The official Australian Bureau of Statistics (ABS) slaughter figures are now coming out quarterly, and a fortnight ago the September stats came out. They confirmed 2020 is heading for an eight-year low in both lamb and sheep slaughter, but large increases look unlikely.

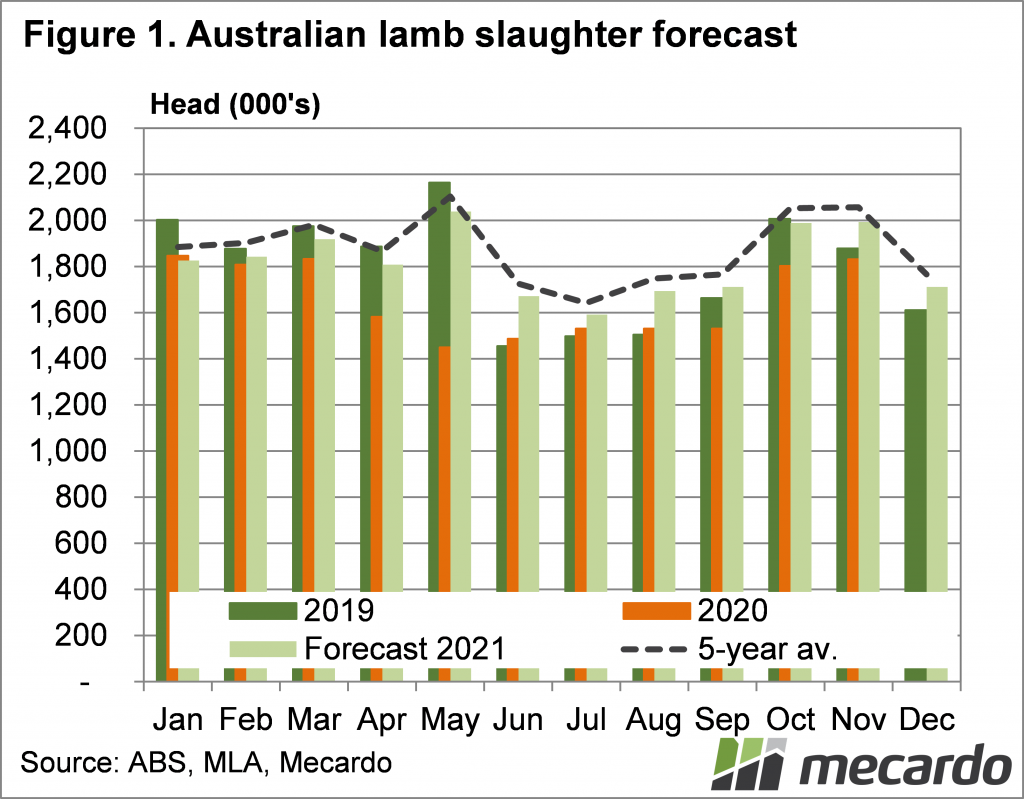

September quarter lamb slaughter changes were relatively benign on the national scale, but this masked some large changes within the states. National lamb slaughter was 1.6% lower than the June quarter, and 1.6% lower than 2019. Figure 1 shows the September quarter figures averaged over the three months, with levels still well below the five-year average.

Remember the Victorian COVID-19 slaughter restrictions; they did have an impact. Victorian slaughter was down 7% on the June quarter, and 13.5% on September 2019. The low Victorian numbers were almost fully offset by an 8.5% year on year increase in NSW and 42% in SA. Both NSW and SA were up close to 15% on the June quarter, as NSW moved close to full capacity, and SA didn’t fall to its usual winter lows.

