The Australian Bureau of Statistics (ABS) quarterly ‘Livestock Products’ report was released last week. The ABS data gives us year-ending official data on numbers of cattle slaughtered, beef produced, and importantly where the herd is headed.

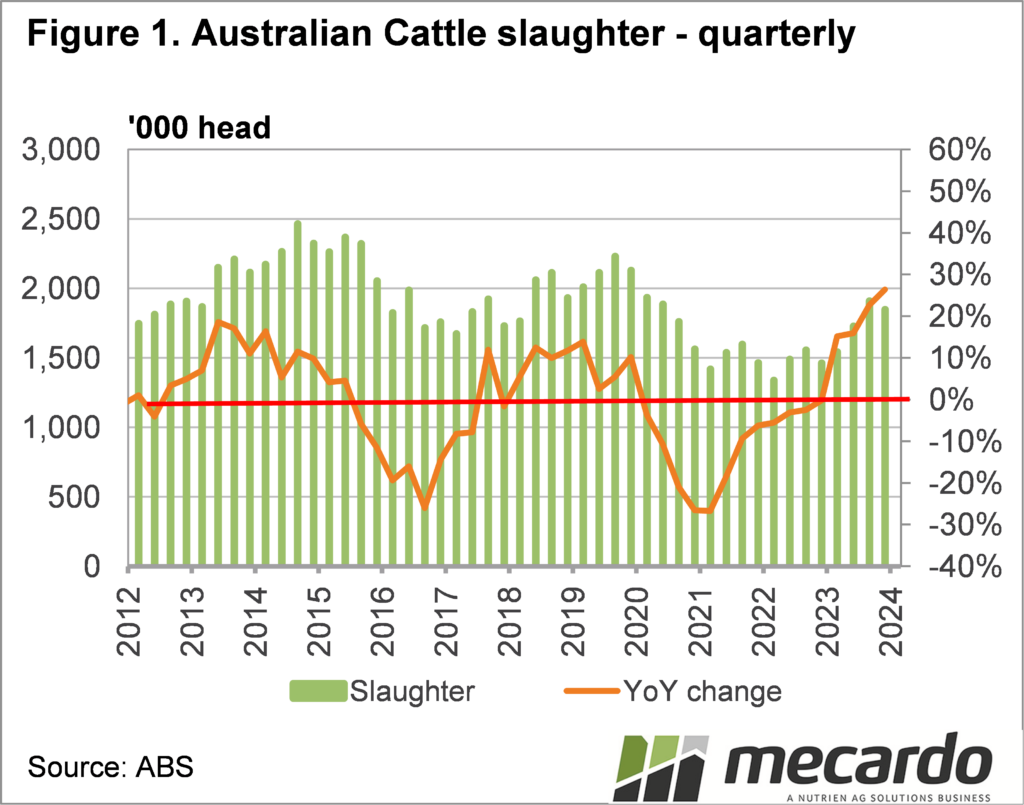

Figure 1 shows quarterly cattle slaughter and the year-on-year change. The December quarter is usually lower than September, with public holidays making the difference. The year-on-year changes show that the herd rebuild has led to stronger supply.

The

December quarter total slaughter figure was 1.848 million head, a 26% increase

on December 2023. Slaughter was the highest since 2019, the fifth highest of

the last 10 years and right on the 10 year average.

Annual

total cattle slaughter came in at 7.028 million head, the highest since 2020.

In 2020, slaughter started out strong, before weakening markedly in the second

half of the year.

