Australian beef exports to key Asian markets such as South Korea, and China continue to display worrying signs of weaker trends, while the US imported beef market continues to suffer from economic uncertainty and strong domestic supply. On the brighter side, ongoing FMD issues in Indonesia may just have encouraged demand for imported Australian beef.

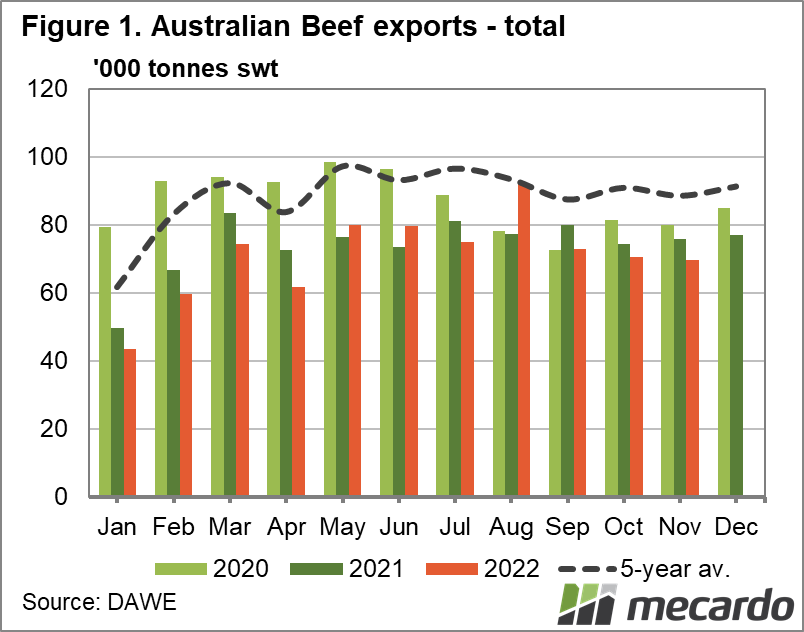

Total Australian beef exports for November were basically flat on a month on month basis, at 69,697 tonnes. Over the last couple years though; the relatively low level of change between October and November isn’t anything unusual though. Compared to 2021, volumes were 8% lower however, and exports are still operating at historically low levels for this time of year, at 21% below the 5 year average. (figure 1)

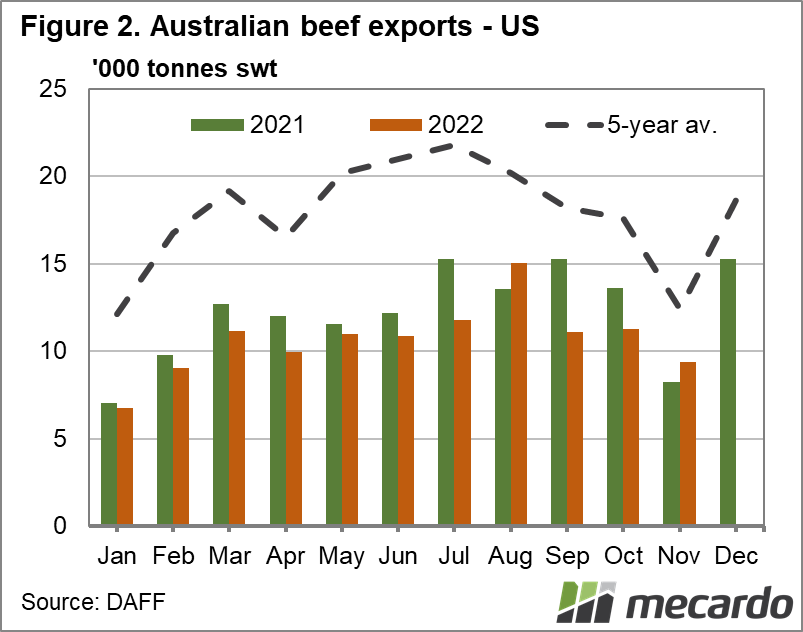

Exports to the USA were 14% above last November, at 9,383 tonnes; but still 25% below the 5 year average, with a downtick in November fairly typical as it coincides with the thanksgiving holiday season, and stocks are usually built up in advance over October to draw down upon over the holiday period. (figure 2). Overall, slaughter in the US is still strong, keeping a lid on domestic prices. Commentary coming out of Steiner Consulting over the last couple months has generally pointed toward weaker demand also, as inventories have built up in freezers, and buyers lose any sense of urgency to procure additional supplies, especially against a backdrop of general economic uncertainty.

