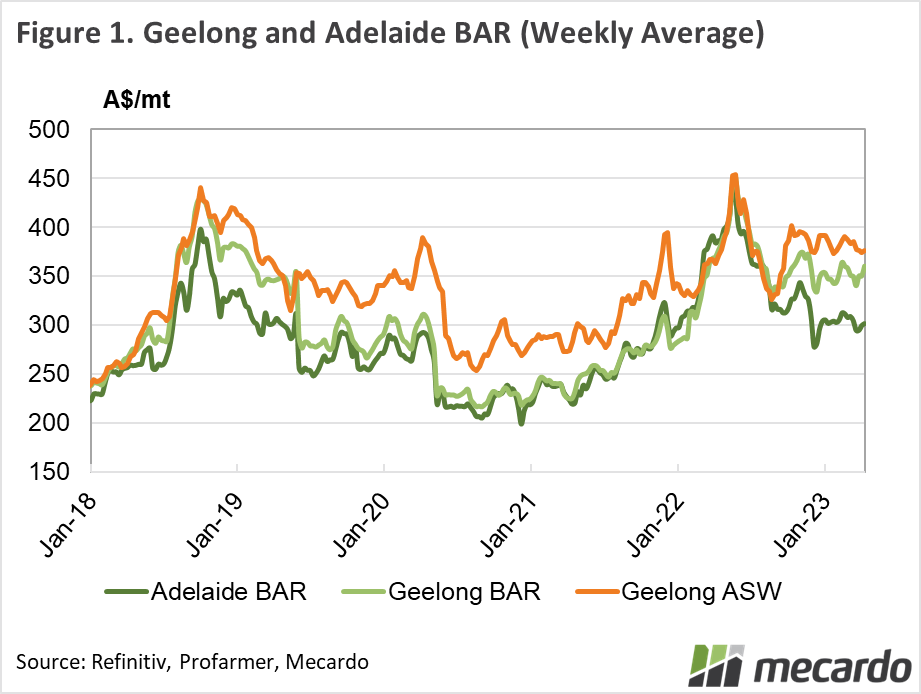

Figure 1 shows how the Geelong BAR price compares to Geelong Australian Standard White (ASW), and Adelaide BAR. Geelong BAR isn’t all that cheap relative to ASW. The new or expanded markets for barley, along with local feed demand on the east coast have barley priced close to its average historical discount to wheat.

In markets that rely more heavily on exports, barley is cheaper this year. The Adelaide BAR price has hovered around $50 below Geelong since harvest. The malt barley price in Adelaide has been close to the BAR price at Geelong when historically it has usually traded at a strong premium to feed.

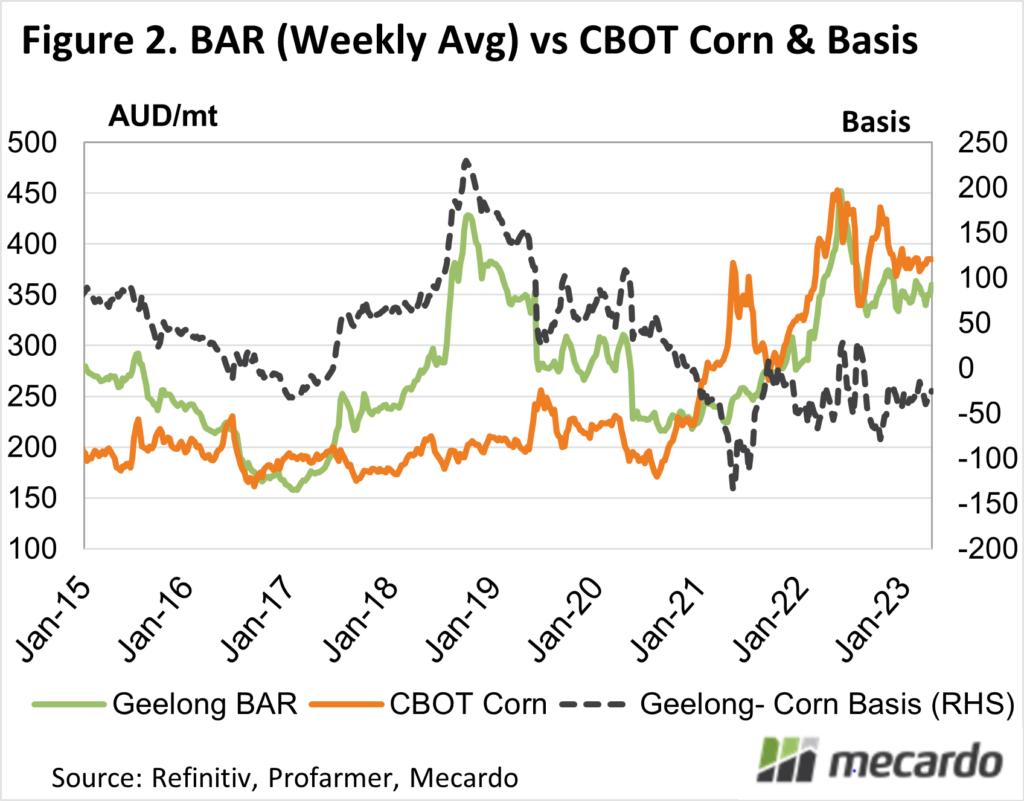

If we look at barley relative to other feed grains, it remains relatively cheap on an international measure. Figure 2 shows Geelong BAR and Chicago Corn Futures, with both trading relatively closely for the last year.

Historically Australian barley has traded at a premium to corn, except when there is a big surplus. We have had a big surplus for the last three seasons, which would be expected to depress prices relative to international values. If the Chinese market was reopened, however, it would likely see our barley move back to a premium to corn.

What does it mean?

Barley prices have been quite acceptable over the year or so, having recovered from the collapse. They would have been better, however, if the market had access to China. This is especially the case for malt barley and for major exporting zones of South Australia and Western Australia.

If the trade is reopened in time for the next harvest we would expect barley prices to be higher relative to wheat and corn. Where exactly the price will sit depends on many other factors apart from the trade with China.

Have any questions or comments?

Key Points

- There is promising talk regarding the barley trade with China reopening.

- Barley prices have been ok, but at a larger than normal discount to wheat and corn.

- There is an upside for barley in a relative sense, especially in major export zones.

Click on figure to expand

Click on figure to expand

Data sources: Refinitiv, Profarmer, Mecardo