You don’t have to be following markets too closely to know that canola prices have tanked in recent weeks. After falling heavily, canola had a little bounce last week, but it remains well below harvest levels. Here we look at the spot and forward pricing, and the impact they might have on sowing intentions.

We’re not at ANZAC day yet, and grain growers still have time to shift sowing plans. Canola’s recent price decline isn’t doing much for its attractiveness as an option this year, and this is in an environment where we are expecting the sowing area to decline heavily.

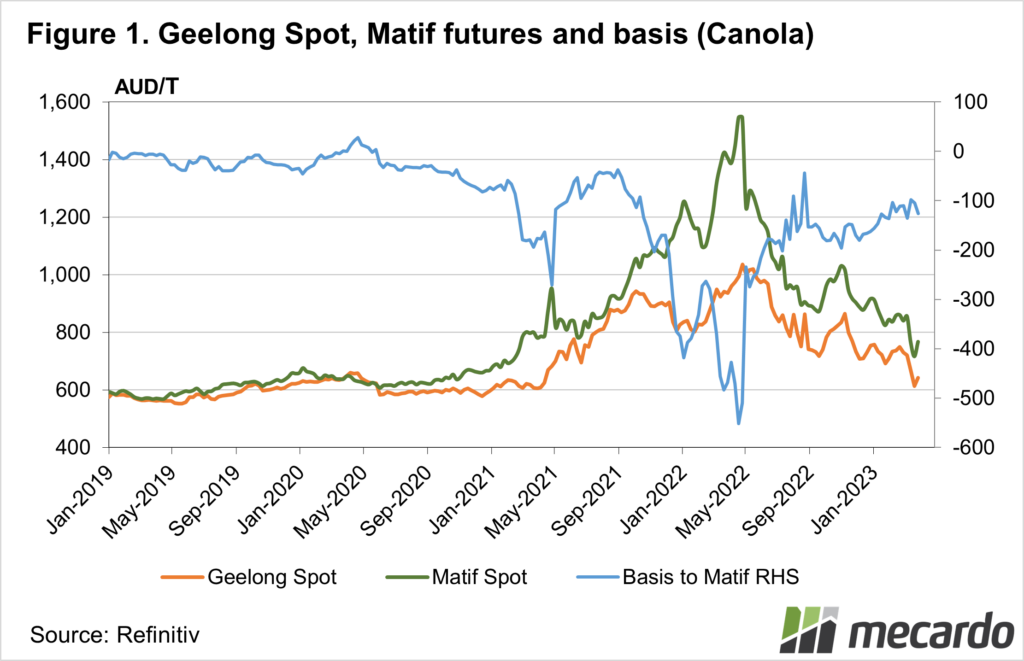

Declining canola prices can largely be put down to issues with demand in Europe and easing soybean prices. Canola values have been trading well above historical averages since early 2021, and the high prices and tight supply seem to have eroded demand.

Add in a fall in soybean prices thanks to supplies coming out of Brazil and some better weather forecasts in the US, and MATIF Rapeseed Futures lost nearly $140/tonne in the first two weeks of March. The bounce was not insignificant though, adding nearly $50 last week.

Figure 1 shows that local prices seem to be tied to MATIF at around a $100 discount. Local canola basis has been remarkably steady given how volatile the base price has been.

Soybean prices have recovered most of their March decline, with rising energy prices helping. This should see canola continue to climb early this week, but these issues with European demand will remain.

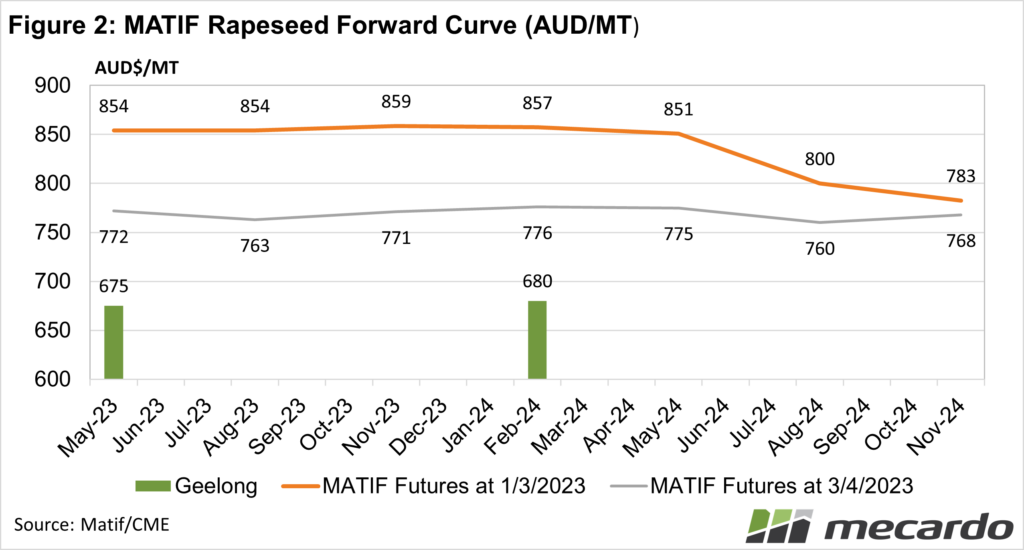

The forward curve for MATIF Rapeseed has flattened out significantly. Figure 2 shows that at the start of March, there was a large decline in price factored in for the northern hemisphere crop of 2024. Spot futures have fallen, with 2024 values only easing slightly.

Locally both spot canola, and forward pricing for new season canola have lost $100/tonne, with both remaining at a $100/tonne discount to MATIF.

The back-of-the-envelope gross income calculations for wheat and canola have closed up significantly. A 3-tonne wheat crop at $400/t brings $1200/ha. Canola would need to yield 1.74 tonnes to bring in the same money, but it would cost more to produce.

What does it mean?

A decrease in the area of canola was likely after the massive crop last year. Falling prices for canola, not matched by cereals or pulses, might see even less canola planted this season. For those sticking with canola, weaker production should see the basis to MATIF tighten up. There is no reason to lock in canola on a physical contract at the moment; swaps or futures offer much better value.

Have any questions or comments?

Key Points

- Canola prices fell heavily in March with lower soybean prices and weakening demand.

- Despite a small bounce, canola is priced nearly $100/tonne lower than at the start of March.

- Margins on growing canola are looking much less attractive compared to cereals, which may impact sowing intentions.

Click on figure to expand

Click on figure to expand

Data sources: ABARES, Refinitiv, Mecardo