The United States Department of Agriculture (USDA) released the World Agricultural Supply and Demand Estimates (WASDE) last week, and as noted on Friday there wasn’t much for wheat. Corn and soybean production was a different story with South American crops still to come in.

As we move through our summer and the northern hemisphere winter the focus of grain traders becomes harvests in the southern hemisphere. The last crops to be harvested in the 2022/23 season will be the summer crops of corn and soybeans in South America.

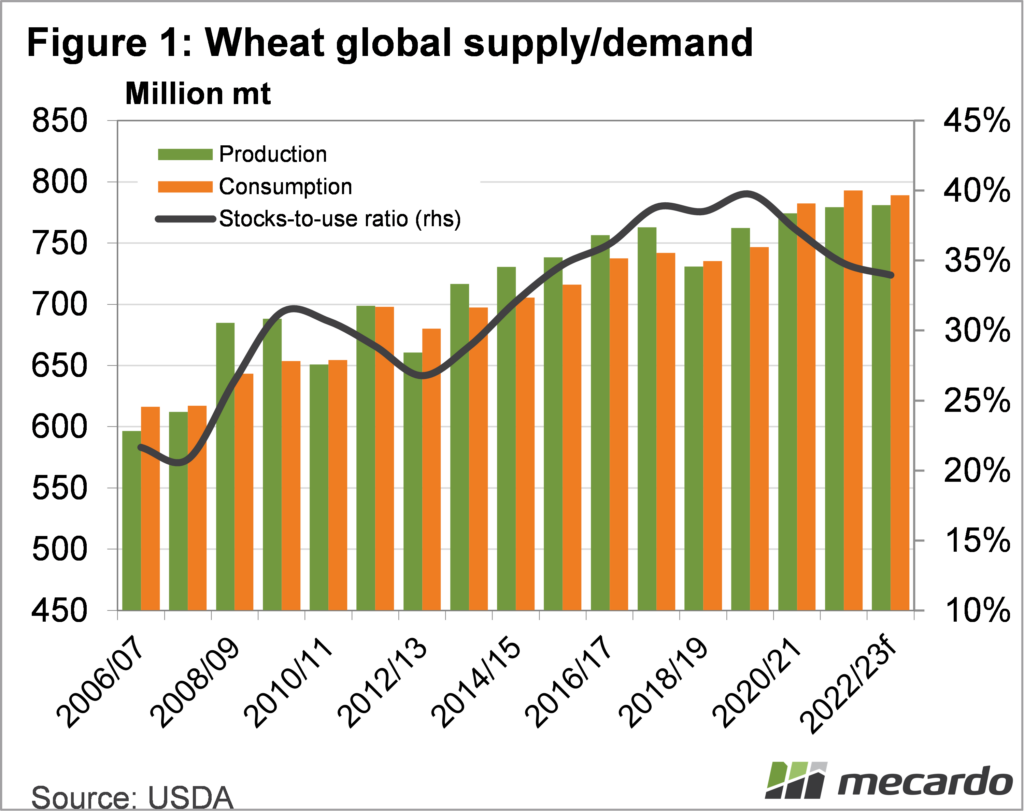

There was little change in the wheat production or consumption forecast, despite Australia’s crop being expected to be larger than the USDA is accounting for. Figure 1 shows that this year’s world wheat crop is expected to be lower than consumption for the third year in a row. The difference is only a marginal 8mmt deficit, which in theory could be made up by increases in Australian and Russian wheat production this year in coming reports.

The current wheat stocks-to-use ratio remains relatively tight, at an eight year low of 34%. This is supportive of wheat, and the market didn’t really show much reaction.

