The unusually wet year in 2022 has seen a very late harvest across the eastern states. Harvest is winding up in some areas, while others still going flat chat, or as fast as you can go in rain and flood affected ground. To open 2023 we’ll do a quick update on price movements over the break.

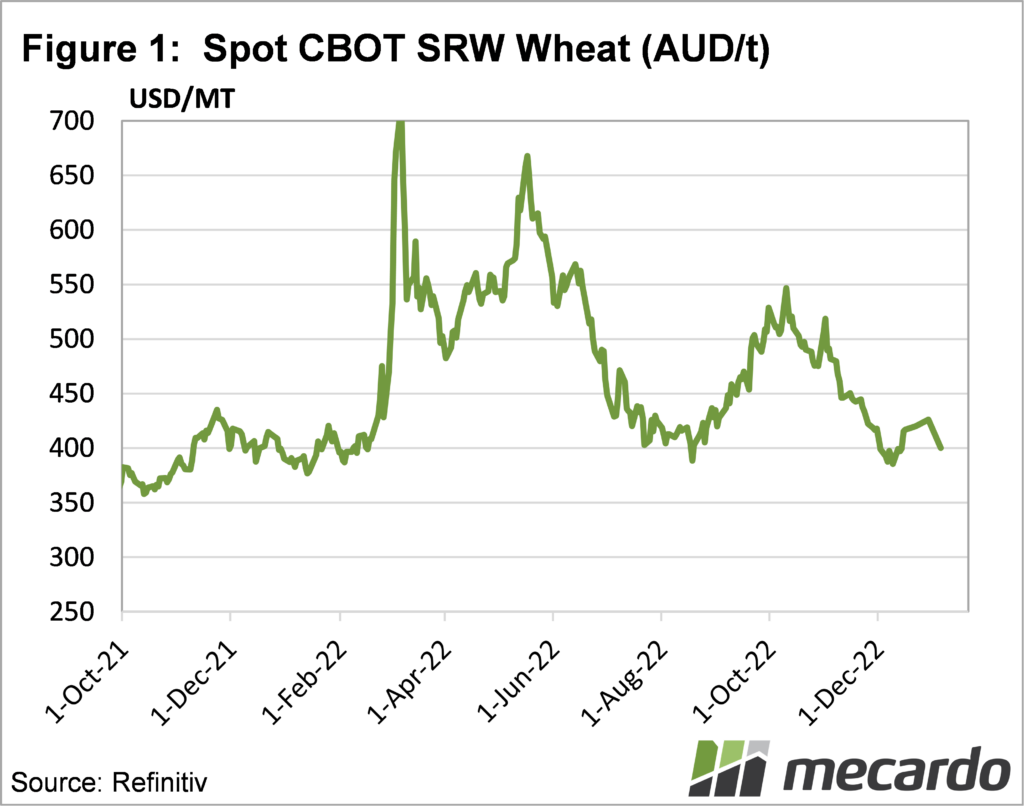

After a wild ride over 2022 the Chicago Soft Red Wheat Futures (SRW) contract finished the year near it’s annual lows. After bottoming out at $385/t after two and a half months of drifting lower, in mid December, SRW did manage a rally to finish the year at $426/t tonne.

A 10% rally is pretty significant, apart from the fact that it looks small on the chart (figure 1) after the massive swings of 2022. Last week SRW fell, and the Aussie dollar rallied to a four month high of nearly 69US¢, leaving SRW in our terms almost right on $400/t.

