Given the dramatic falls in lamb and wool, it is time again to take a look at relative pricing, and the results are interesting.

It has been a while since we compared the prices of sheep and lambs. How the prices are situated relative to each other can often give an indication of how sheep producers might be thinking about their enterprise mix.

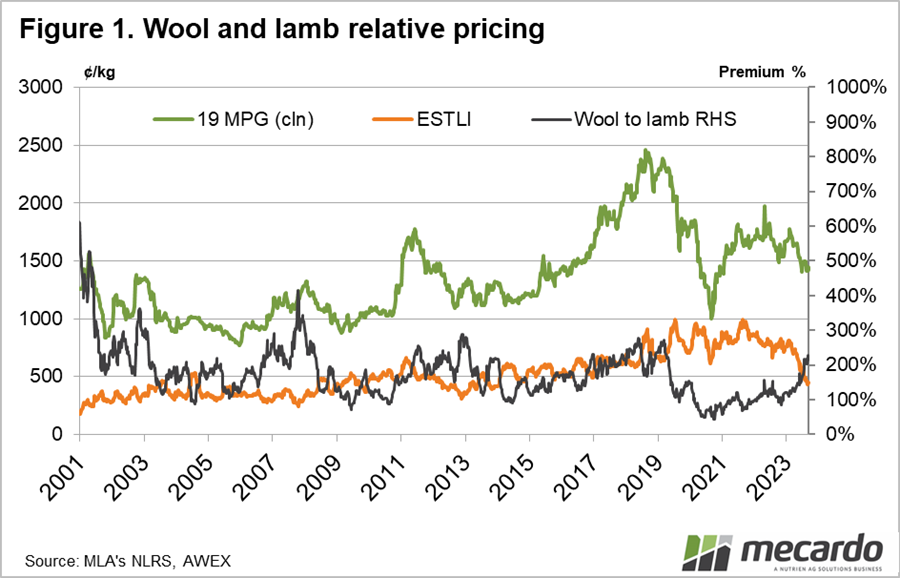

After Covid hit in 2020, depressing wool prices and supporting lamb, the 19 Micron Price Guide (MPG) traded at historic lows relative to the Eastern States Trade Lamb Indicator (ESTLI). Figure 1 shows that for much of 2020 and 2021, the 19MPG was at less than a 100% premium to lamb.

Needless to say, lamb and mutton income was outstripping wool in merino operations, which, along with favorable seasons, brought with it an increase in the number of lambs being produced.

The fruits of the swing to lamb are now playing out with heavy supply and weak prices. As we’ve noted several times, weakening demand has seen lamb producers hit from both sides.

Despite weaker wool prices, the 19MPG is now at a 215% premium to the ESTLI, almost exclusively on the back of falling lamb values.

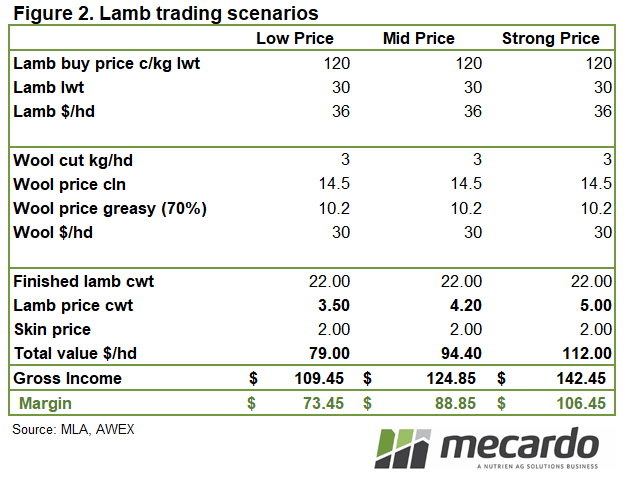

At this time of year, we also like to look at the trading opportunities in buying autumn drop wether lambs. To say they are cheap is an understatement, with many selling for around 100¢/kg lwt, or $25-35 per head.

Figure 2 shows some trading scenarios on buying Merino wether lambs, and in percentage gross profit terms it looks fantastic. Spending $36, and making $124 sounds extraordinarily profitable, but we know, however, that rising costs of shearing, transport, and production will shave a lot out of the margin especially if lambs have to be fed.

Note that this trade calculation does not allow for any feed costs; these will vary between enterprises and should be calculated on a case-by-case basis when considering any trade.

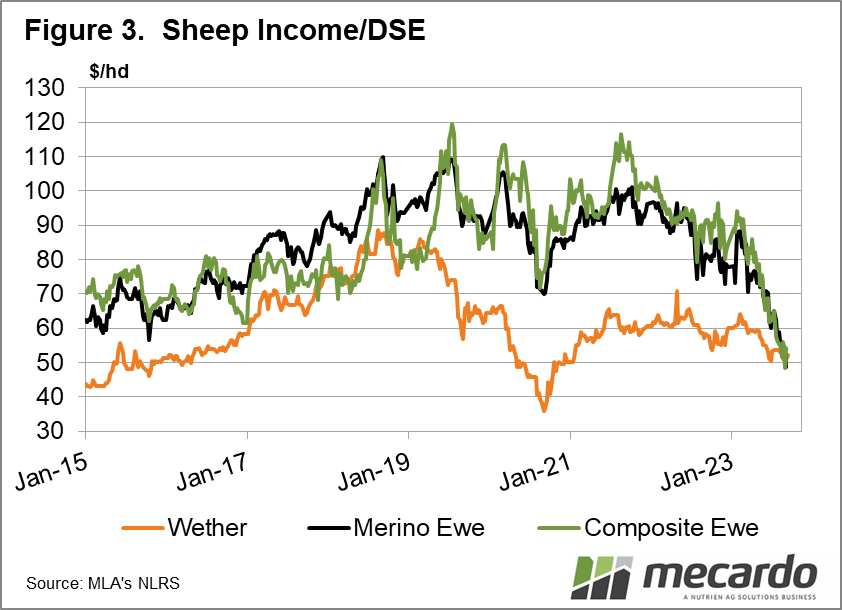

Looking at Figure 3, some merino wether lambs might avoid the slaughterhouse altogether this year. There are a number of production assumptions that go into calculating the sheep income per DSE, but the bottom line is that crashing lamb values now have wethers competing with breeding operations for the first time in four years.

What does it mean?

With sheep and store lambs worth less than they were 12 months ago and merino wool still priced at what can be described as historically reasonable levels, merino producers who can, might hold onto wethers this year. Those who have room to buy wethers might potentially benefit, depending on how the season breaks and pricing responds.

Have any questions or comments?

Key Points

- Merino wool prices are at their strongest level relative to lamb since 2019.

- Cheap merino wether lambs present potentially strong trading opportunities.

- Falling lamb prices make Merino wether enterprises more competitive.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, AWEX, Mecardo