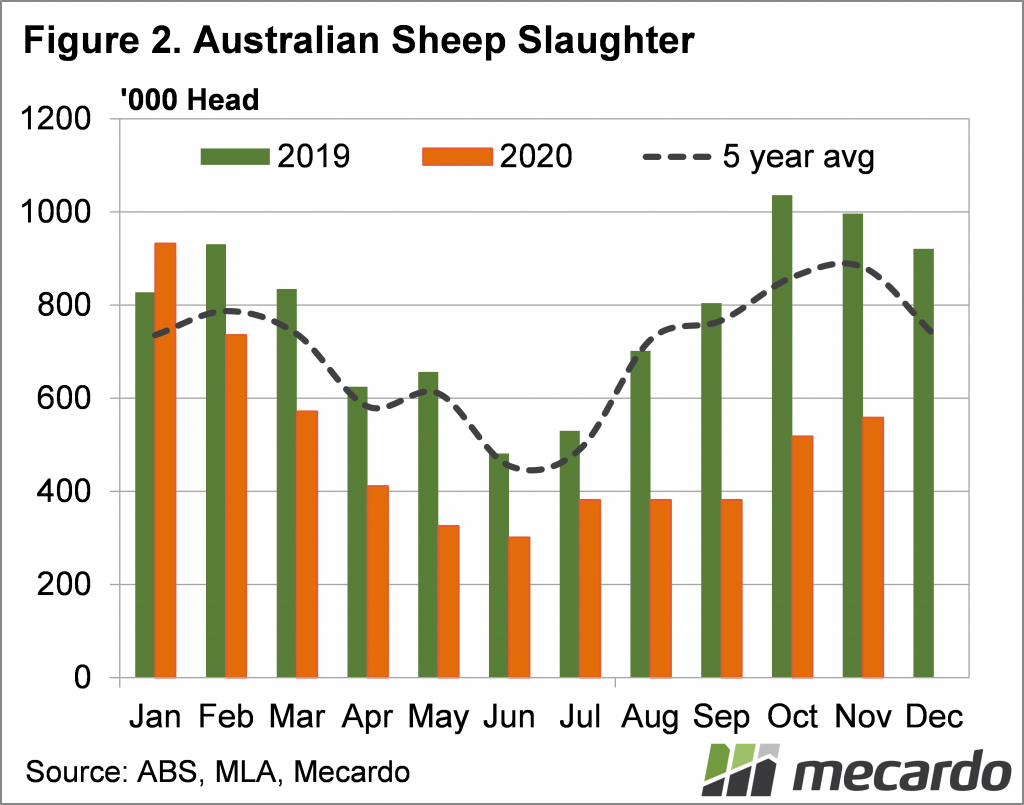

Sheep slaughter lifted in the September quarter, breaking out of its June quarter lull. National sheep slaughter was up 10% on June, but down 44% on September last year (figure 2). WA slaughter was up 41% on the June quarter, and ‘only’ down 13.5% for September. With WA accounting for 31% of national sheep slaughter in the September quarter, compared to 20% last year, it is the West propping up mutton supplies.

We can estimate monthly lamb and sheep slaughter levels for October and November using Meat and Livestock Australia’s weekly figures. It looks like both sheep and lamb slaughter have lifted in October and November, but are still behind last year’s levels. Sheep slaughter isn’t much more than half of last year’s levels.

Since July around 330,000 fewer lambs have been slaughtered, which is around a week’s slaughter. At this stage it looks like the lower levels are due to fewer lambs on the ground, along with restocker demand for ewe lambs for breeding.

What does it mean?

The good news for lamb producers is that slaughter for the financial year to November hasn’t been that far behind last year. This means it’s not likely a big flush of lambs will appear in the New Year depressing prices. The 2021 forecast on figure 1 looks like holding true.

For sheep there doesn’t appear to be any chance of a significant increase in supply in the medium term, which will support both sheep and lamb prices.

Have any questions or comments?

Key Points

- ABS slaughter figures for September were well down in Victoria, but offset by NSW and SA.

- WA propped up sheep slaughter in September, but national numbers were still well down.

- Lamb supply in the New Year should be close to 2019, but sheep will continue to be tight.

Click on graph to expand

Click on graph to expand

Data sources: MLA, ABS, Mecardo.