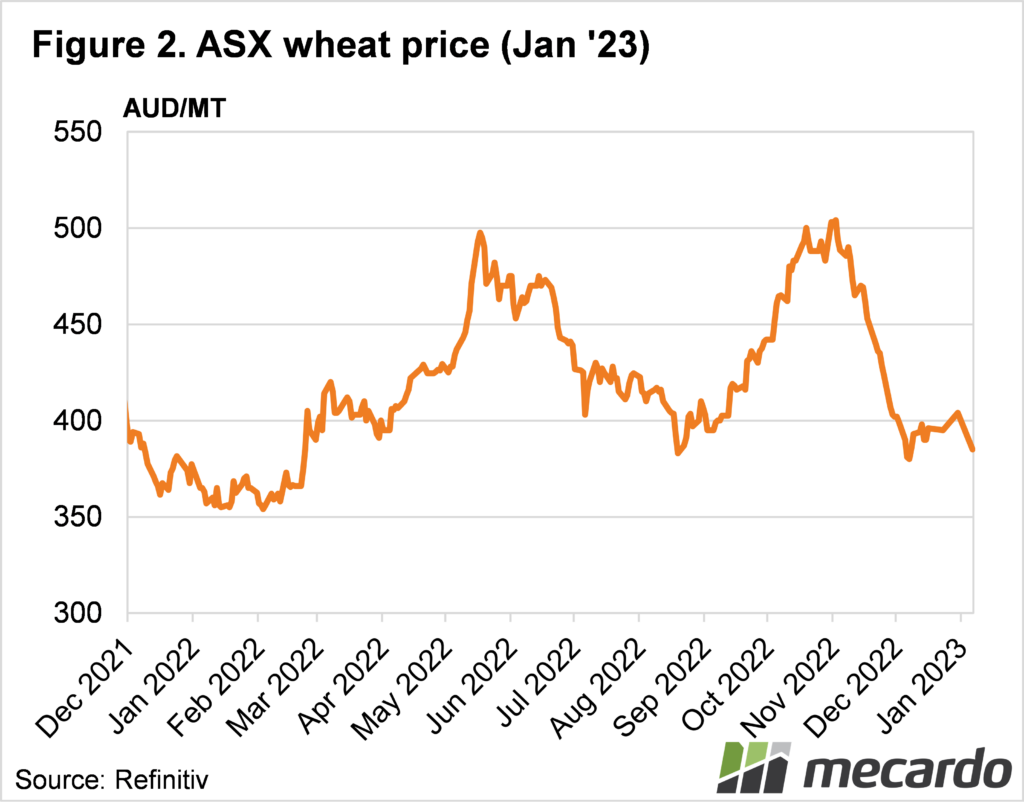

Locally ASX Wheat Futures followed the SRW trend over the break, with a year ending rally followed by a year starting decline. ASX Wheat traded at $385/t on Friday, a discount to SRW, and to many of the southern port zones.

ASX Wheat is deliverable across the east coast, and as such is always priced at the lowest priced port. Currently that is Newcastle, where APW is quoted around the $380-390/t mark. In Geelong APW is fetching $425-430, and in Port Adelaide it’s $408/t.

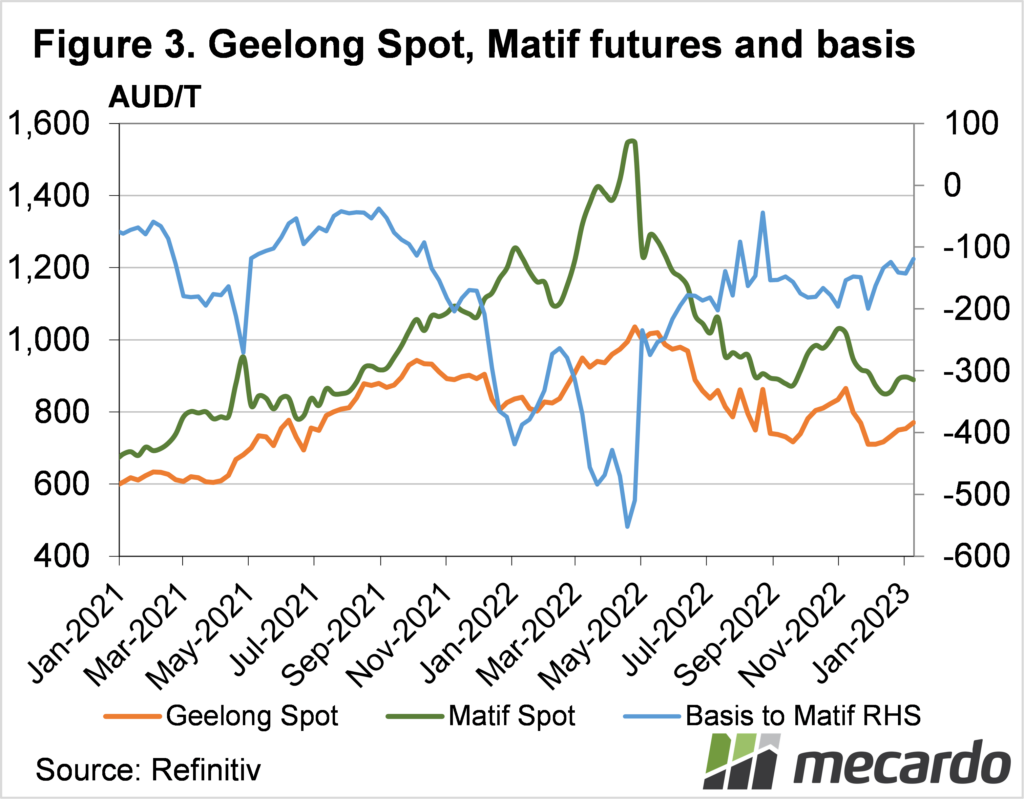

In the Geelong Zone SFW1 is making $400 delivered port, less than a $30 discount to APW. The narrowing of the spread might be due to shipping deadlines, with the late harvest meaning the volume is late moving through the system.

Canola prices have started the year at levels not seen since November, making $770/t at Geelong. The canola rally is largely based on rising prices in Europe over late December, but our prices are still way behind. Matif Rapeseed is priced around $890/t, so the local discount is still pretty heavy.

What does it mean?

With wheat priced close or better than SRW, it looks like a pretty good sell at the moment. We know the crop has been rain affected, but there is still plenty of volume so those looking for upside will be relying on improving international values.

Canola remains at a heavy discount so looks like the commodity to hold, if holding anything. There may be room for improvement in the spread, although it could come from falling international values.

Have any questions or comments?

Key Points

- Grain and canola prices rallied during late December, with wheat easing last week.

- Wheat and canola are both priced better now than during December.

- Wheat looks like a good sell, canola might have some upside.

Click on figure to expand

Data sources: Refinitiv, Profarmer, Mecardo.