Last week we took a look at cattle on feed number from the end of June, but since then there have been some pretty wild price swings. This week we see what feeder and heavy steer prices are doing in response to shifting demand and supply.

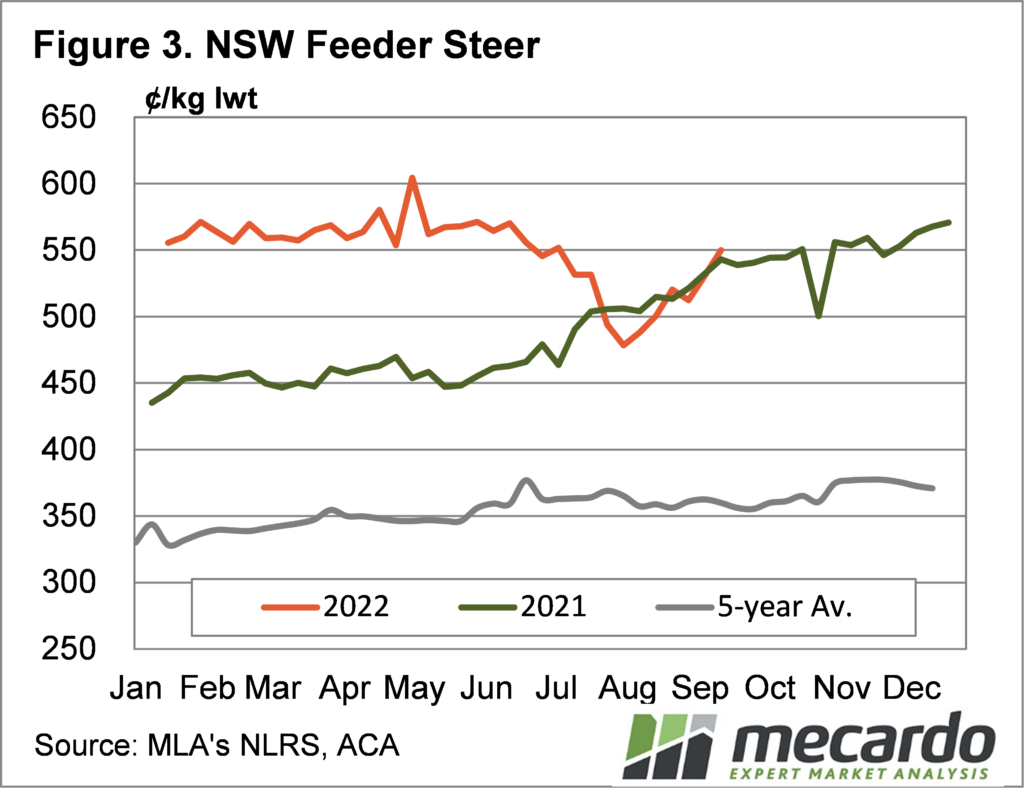

A number of factors go in to setting feeder steer prices. The price lotfeeders can pay is set by the price of grainfed cattle, the price of grain, along with other variable and overhead costs. Price series of grainfed cattle prices are hard to track down. We can use heavy grainfed cattle prices as a proxy.

