While we’ll have to wait for Australian Bureau of Statistics (ABS) data on lamb slaughter and production to get an idea of recent lamb slaughter weights, anecdotal reports are that plenty of light lambs are going to processors. What does this do to next year’s supply?

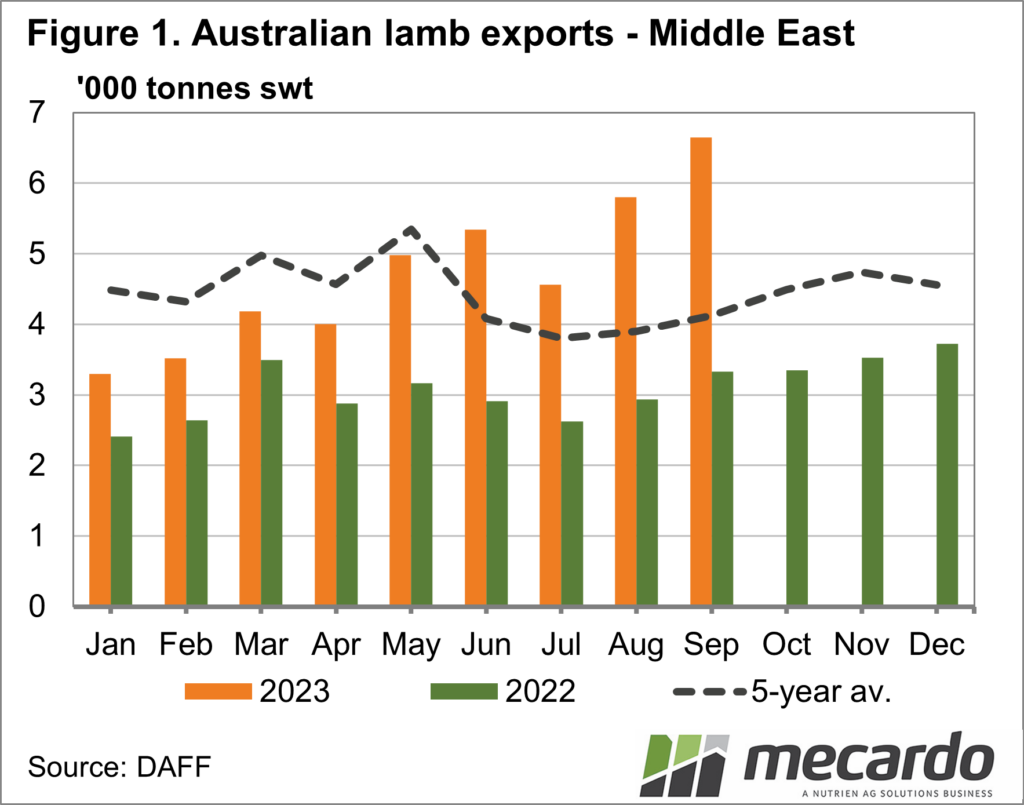

The reports of ‘bag lambs’ being killed and sent to the Middle East are mounting, and the export data is backing it up. Figure 1 shows lamb exports to the Middle East are up a massive 60% year to date, with the last four months being 89% higher than last year.

Looking at exports to other markets, the increase in exports to the Middle East is almost entirely down to new business. China has been making up for the fall in exports to the US, although the US recovered in September to take the same amount as last year.

The last time the Middle East took over 21% of our lamb exports, as they did in September, was in 2019. In that year lamb slaughter weights averaged 23.3 kilograms, much lower than the 25.1kgs seen in 2022 and the 24.5kgs of the first half of 2023.

There is some evidence to the contrary, however. Total lamb slaughter for the last two months has been up 13.5%, yet total exports were up 19%. With the increase in exports more than slaughter, it would suggest stronger slaughter weights, but domestic consumption might be soaking up some of the extra lambs, meaning the weight of export lambs has decreased or remained steady.

