There is a wide spread of prices that Aussie beef achieves across its various export destinations, but exactly which countries have historically been paying top dollar, or budget prices?

Australian’s have no chance of eating all the beef our country produces, even if we had a BBQ for breakfast, lunch and tea, so trends in export markets are a subject we watch carefully. A lot of attention is put on the volume of beef that we export to various countries, but price is also important- and an area that is a bit neglected, despite the fact that it’s the international prices for beef that really dictate what can sustainably be paid to producers over time.

You have probably heard that some markets are “premium”, while others are “budget” destinations for our product, but let’s put some actual numbers against them.

While the main behemoths in the market for Aussie beef by volume are the US, China, Japan and South Korea, higher price premiums seem to be being paid in the smaller, niche countries indicating that specialized export markets may contain significant premiums to be captured, though the volume is not particularly significant in the scheme of things.

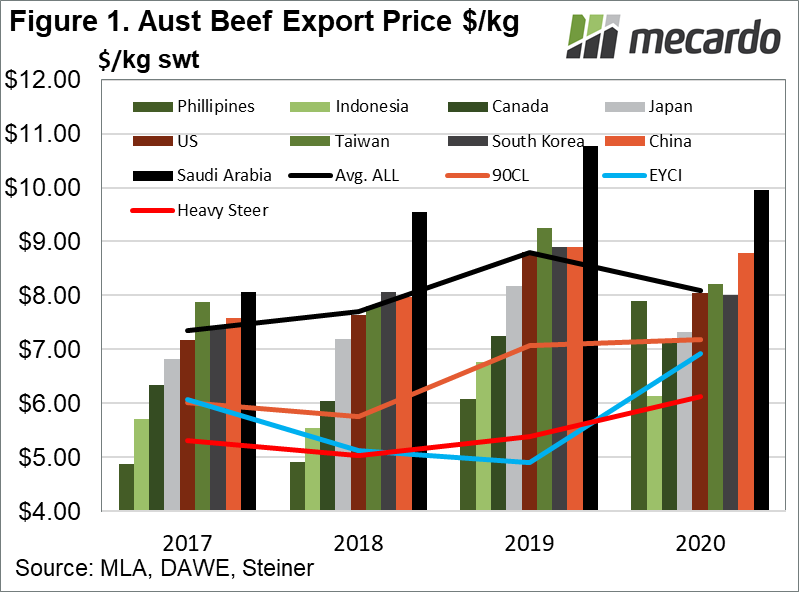

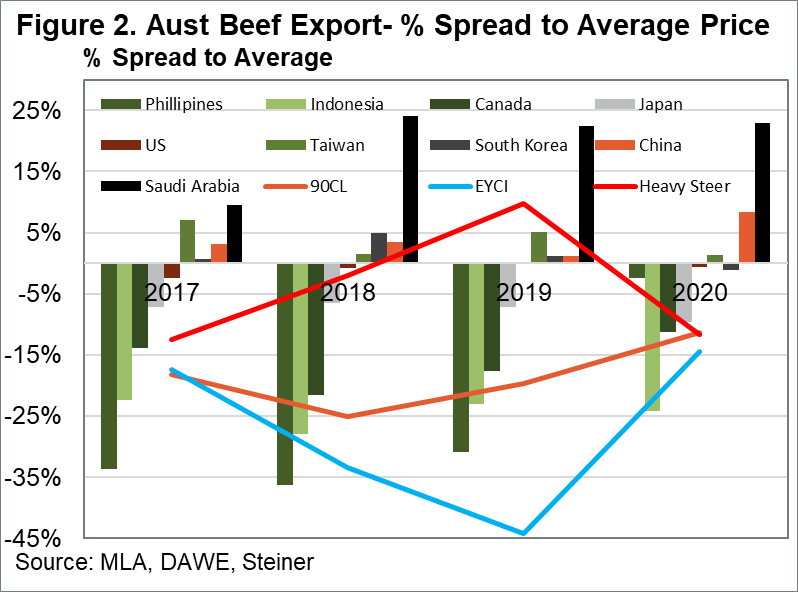

Saudi Arabia holds the crown as the top premium major destination for Aussie beef, (Figure 1) paying the most in 2019, at an average $10.77 / Kg shipped weight (swt), representing a 22% premium to the average (Figure 2), followed by China and South Korea, both on par at $8.90/ Kg swt , and the US, at $8.80 / Kg swt. However, Saudi Arabia only represents a relatively tiny high value export market, as the volume of 10Kt or so that we send there yearly is less than 5% of what we export to China alone.

