This year has been one of relatively consistent price declines for grain and oilseed markets. Coming out of a season where we reached record levels (driven largely by geo-political factors) this is no surprise, but now that markets have adjusted, where are we headed next year?

Grain markets are

highly volatile, and the previous two years took that volatility to a new

level. While we saw less variation in

prices in 2023, there were still a couple of spikes in the middle of the year

on the back of concerns about commodity movement out of the Black Sea.

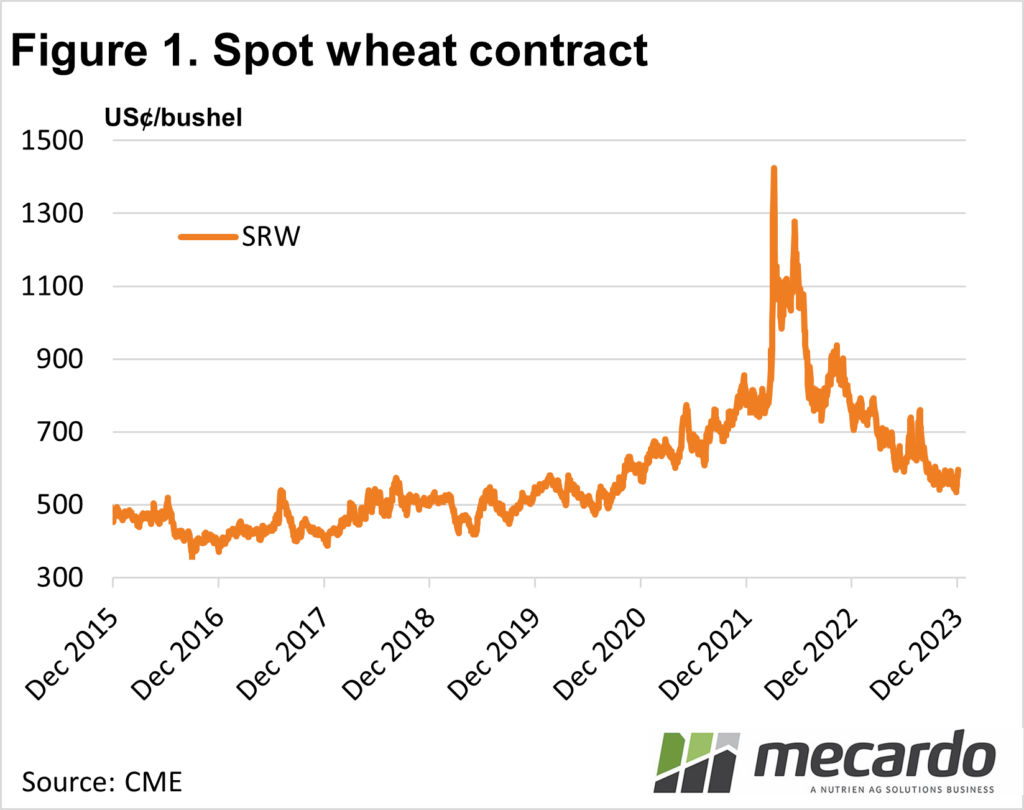

Figure 1 shows that

apart from the winter spike, wheat has trended downwards in 2023. Regular

readers will know that the price decline has eventuated in spite of supply

fundamentals, which suggest that wheat prices should be finding some support,

if not rising.

Positive forecasts for

corn production in both North and South America have helped keep a lid on prices

for all grains, with the downturn dragging wheat down with it.

Figure 1 shows wheat

approaching the 500¢/bushel level which persisted for much of the 2018-2020

period. The more gentle price rise before

the war in Ukraine spike was due to tightening seasons and supplies in major

exporting countries. With El Nino

generally leading to better growing conditions on the other side of the Pacific,

we might have to wait longer to see a strong price improvement.

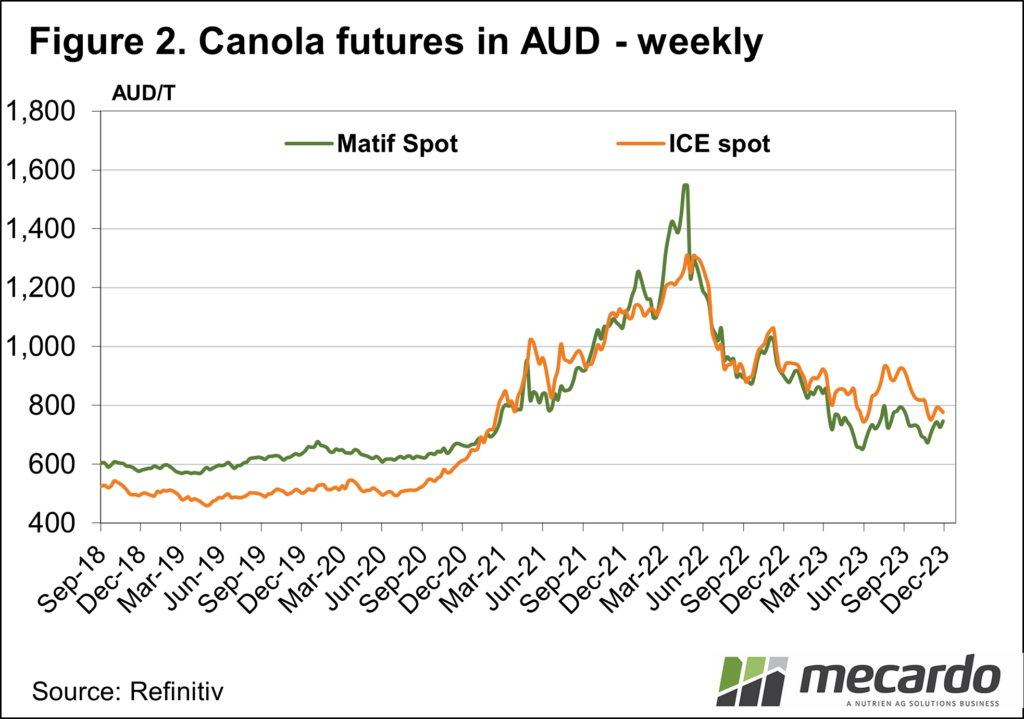

Historically canola

prices remain relatively strong. Figure

2 shows Canadian (ICE) and French (MATIF) futures sitting close to $800/t in

our terms. Supply in the oilseed

complex, driven by soybeans, doesn’t have as strong an outlook as corn, and

hence prices have been holding over the second half of 2023.

Locally we should see

the usual post-harvest price improvement in the new year, something which was typically

absent in 2022 due to the record harvest.

From there things again come down to the weather, with an increased risk

of a dry autumn possibly encouraging growers to hold grain through the autumn.

What does it mean?

Price declines over 2023 came as no surprise, and while it’s hard to see huge upside in international markets in the short term, we should remember how rapidly geo-political events can move markets. This is usually to the upside, rather than down.

All else being equal (which it never is), 2024 looks like it might be a year of consolidation for international grain markets. How our prices relate to international values relies entirely on autumn rainfall, and the season thereafter.

Have any questions or comments?

Key Points

- After a year of price declines, grain and oilseed markets look to be steadying.

- Better seasons across the Pacific could continue to put pressure on prices.

- How local prices will reflect international values depends on autumn rainfall.

Click on figure to expand

Click on figure to expand

Data sources: CME, Refinitiv, MATIF, Mecardo