After the Foot and Mouth induced price decline back in mid winter cattle and lamb markets have forged different paths. Continued strong demand and tight supply has seen cattle bounce, while lambs have trended sideways. Here we look at the spread and what it might mean going forward.

Even a brief glance at cattle and lamb indicators will have growers thinking about the widening spread. Traditionally cattle and lamb prices will move together over the long term. Australia has a lot of grazing country suited to either sheep or cattle. A strong premium for one livestock category will see a slow shift towards producing that type of livestock, and a shift in supply profiles.

There are similar impacts on the demand side of the cattle and lamb equation. If beef becomes more expensive at retail level, consumers will buy more lamb, and less beef. Eventually this will see prices converge.

The time it takes to build herds or flocks means that we tend to see large overcorrections in cattle and lamb relative prices.

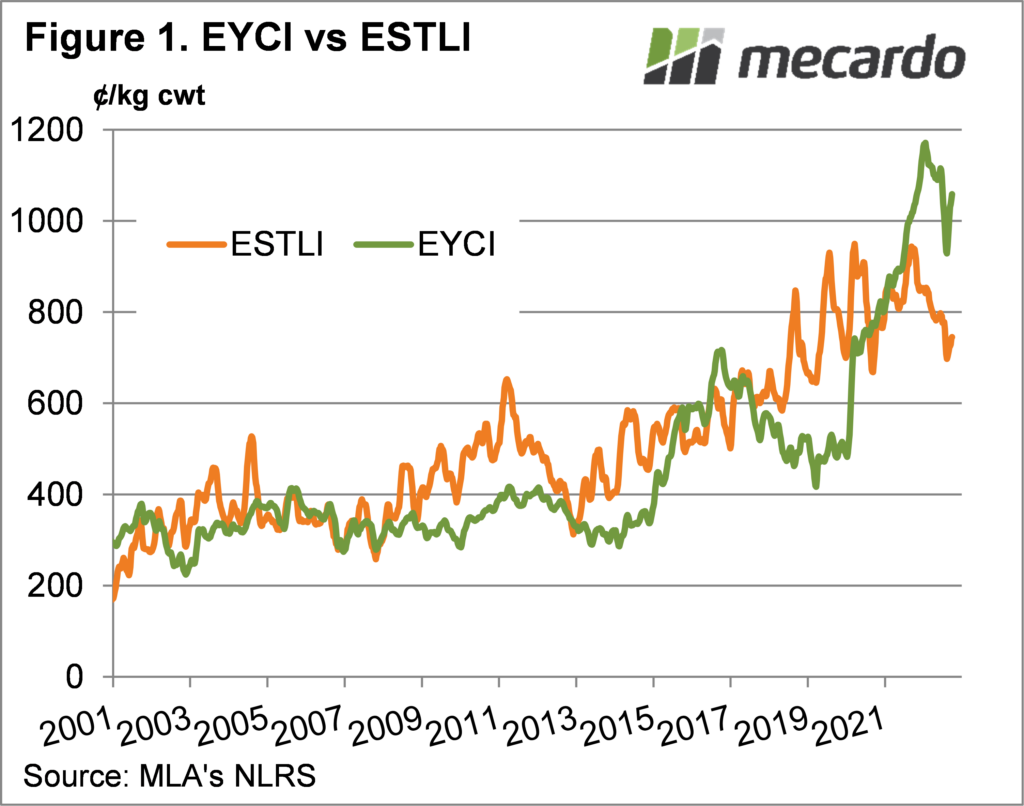

Figure 1 shows the last three years has seen lamb prices, as shown by the Eastern States Trade Lamb Indicator (ESTLI), largely trend sideways, albeit with some massive volatility. Lamb supply has been growing, but demand has been matching it, see prices move sideways.

Over the same period, cattle prices, in this case the Eastern Young Cattle Indicator (EYCI), have had a very strong rally. The end of the drought, accompanied by very strong international demand has seen the EYCI rally to record highs, and as it turns out, a record premium to lamb prices.