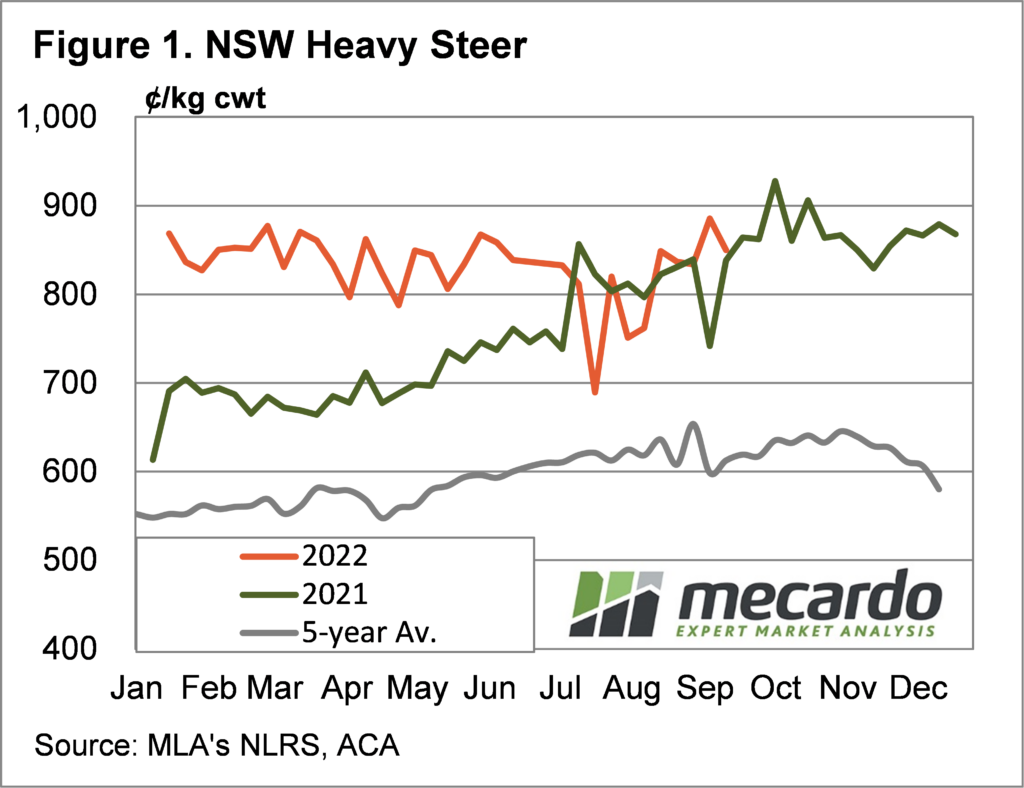

While the volume of heavy steers going through saleyards at this time of year is low, the indicator for NSW is relatively consistent. Figure 1 shows the NSW Heavy Steer Indicator has regained all the ground lost in July, and it’s back at the top of the range.

Heavy steer prices are impacted strongly by export beef demand, and the supply of finished cattle locally. We have seen from recent export data that Australian beef is still sought after, but the 90CL Frozen Cow Export Beef indicator has been on the decline since March. The 90CL Indicator does remain close to last year’s level however.

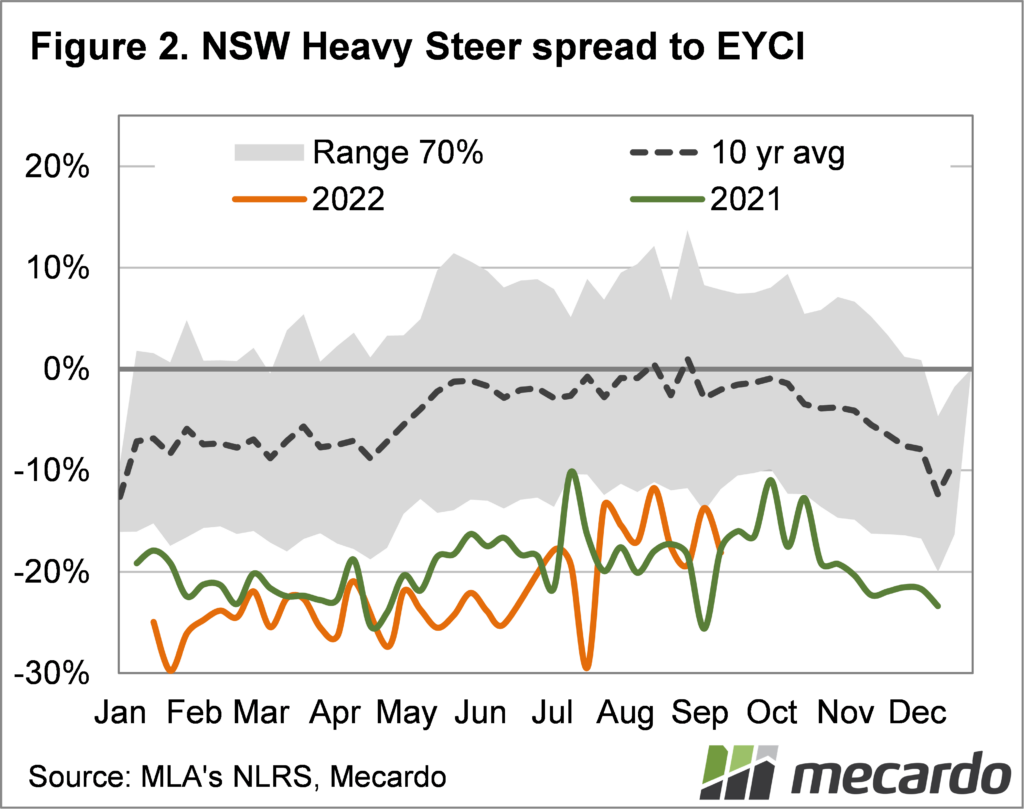

While the NSW Heavy Steer is back at the prices seen earlier in the year, the EYCI is at a 7.5% discount to prices seen in early June. If we look at the Heavy Steer spread to the Eastern Young Cattle Indicator (EYCI), the discount has reduced, but not back to historical levels. There was a similar move last year, as the Heavy Steer discount moved from around a 25% discount, to under 20%.

The rise in Heavy Steer prices hasn’t translated into stronger feeder cattle values. Figure 3 shows that while Feeder Cattle prices have improved from the lows of late July, they, like the EYCI, haven’t recovered to 550¢/kg lwt plus levels of earlier in the year.

What does it mean?

Feeder cattle prices are very strong, but not quite as strong as they were. Heavy Steers are back close to the record levels of earlier in the year. This suggests margins on feeding cattle are improving, or costs have gone up. In reality it’s probably a bit of both, and there is still plenty of uncertainty in markets.

Have any questions or comments?

Key Points

- Both Heavy and Feeder cattle prices have recovered from July falls.

- Heavy cattle prices are almost back to the levels of earlier in the year, while feeders are lagging.

- While feeding margins might have improved a little, rising costs and uncertainty are also being factored in.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, Mecardo