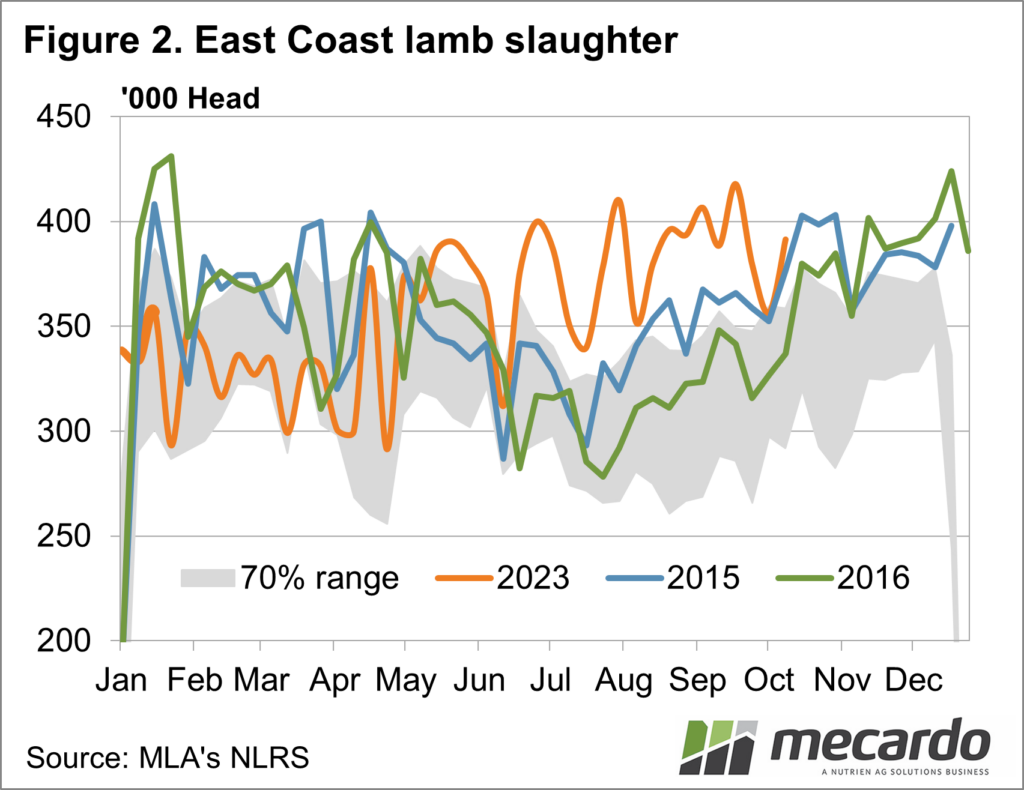

The last time we saw lamb slaughter and Middle East exports at these levels was in 2014 and 2015. Interestingly, this was the period we looked at a fortnight ago when assessing slaughter and price trends.

Figure 2 is busy, but it shows that in both 2015 and 2016, after strong spring slaughter rates at or around 400,000 head, the following February and March saw it drop back by 8-10%. In the winter lamb slaughter hit was back in the 300,000-350,000 head range. This is more of the traditional supply trend.

What does it mean?

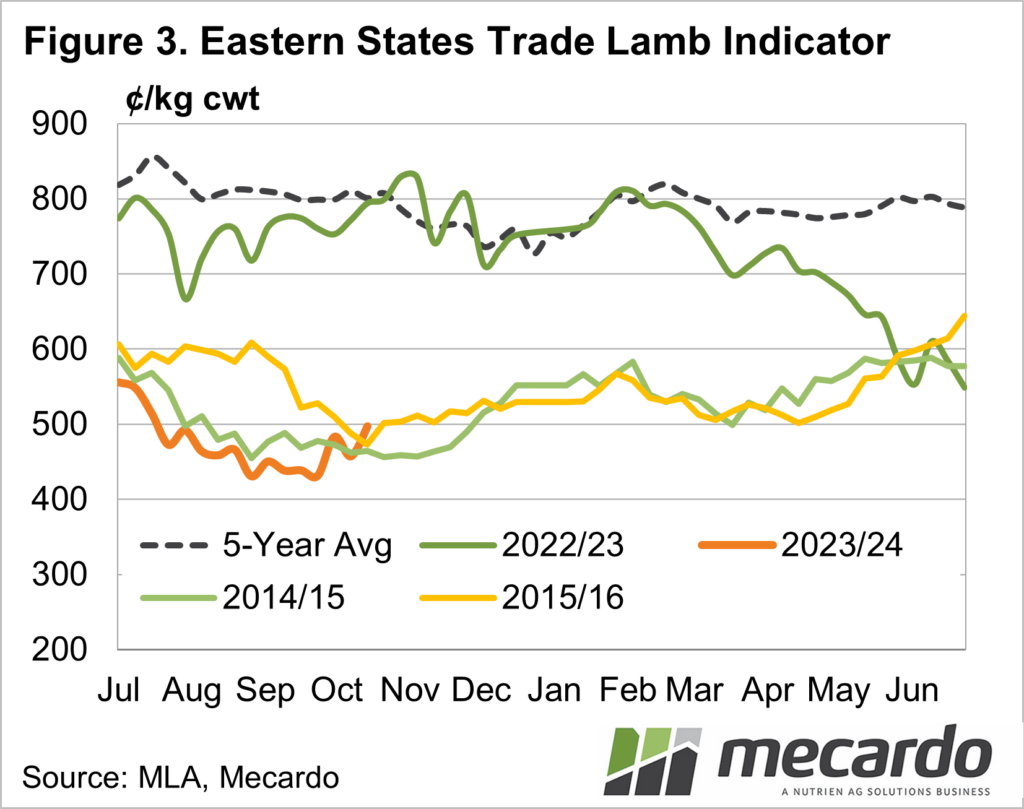

Figure 3 shows how prices reacted in 2014-15 and 2015-16 to the traditional supply trend. As the supply of suckers declined in December, prices rallied, in January and February, and then again in May and June as supplies dwindled further.

There is scope for prices to improve back to 600¢+ level in the medium term if supply tightens, and the premium for holding weaning and finishing lambs should be back next year.

Have any questions or comments?

Key Points

- Lamb slaughter and Middle East exports have been very strong, suggesting more lighter lambs are being processed.

- The last time both exports and slaughter trended like this was in 2014 and 2015.

- Price trends are looking similar, with potential upside over summer and in winter.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, Mecardo