Long-time readers will know that we like to take a look at cattle trading margins on a semi-regular basis. The calculations are easily done, but we also like to measure value by looking at spreads and what margin buyers might expect.

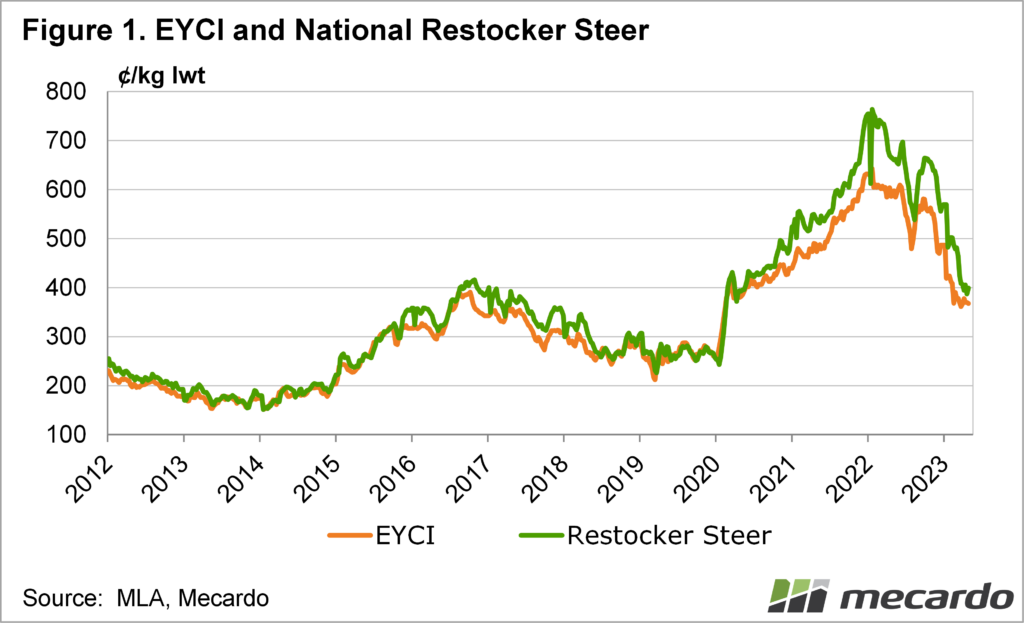

Store and restocker cattle have not been immune to the decline in cattle prices. Figure 1 shows the Eastern Young Cattle Indicator (EYCI) along with the National Restocker Steer (NRS) indicator. While the NRS managed to defy the decline on a couple of the sharper legs down, over March it succumbed and moved down towards an EYCI sitting at a three-year low.

Indeed, the NRS hasn’t been this cheap since early 2020, which was shortly after it had the very rapid leg higher. One thing we can also notice is how the NRS premium to the EYCI has dissipated.

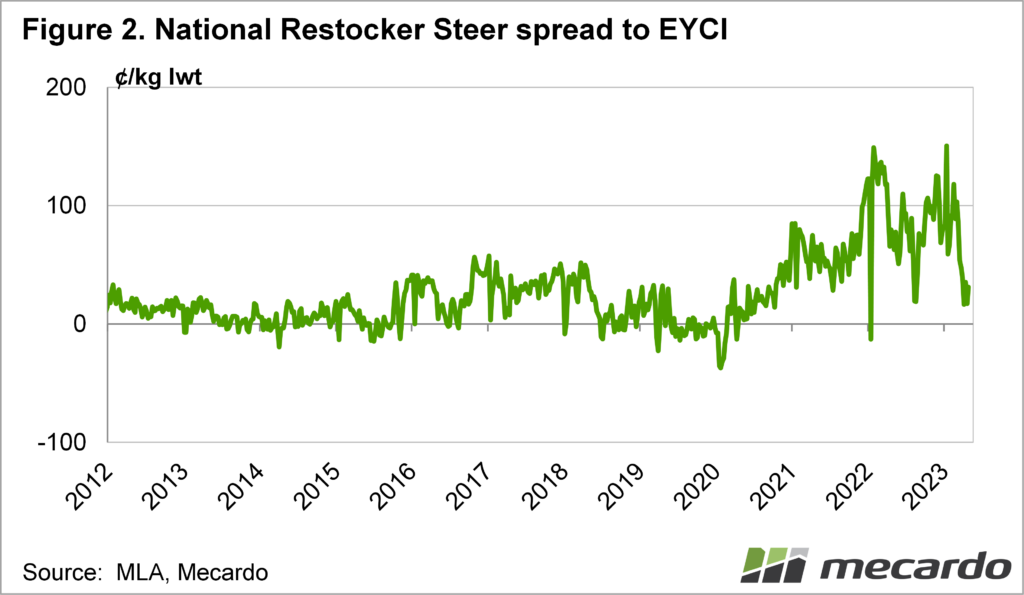

During good seasons strong restocker demand not only helps drive the EYCI but also pushed restocker cattle higher relative to the EYCI. The EYCI is made up of restockers, feeders, and processor cattle, and as such is usually at a discount to cattle that are purely bought by restockers. During drought, when feed costs make it very expensive to finish or put weight on cattle, restockers can be at a discount to the EYCI.

We’re not anywhere near drought conditions in most areas, but Figure 2 shows the NRS indicator is now sitting 30¢ lwt above the EYCI. While way off the heady highs of 130¢ lwt seen over the last two years, the NRS is still sitting at the top of the pre-2020 range, but it is around average in percentage terms.

With restocker cattle at a three-year low in absolute terms, and also in relative terms, we are getting a pretty strong buy signal. Given this, we’ll have a look at what a trade could look like.

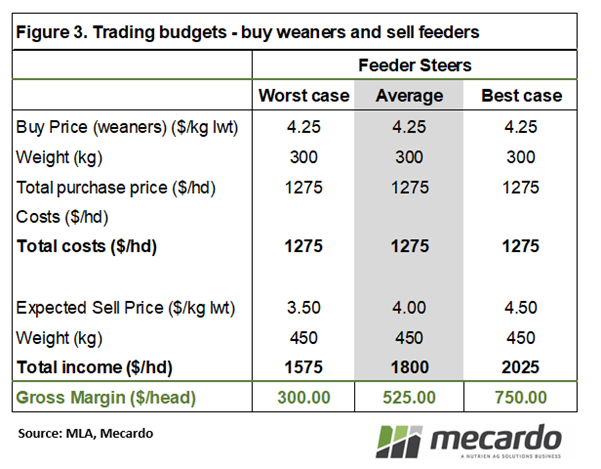

Figure 3 shows how gross margins might look under three different sell price scenarios for feeder steers. The worst case of 350¢/kg lwt looks unlikely at this stage, as it would require a further decline in all cattle prices.

Current prices are at or just under 400¢, so we think it can be pegged as an expected price in the spring when cattle bought now would be turned off. It’s not the best case, as we’ve seen in the past feeder prices can move quickly, but 450¢ would be a good result for those buying cattle now to sell as feeders.

What does it mean?

The three measures of restocker cattle value seem to be aligning at the moment. Cattle are at long-term lows in both absolute and relative measures, while margins look good at expected prices. Even with further price declines, trading margins are likely to be better than break even.

Have any questions or comments?

Key Points

- Restocker cattle prices have declined to be in line with the EYCI at three-year lows.

- The price of restockers relative to the EYCI is also at a three-year low.

- Cattle trading looks promising on the back of cheaper restocker cattle prices.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, Mecardo