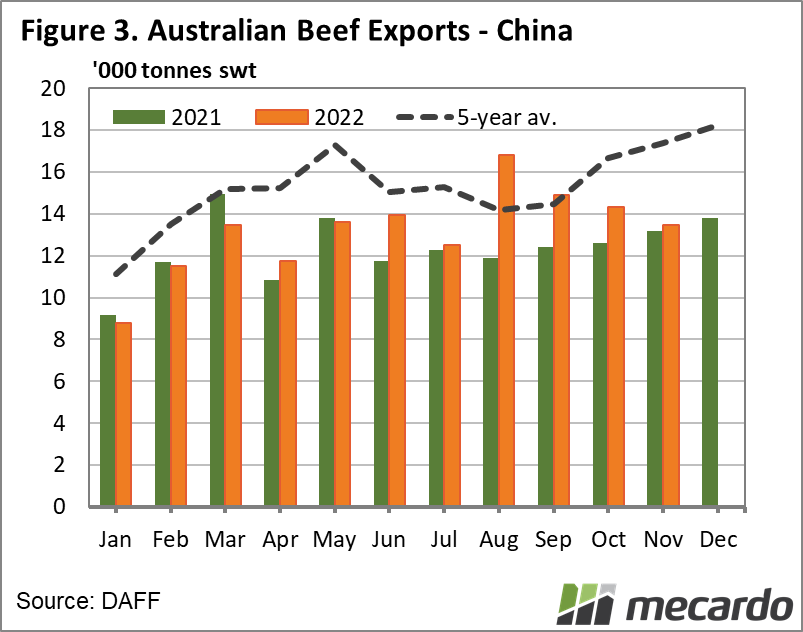

Chinese buying patterns have taken a concerning trend for the worse over the past three months. When looking at the 5 year average, and how 2021 played out, the normal pattern at this time of year is for volumes to increase month on month into December. The past three months have displayed a progressively lower volumes, with November coming in at 13,438 tonnes, 3% below 2021, and 22% below the 5 year average volume. (figure 3) The cause is probably down to falling demand stemming from the Chinese government’s pursuit of COVID-zero. In the last fortnight however, major changes have been announced which represent the first major shift in China’s COVID management policies, which include the scrapping of smartphone health codes which track health statuses which previously dictated whether citizens could leave their homes or need to quarantine. Under the new guidelines; people will be able to enter most public places without having to show proof of a recent negative test; or show their health status code, and internment in quarantine camps for asymptomatic patents will be phased out, enabling home isolation. These changes may pave the way for stronger beef demand coming out of both foodservice, and the home cooking channels.

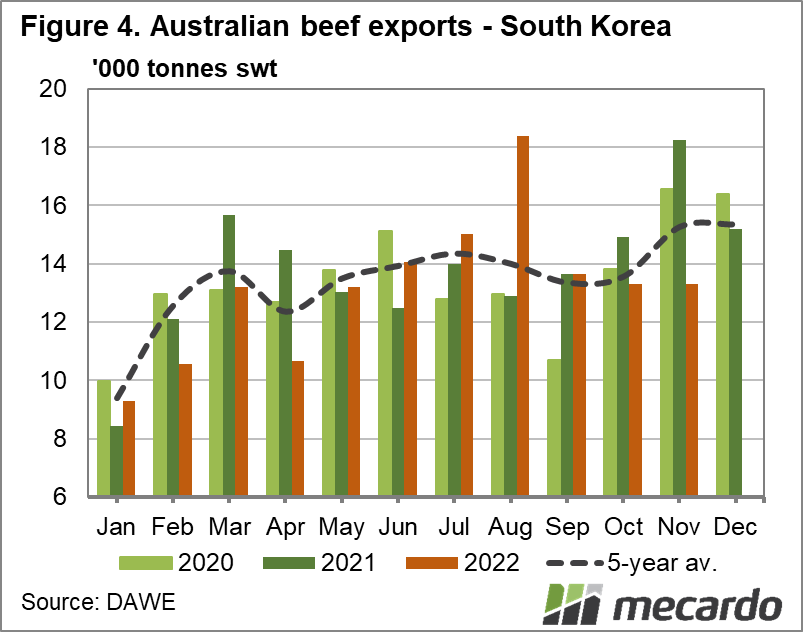

South Korean volumes for November were flat at 13,300 tons during a month that is typically characterised by quite a strong uptick. November volumes slipped 27% below 2021 volumes, and were 13% shy of the five year average. (figure 4)

Among a slew of concerning news on the export front, there was one rising star worth noting- that exports of beef to Indonesia have been tracking at in excess of 25% above 2021 levels in the last couple months, and that November volumes, at 3,895 tonnes were 3% above the five year average. Once could speculate that that the ongoing problems that the country is experiencing with FMD and LSD outbreaks have cut onto consumers appetite for locally slaughtered beef, and demand for imported product has improved. Because the biosecurity crisis there is unlikely to resolve quickly, this trend toward higher imports of Australian beef, as opposed to live cattle may persist for some time to come, especially as Australian beef prices trail off, improving affordability.

What does it mean?

A number of key export markets are displaying softer demand for imports of Australian beef, and some seem to be backed by softer overarching macroeconomic trends as global growth has taken a slowdown. Chinese demand may make a recovery though as the impact of COVID related restrictions easing flows through. One can only hope that health conscious, well to do Indonesians develop a permanent preference for Australian branded beef, even beyond the FMD crisis, providing additional diversification in our export portfolio.

Have any questions or comments?

Key Points

- Total Aussie beef exports essentially flat at 69kt

- Exports of beef to China were on a downtrend, but zero-covid rules are loosening, improving the outlook.

- Exports to Indonesia up 19% MoM to 3.9kt; with the FMD crisis possibly driving demand

Click on figure to expand

Click on figure to expand

Data sources: DAWE