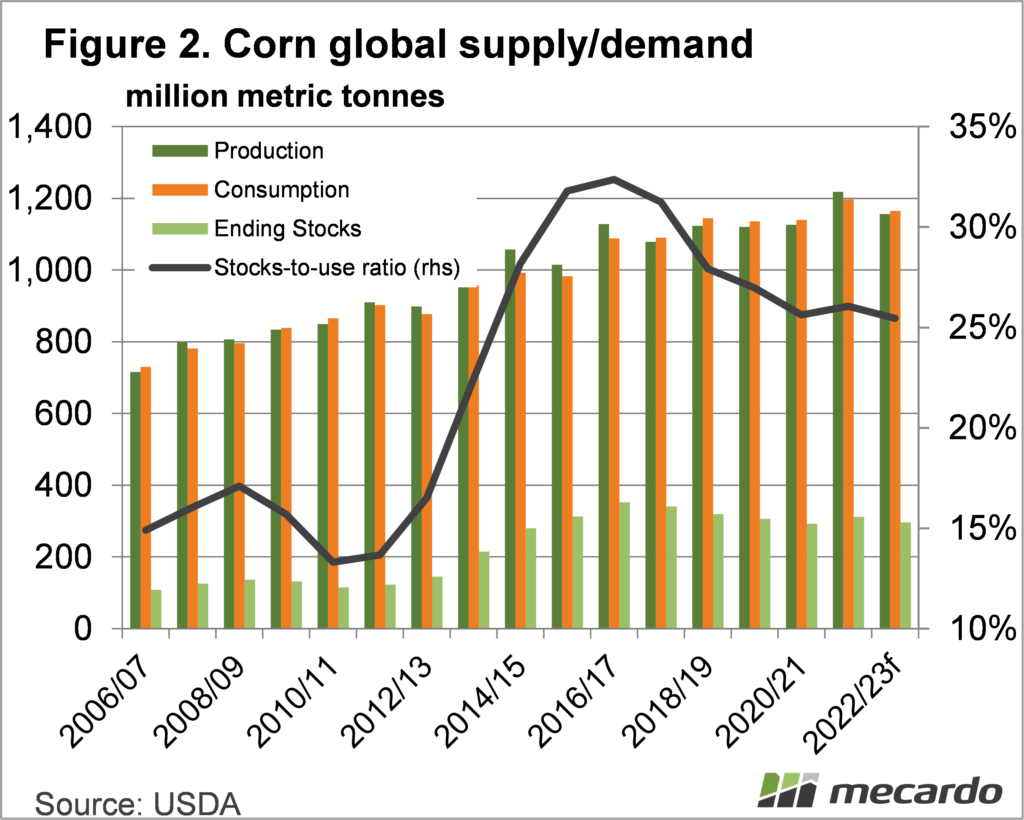

It was in corn and soybeans where the action was. Movements in South America stripped 6mmt of corn out of world production estimates, and 5mmt from consumption. The result was a forecast of tighter stocks by 2mmt.

Figure 2 shows that after producing a surplus last year, corn is headed for a fifth year out of six where stocks have declined. The cut in corn production gave CME Corn futures a boost, lifting to 675c/bu, moving towards a two month high at the end of last week. In our terms, CME corn sits at $389/t, this is no doubt helping support our feed grain markets.

Soybean production was also cut in the WASDE report, but it was more marginal. World soybean production was cut by 3mmt, with a similar adjustment in consumption. The cut in soybean production saw prices rally back to the peaks of late December, close to a six month high.

What does it mean?

The tighter forecasts for corn and soybeans, and subsequent stronger futures should flow through to support feed grain and canola values here this week. There is, however, plenty of local supply and demand influences still playing out.

Canola has been following world markets recently, albeit at a heavy discount, and the soybean move should see it back near harvest peaks this week.

Have any questions or comments?

Key Points

- The USDA WASDE report was benign for wheat but bullish for corn and soybeans.

- Tighter supplies saw US futures lift, which should flow through to local values.

- With stronger prices in the US, canola still has some market upside.

Click on figure to expand

Click on figure to expand

Data sources: USDA, CME, Mecardo