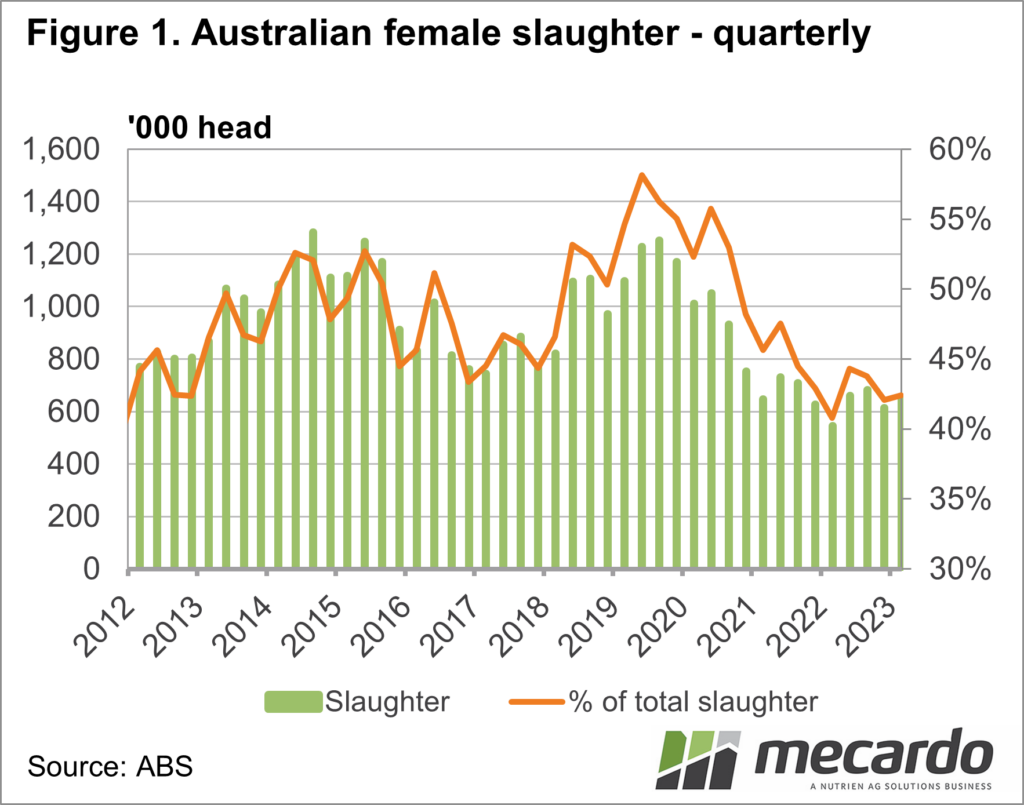

The Australian cattle industry’s Female Slaughter Rate (FSR) continued its’ rebuild streak for the first quarter of this year, barely increasing and not reaching anywhere near the traditional herd liquidation mark of 47%. At 42% of total slaughter, the FSR would indicate that declining young cattle prices had yet to dampen producers' enthusiasm for rebuilding in the January-March period, with it not making any ground on total slaughter.

Looking back, the FSR has only been at a lower point once since 2012, being the March 2022 quarter when it sat at 41%. The five-year average for the March quarter is 48%. Little has changed from the previous quarter in terms of each state’s FSR, and they’ve also held relatively steady year-on-year. The most notable change has been NSW, which sat at 42.4% for the March quarter, a jump of just 1% on the three months to December, but up more substantially on the previous January-March period, where it was 38.6%. It is sitting below the five-year average for the quarter, which is 45%. Queensland has headed in the other direction, with an FSR of just 31.8%, down very marginally from the previous quarter, but more noticeably from the 34.9% of March 2022. It is also below the average for the quarter, but more significantly so, with the five-year mark being 41.4% for March in QLD.