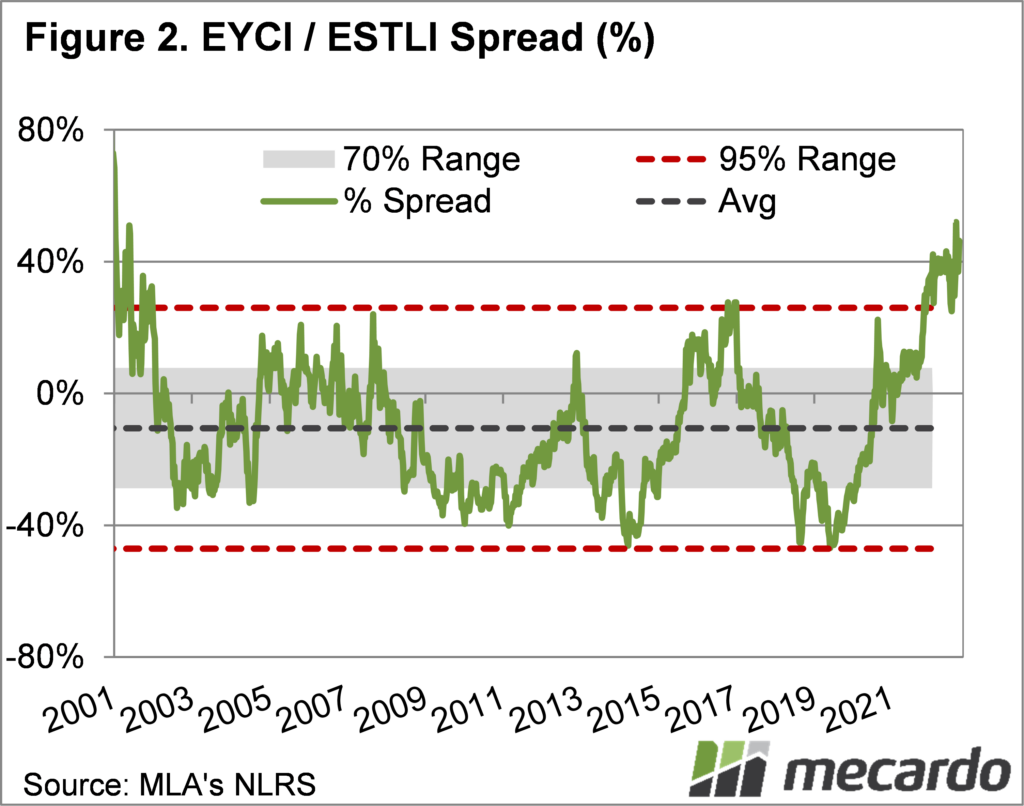

Figure 2 shows that with the decline in lamb prices this year, combined with continued strong cattle prices, the EYCI has moved to a 40% premium against the ESTLI. The EYCI premium is outside the normal range, and is due to continued tight supply of cattle, and strong restocker demand. Lamb prices are being depressed by supply chain bottlenecks, largely due to labour shortages.

The EYCI spread could get stronger, but it won’t last. With stronger prices for cattle, come stronger profits and herd growth, at the expense of sheep flocks in mixed operations. Properties changing hands might switch over to cattle, adding to stronger growth in the cattle herd relative to sheep.

What does it mean?

It might take some time, but cattle and lamb prices will move back into line. Figure 2 shows that over the last 20 years the EYCI has actually averaged a discount to the ESTLI. The prices are likely to converge through both a fall in cattle, and a rise in lamb, rather than one or the other. A canny trader might see this as an opportunity to get out of cattle and into sheep, and ride the spread to profits.

Have any questions or comments?

Key Points

- Cattle prices have bounced while lamb remains low leading to a record cattle premium.

- It looks like cattle are overpriced, and lamb underpriced, but markets take time to turn.

- There is a long term trading opportunity in swinging out of cattle and into lamb.

Click on figure to expand

Click on figure to expand

Data sources: MLA