In the space of a week, Russia attempted to suspend, then backflipped and reopened, the black sea grain corridor causing panic and havoc on international grain markets as food security fears run rampant.

According to Russia, on Saturday, 29th of October, the Ukrainian military launched a significant attack against Russian naval vessels and infrastructure located near the port of Sevastopol in the Russian controlled Crimean peninsula. In times of war, an attack by Ukraine on Russian assets would normally be nothing special, however, the manner of how the military operation was carried out is what has put the Black Sea grain corridor deal with Russia under threat. The sticking point has been that seven or more maritime drones, or remote controlled boats were utilized in the attack, accompanied by aerial drone support.

Russian authorities have cited that the use of the sea drones, was a major violation of the agreement made that facilitated the flow of grain out of Ukraine which shored up world food security. The result was that the Russian ministry of defense announced that it would halt participation in the UN and Turkey brokered deal, and “could not guarantee the safety of shipping”.

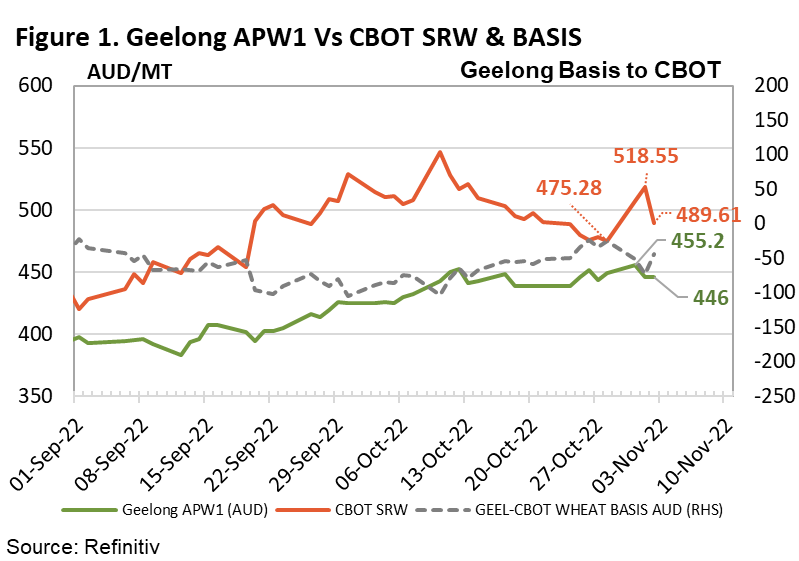

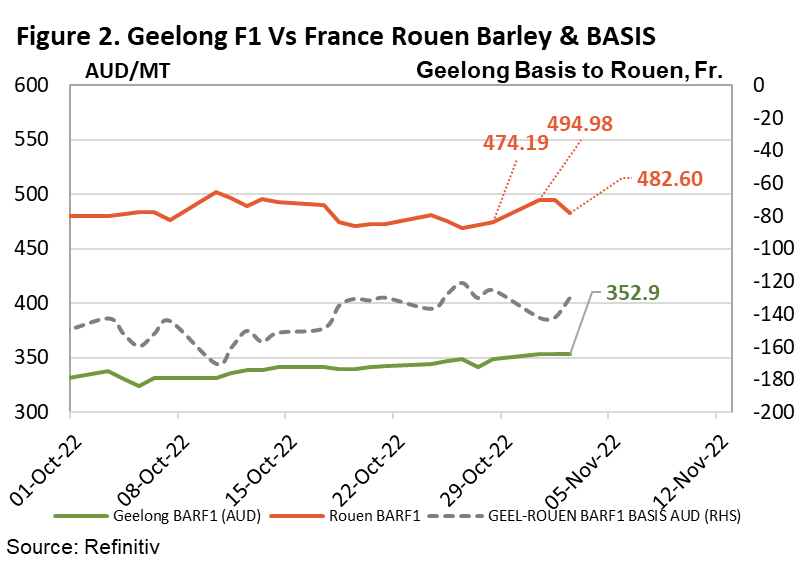

The impact on the market was immediate. US CBOT SRW nearby wheat futures spiked $43.27AUD, or 9.1% to close at $518.55/ton on the 1st of November (figure 1). French Rouen barley lifted $21/ton (4%) to $495AUD/ton.

