The March Crop Report released by the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) rarely changes much from December for winter crops, unless it is a real bumper. This year is no different, but it’s the increase in summer crop production that is likely to pressure the feed market.

There were

some minor changes to the winter crop numbers in the quarterly crop

report. ABARES added 0.5mmt to the wheat

production estimate. There was basically

no change to the barley production forecast, and canola had 0.1mmt added.

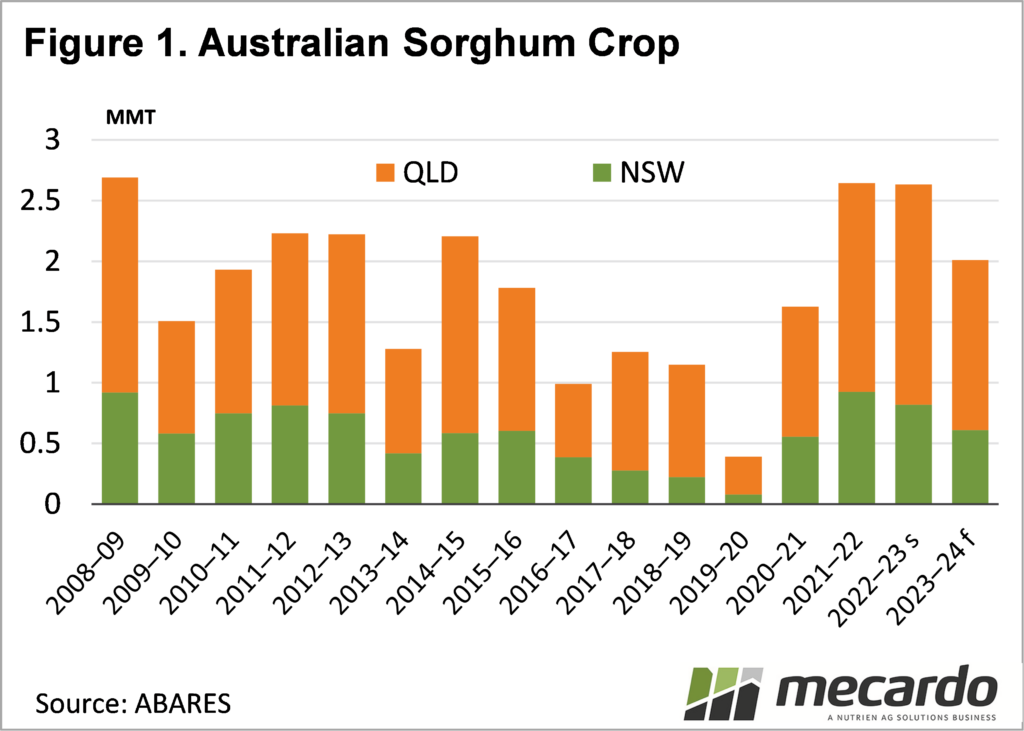

The March

Crop Report did show some better production estimates for sorghum and

cottonseed. Figure 1 shows that Australia is now forecast to produce 2mmt of sorghum,

an increase of around 34% on the estimate released in the spring.

The boost

in sorghum production was largely put down to the wet summer in the north,

which promoted an increase in plantings and yields. After two big sorghum crops, the decline this

year was expected to be considerable.

The sorghum crop is still expected to be down 18% on 2022-23, but it’s

still forecast to be the fourth largest crop of the last ten years.

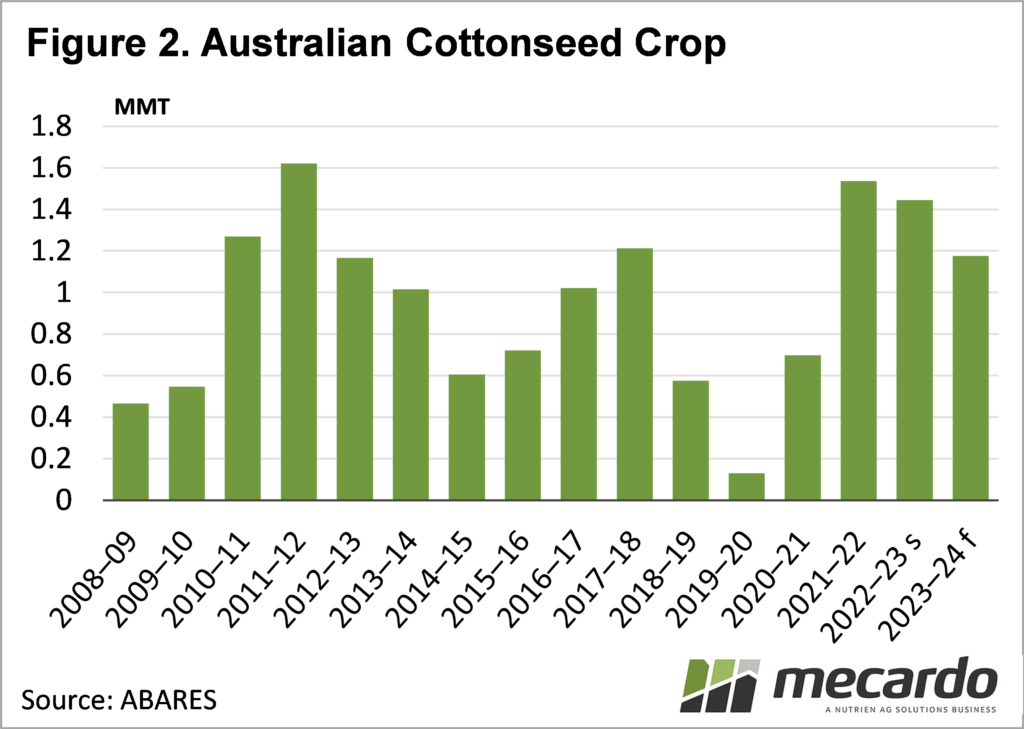

The

cottonseed crop is important in the lot-feeding industry, and it also received

a lift to expected production. Figure 2

shows the cottonseed crop is also down on last year, at 1.175mmt, but again, it

is well above pre-planting estimates and is also forecast to be the fourth

highest of the last ten crops.

Sorghum

prices have suffered from the increasing supply, along with the weakness in

feed grains in general. Since December

sorghum delivered Brisbane has fallen from above $430/t to be quoted around at

$362/t late last week.

Croppers in

the south would love to be getting $350/t plus for their feed grain now, given

feed wheat and barley are now hovering not far north of $300/t at port.

The large

local demand in northern NSW and South East Queensland tends to hold feed

prices at a premium to the south when crops are ok.

What does it mean?

Adding more grain to the feed supply is obviously not great for prices, as we move through the autumn. The bigger drag is international influences, as outlined in Friday’s Market Comment, but stronger supply here helps keep a lid on any locally driven rallies.

Have any questions or comments?

Key Points

- Summer crop production prospects in the north have improved with summer rainfall.

- The increase in production, along with waning feed grain prices in general has seen sorghum prices ease.

- The market is still driven by international values, but stronger supply will keep a lid on rallies.

Click on figure to expand

Click on figure to expand

Data sources: ABARES, ABS, Mecardo