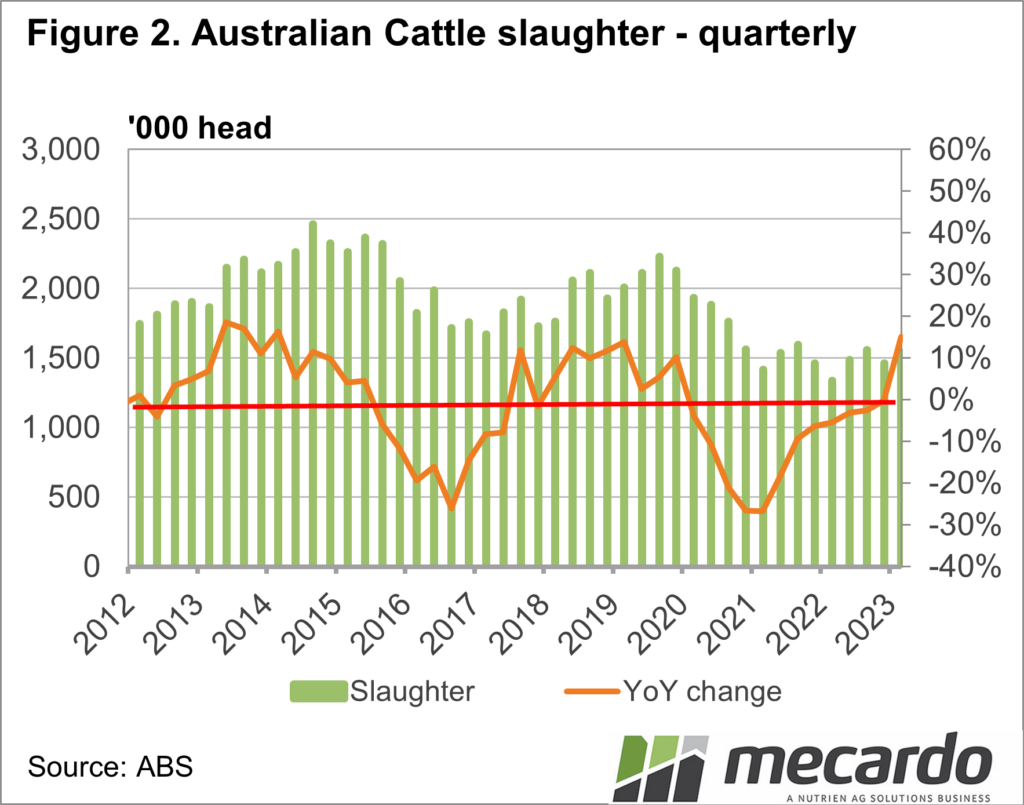

To put the FSR into perspective, and of course, reaffirming the increase in supply which has pushed prices downwards, total cattle slaughter for the March quarter, according to ABS, was up 15% year-on-year, from 1.339 million head in 2022 to 1.542 million head. It had also jumped more than 5% from the previous quarter (being December 2022). If we look at actual figures, rather than the percentage of total slaughter, cow and heifer kill numbers have actually risen by 20% year-on-year, but still sat 21% below the five-year average.

Having a look at annual averages, this herd rebuild has not only outlasted the previous growth period in 2016/17 but has also had a historically low FSR. For the 12 months of 2022, the FSR averaged 43%, a figure not seen since 2011, after 2021 averaged 45%. While the 2016/17 rebuild, which averaged 46% across the two years, was also experiencing what was then record young cattle prices, this time around the seasonal conditions for producers have outlasted the price surge.

The June quarter has the highest five-year-average FSR of 51.8%, and while a solid wet season and a good autumn start have left many cattle producers in good stead season-wise, the duration of the low FSR will see capacity being reached in some areas sooner rather than later.

What does it mean?

While declining prices (the Eastern Young Cattle Indicator is 44% lower year-on-year, the medium cow price 39% down) should be putting a damper on industry confidence and continued herd growth, it also could be prompting producers to hold onto stock if they can in case the market improves.

Supply, which has been surging this autumn, fell away last week as those looking to turn off consider if they are willing to meet the market. Case in point, AuctionsPlus had the largest commercial cattle number listed for the year last week but only cleared 38%. It’s likely the FSR will rise this quarter but will still sit below liquidation.

Have any questions or comments?

Key Points

- Female slaughter rate remains below both the five-year average and the traditional herd liquidation mark of 47%.

- Despite the decline in cattle prices, the Female slaughter rate barely moved in the first quarter of this year.

- Total slaughter lifted 15% year-on-year, but declining prices are yet to hit females.

Click on figure to expand

Click on figure to expand

Data sources: Meat and Livestock Australia, ABS, Mecardo