It’s a bit wet is phrase often heard at the moment. It’s a typical massive understatement from farmers being impacted by rain and flooding. Today the focus is on grain crops and markets. It’s impossible to know how rain has shifted yields yet, but markets will give us an idea of grower sentiment.

A really wet spring has the potential to push and pull grain yields, depending on where crops are. Some crops will no doubt be lost, many producing lower yields, plenty which are close to harvest downgraded in quality.

On the other hand, more marginal cropping country, which has not been flooded will benefit from wet weather, producing higher yields, in some cases double. Across a big area, higher yields can compensate for lost and downgraded crops.

Markets don’t always get it right, with overreactions common, but they are our best guide to how sellers and buyers think the crop will fare.

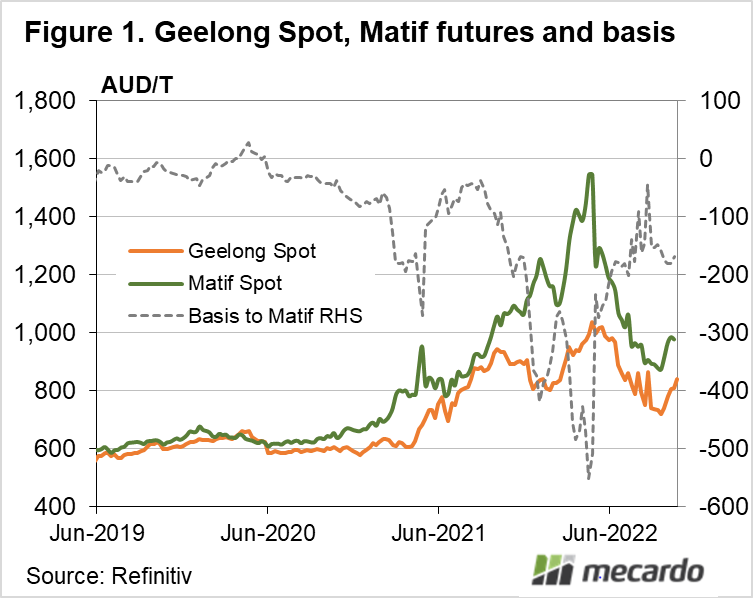

Canola is the major crop most susceptible to waterlogging and disease which comes with wet weather. Figure 1 shows canola prices have rallied in recent weeks, but most of that has been on the back of rising prices in Europe.

Last week was different however, with Geelong canola gaining $12 to hit highs not seen since July at $840/t. The price rise was in spite of a small fall on MATIF, but as we can see in figure 1, Australian canola is still at a heavy discount to its’ European counterpart.

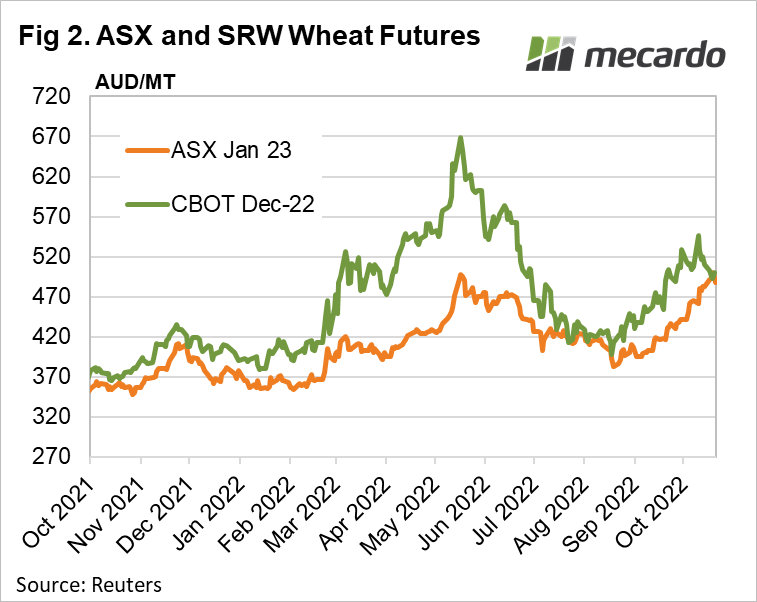

For wheat the story is similar. For the first time since prices were in the (relative) doldrums back in August ASX Wheat Futures are priced at the same level as Chicago Soft Red Wheat (SRW) Futures. Figure 2 shows ASX Futures have continued to climb, despite SRW falling, with both now close to $490/t.

APW or better protein wheats get a push in price from both declining yields in key areas, along with crop downgrades due to the wet weather. Generally this would see feed wheat prices fall, but they have been steady. This suggests there is some concern over yields as well as quality.

What does it mean?

With such a big crop in the ground, there will still be plenty of area which will yield well, and flooded paddocks making up a small percentage of what was expected to be record tonnage. The market seems to have acknowledged this, with relatively small moves up in both absolute prices and basis over the last week.

A bigger move might be on the cards if harvest is delayed, and forward contract delivery dates start to approach. Historically this is when the big spikes can come.

Have any questions or comments?

Key Points

Rain across the eastern states is both good and bad for crop yields.

· Markets are rising relative to international benchmarks, suggesting some concern for supply.

· Big moves often wait until harvest delivery deadlines approach.

Click on figure to expand

Click on figure to expand

Data sources: Reuters