One of Australia’s biggest export beef market competitors; arguably the biggest competitor actually, with more than 20% of the entire global trade, is also feeling a domestic cattle price pinch.

Brazil’s cattle price cycle is heading south, with returns for their cattle in July reportedly 22% lower than they were at the same time last year. Slaughter is moving in the opposite direction, forecast by the USDA to increase by 7% year-on-year in 2023, which will equate to an 8% increase in beef production. Sounding familiar? These two countries also share their major export market partners, in China and the US, which rank first and second for Brazil respectively, and are currently third and first for Australia.

For the first half of the year, Brazilian beef export volumes were down 3.8% year-on-year. Trade with China, by far the country’s biggest market, stalled earlier this year because of atypical BSE detection, which meant China went from taking more than 70% of all Brazilian beef exports in 2022 to just over 50% this year. The next biggest importer of Brazilian beef, being the US, has received 7% so far this year by comparison. However, the stall was short-lived, and June saw the second-biggest monthly total volume of beef go from Brazil to China on record. Chinese demand for Brazilian beef is set to remain in the medium term, in terms of volume at least, with imports potentially slowing down for the remainder of the year, but Brazil is in the box seat to fill the demand because of its ample supply and low prices.

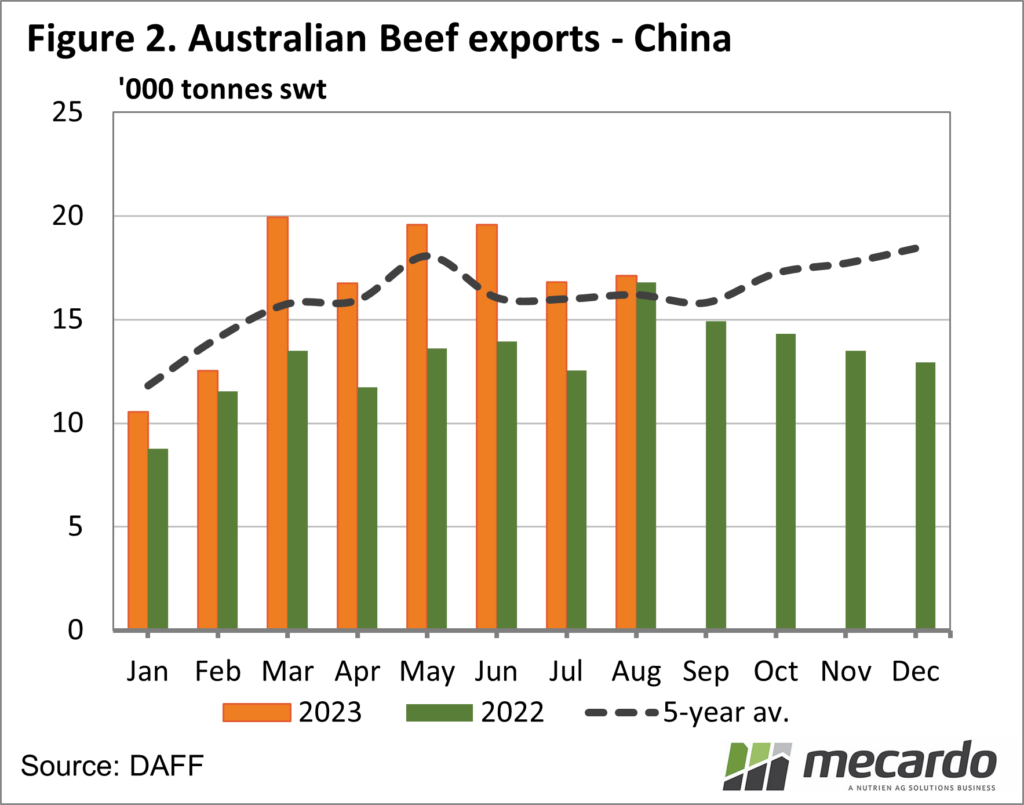

Australian beef exports to China (our third largest beef market) are well below Brazil in actual volume, but all the same, we have sent 33% more beef there for the year-to-August compared to 2022. As well as being stronger year-on-year, Australian beef exports to China have been tracking above the five-year average since March, and they have made the fastest gains of all exporters in this market so far this year. At a record high 19.6%, China’s market share of Australian exported beef is now within a whisker of the other two top markets, the US and Japan.