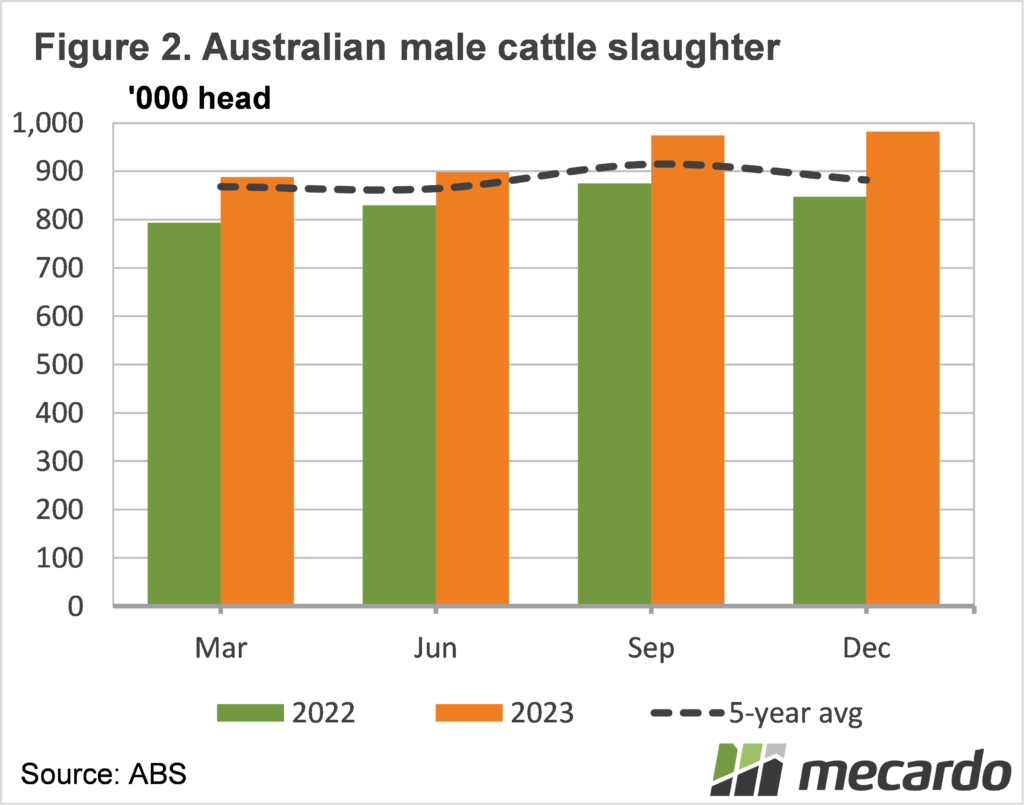

Splitting

cattle slaughter into male and female gives an indication of how the herd is

tracking, and the direction it might be headed.

Almost all

male cattle are slaughtered, and as such the size of the herd can in part be

gauged by how many male cattle hit the processors. Male slaughter doesn’t have

the large swings we see in female slaughter, but it was up 16% year-on-year in

the December quarter.

Male cattle

slaughter was up 12% in 2023 which was the highest since 2019 at 3.53 million

head. The herd does have some way to go

however, for male cattle slaughter to reach the heights of 4.5 million seen in

2014-15.

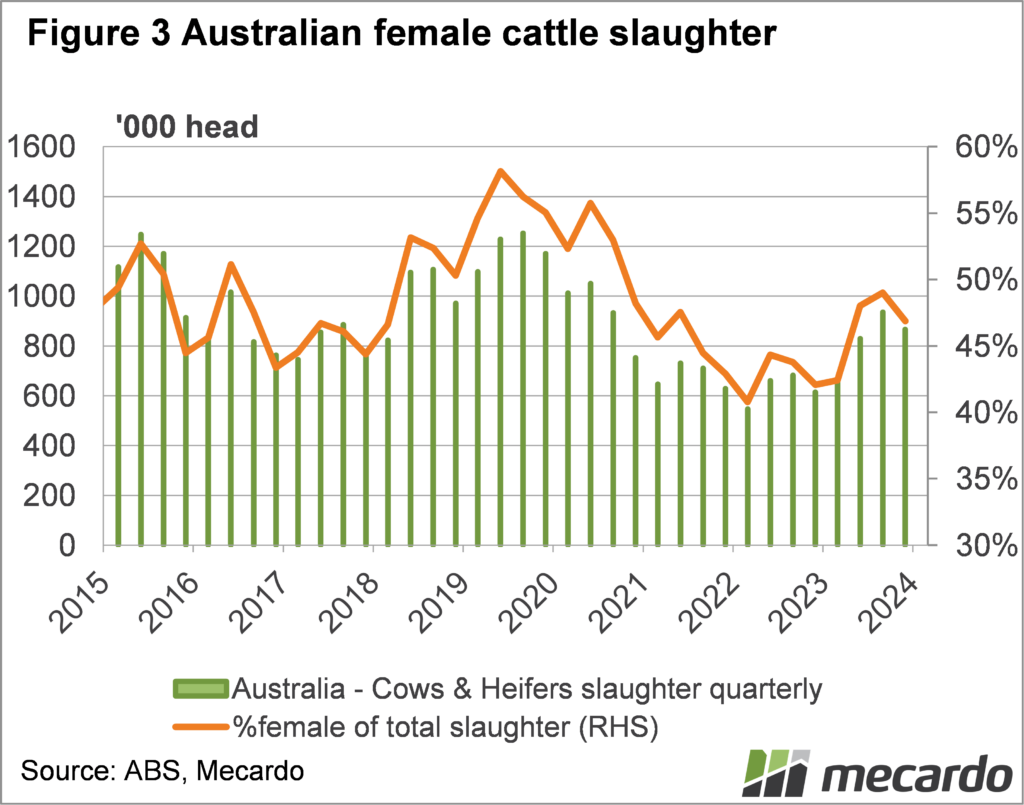

Female

cattle slaughter is the best indicator of producer intentions to grow or

liquidate the herd. In the December quarter female slaughter was up a massive

41% on 2022, but down 7% on the September quarter.

The female

slaughter ratio was 47% for the quarter and for the year. The 47% level has

historically been the tipping point between herd growth and herd liquidation. It

has been an interesting year, but this suggests we went into 2024 with a steady

herd.

What does it mean?

The ABS cattle slaughter data suggests herd growth may have

stalled well below historical maximum herd levels. There was significant trepidation around the

season through mid-2023 which no doubt contributed to mid-year female sell

off.

This does mean that with reasonable season, we could expect herd growth to kick off again, and with strong export prices, this would bring better prices..

Have any questions or comments?

Key Points

- The ABS quarterly slaughter figures for December showed strong year-on-year growth.

- Male cattle slaughter remains well below the highs seen in 2014-15.

- The FSR sat right on a static herd level in 2023, and there is room for further rebuild.

Click on figure to expand

Click on figure to expand

Data sources: ABS, Mecardo