Insurers also reacted negatively, with Lloyds of London insurer Ascot immediately suspending the writing of insurance cover for new shipments that relied upon the Ukrainian grain corridor, although insurance already issued would still stand. The change is significant as it impacts an Ascot & Marsh grain insurance facility which has reportedly supported a substantial proportion of the 9mmt of Ukrainian origin grain shipments that have occurred since the deal began.

Martin Griffiths, Chief of UN aid stated that he had received advice that insurers would increase the premiums levied for black sea crossings by up to 50% as a result of the elevated risk environment in the region.

Despite Russia’s withdrawal from the program, grain continued to flow out of Ukraine, with Turkey, the UN and Ukraine informing Russia of their operations. As of the 2nd of November, however, Russia backflipped on its position, rejoining the UN program, in response to written assurances from Ukraine that the grain corridor would not be used for military purposes.

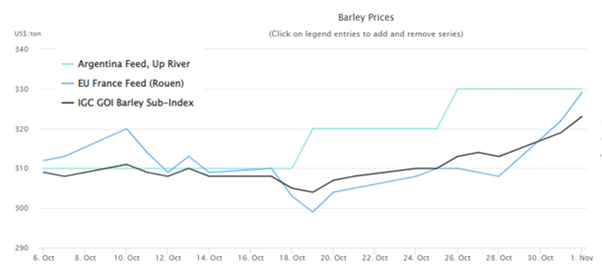

The market seesawed in response, with CBOT SRW wheat falling back $29AUD (5.5%) to close at $489.61AUD as of the 2nd of November. Following the trend, French Rouen domestic barley prices dropped $12 (2%) to $482.60AUD (note that the IGC quotes Rouen export prices at $329US/ton however ($519AUD) (figure 3)

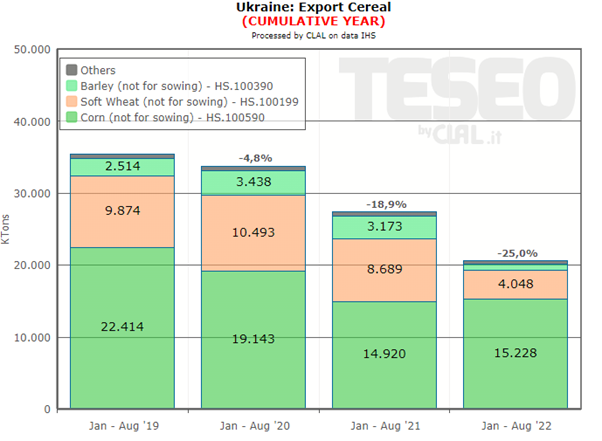

An important point to note though, is that while Russia may have conducted a spectacular reversal of position, and backed down at the present time, there is no guarantee that the grain corridor deal will remain in place after the expiry of the agreement on November 19th. IHS market data indicates that Ukraine had exported 51mmt of cereals in CAL-2021. As of August 2022 however, barely 21mmt of grain had been exported, down more than 25% from the prior year, with wheat volumes halved to 4mmt. (figure 4) Looking forward, the USDA are already forecasting that Ukrainian grain exports will decline by 44% in 2023, with a big driver being reduced production.

What does it mean?

Continued Russian cooperation in enabling wheat from Ukrainian ports to flow into international markets continues to remain under a cloud. While the Russians are back in the deal, there is no guarantee that it will be extended beyond its expiry on November 19. If grain exports from Ukraine and Russia are curtailed, this will squeeze world grain supply, pushing prices up.

Of more immediate note, the deteriorating situation in the region also pose threats to the price, and supply of essential insurance for new grain shipments out of the Black Sea. More broadly, this continued uncertainty is unlikely to encourage grain production by Ukrainian farmers, leading to lower supply in 2023.

Have any questions or comments?

Key Points

- The accusation of Ukraine’s use of sea drones on the 29th Oct triggers a halt to Russian participation in the Black sea grain corridor deal, threatening millions of tons of grain into world markets.

- Russia backflipped on its suspension of the deal three days later however.

- Wheat markets have seesawed 6% since the crisis began and remain slightly elevated.

Click on figure to expand

Click on figure to expand

Data sources: Reuters