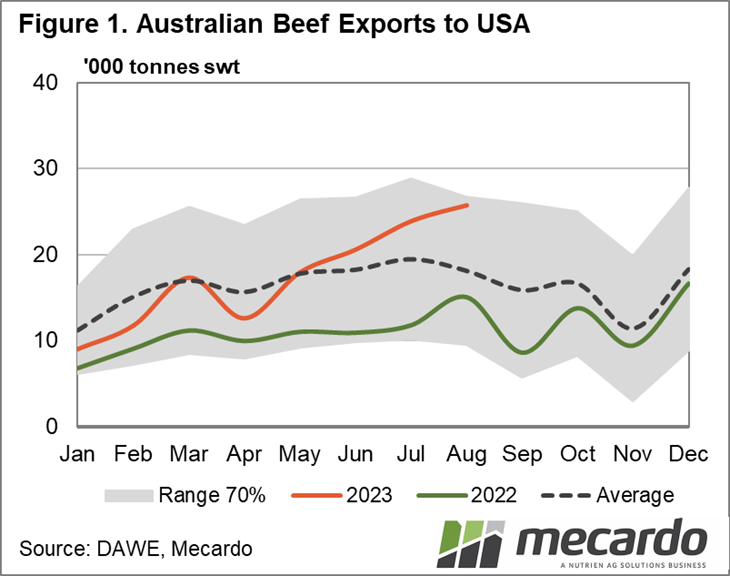

When it comes to the US, Australian beef exports for the year to August have already surpassed last year’s total volume. According to the Steiner Group, Australian shipments to the US will be up 179% year-on-year for this month and will secure the US as the biggest market for Australian beef as exports to Japan are actually lower than in 2022. Australian cattle slaughter is currently 22% higher year-on-year, while the US is tracking 10% lower. While Australia is making good gains in the US, we don’t have to go that far back (less than a decade) to see a time when the US made up more than 30% of Australian beef exports (compared to 20% now) and volumes were 44% higher than they are currently.

Despite having lower prices and plenty of production, Brazilian beef exports into the US have actually fallen year-on-year. A contributor to this is the quota in place, which Brazil has already fulfilled which means a 24.6% tariff is now at play. According to the USDA, while Brazil will continue to be competitive in the US as their prices are likely to fall further later this year, they will be capitalising on the US’s falling production by targeting markets that the US may be struggling to fill.

What does it mean?

Brazil’s low price point and ample production are in direct competition with Australia when it comes to global beef markets, and like Australia, it is expected there is still growth in beef production to come. There is also no guarantee their prices have hit the bottom just yet.

Specifically, when it comes to the US, Brazil’s trade quota will keep Australia as the frontrunner to provide that market for the remainder of the year, however, China could be a different story if the economy and the reported supply chain backlog start to come into play in coming months. The positive news is both the US and the EU prices remain high and their production growth low, opening up more market space for both Australia and Brazil.

Have any questions or comments?

Key Points

- Brazil will remain the world’s biggest beef exporter this year and next, with China still its biggest market, a position it has held since 2009.

- Brazilian beef exports to the US are lower for the year-to-date than in 2022, and well below Australian volume into that market.

- Australian beef exports to the US for year-to-August are already higher than the total volume last year.

Click on figure to expand

Click on figure to expand

Data sources: Meat and Livestock Australia; Rabobank; Steiner Consulting Group; USDA, Mecardo