Despite the fact that when we think about the US export market, ground burger mince springs to mind immediately, the average export price of $8.80 /$Kg Swt was at a 24% premium to the 90CL (grinding beef) price of $7.07 in 2019. This indicates that a good portion of US exports sit in the premium category, so there is a lot more to this market than hamburgers. However, when we move across to 2020 year to date, the premium to 90CL’s 2020 price of $7.18 of has slipped to only 12%. This can be explained by the impact of COVID-19 on premium foodservice channels.

The countries that have historically been paying the lowest, or budget prices for Aussie beef are the Philippines at $6.08/ Kg swt, Indonesia $6.77, Canada $7.24 / Kg swt and Japan $8.17 / Kg swt. in 2019. The price paid by the Philippines in year to date 2020 has taken a major turnaround, from consistently being the cheapest destination by a mile for years at a 30%+ discount to the average Australian export price, to closing the gap rapidly, to only 2% below average, which is higher than that currently being paid by Japan.

Again, with the exception of Japan, individually, these lower value markets are all minnows in terms of volume compared to our key beef trading partners, though collectively, Indonesia, Canada and the Philippines accounted for close to 100,000 metric tonnes of beef exports in 2019, or 8% of total exports by volume. As such, the main, relatively budget destination for Aussie beef to watch the price of is Japan, which represents around 25% of our exports by volume, so any changes in the price they pay has the potential to have a significant impact on producers in Australia.

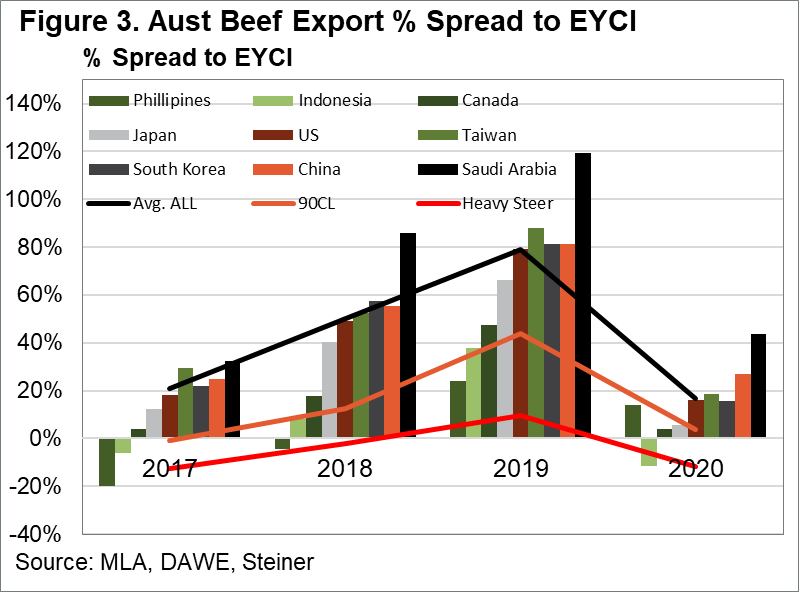

There has been talk recently that Australian beef is currently the most expensive in the world. If we compare the price achieved for our exports, to the EYCI and heavy steer prices across time (Figure 3) we can see that the spread between what producers receive for cattle, and what processors can sell beef for internationally has essentially collapsed, across all export destinations.

In 2019, export prices were, on average, at an all-time peak of 80% higher than the EYCI, while now in 2020, this margin has reduced substantially to only 17%. To put this into perspective, this is a level that has not been seen since 2016, and is less than half the 45% average we have seen over the past 10 years. At Mecardo, we regularly run calculations on estimated processor margins, and right now, these are deeply negative.

For Australian beef export volumes to continue to be sustainable in the longer term, the price of cattle must come down, or export prices must rise. Given Australia’s competitive position worldwide, and global growth stuttering and falling due to COVID-19, it is most likely going to have to be the former in the medium to long term.

What does it mean?

While there is a substantial spread of average prices paid, from super budget, to ultra premium for Australian beef across all our export destinations; the top countries from which Australian beef fetches premium prices are largely our key trading partners by volume, which include China, South Korea, and the US. While niche destinations such as Saudi Arabia and Indonesia do occupy super premium or, conversely, budget segments in the marketplace they are important for our diversified customer base. The economic fortunes of our key partners, which largely dictates their demand for beef, and ability to sustainably pay good money for the Australian product is one to watch, especially in the current environment.

Have any questions or comments?

Key Points

- Saudi Arabia pays top dollar, ~$11/Kg, but is a small market

- The Philippines has been the most budget destination, at $6.08, but this has changed rapidly in 2020.

- The spread between export prices and the EYCI has collapsed in 2020 from 80% to only 17%, indicating processors are probably losing money.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: DAWE, MLA, Mecardo