Both lamb and mutton prices have fallen in response to the Covid-19 crisis, but lamb has borne the brunt of the decline. There are a few reasons behind the tighter spread between lamb and mutton, but a driving force seems to be the cheap protein vs high value meat.

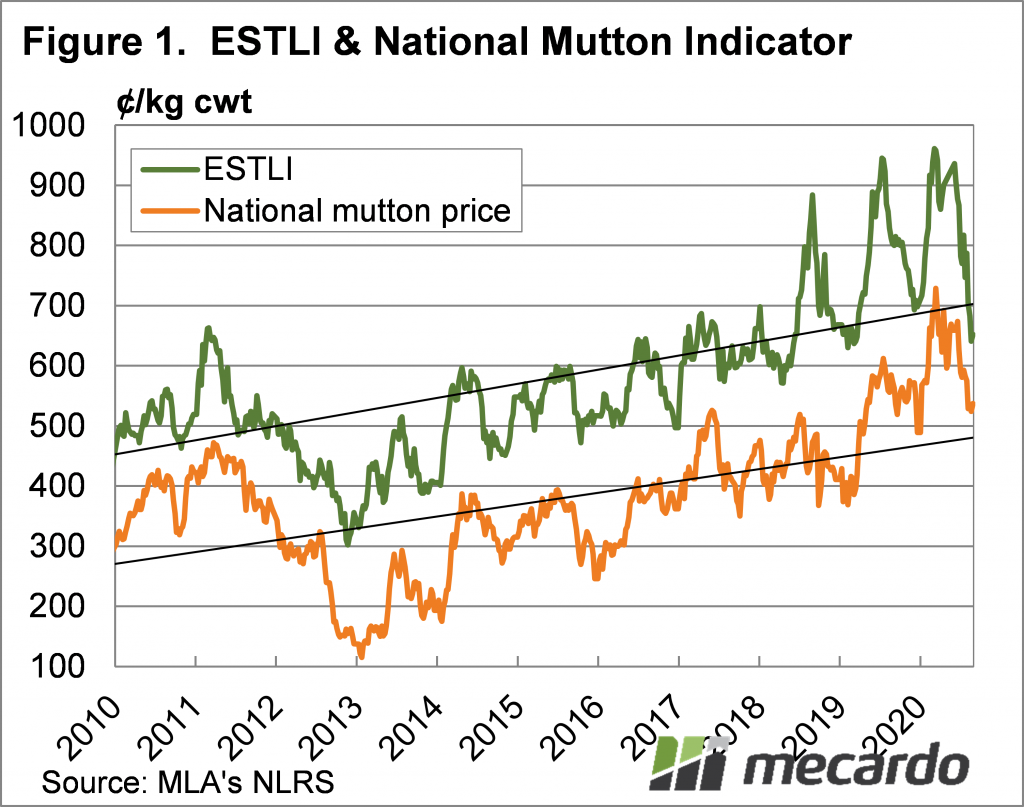

There are a raft of stats we can quote in relation to lamb and mutton price performance in 2020. From the peaks seen in March, the falls are not too dissimilar. The Eastern States Trade Lamb Indicator (ESTLI) has fallen 32%, while the National Mutton Indicator (NMI) has lost 26%.

We can see in figure 1, however, that mutton prices were coming off extreme record highs, while lambs where only marginally above last year’s levels. Compared to this time last year the ESTLI is down 21%, but the NMI is down only 8%.

Figure 1 also shows that while the ESTLI has fallen below the long term upward trend, which is not a great sign, the NMI remains above the trend. Sheep producers will be hoping the trend line can signal some support.

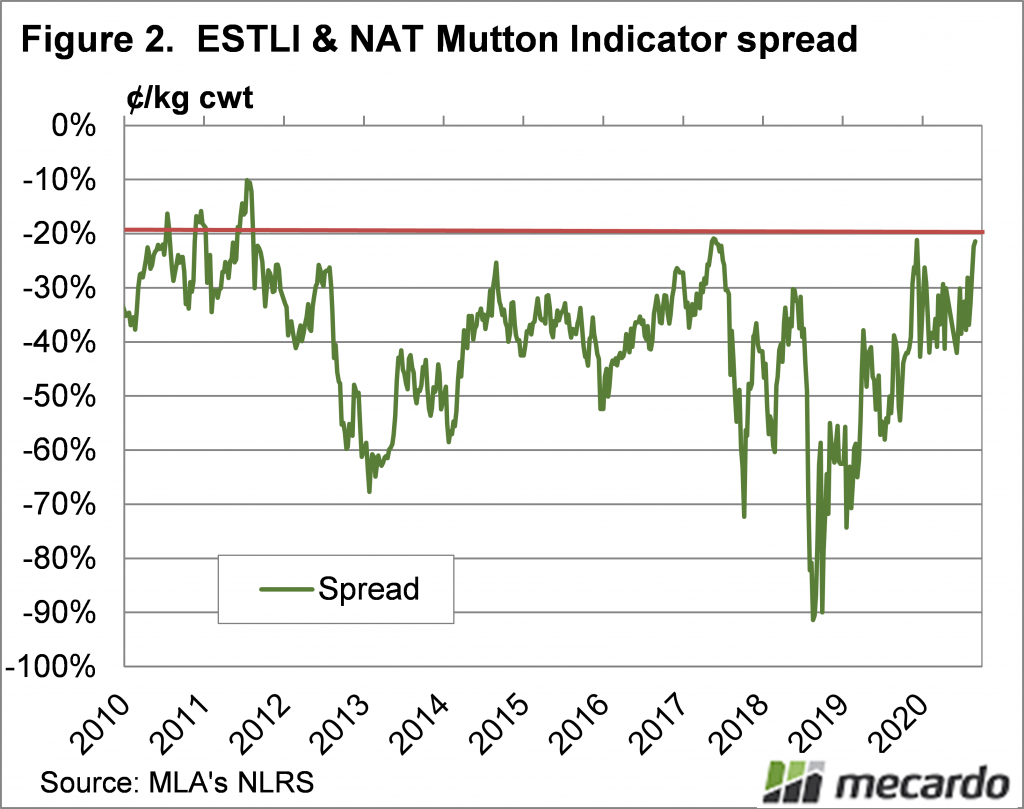

When we compare the lamb and mutton values, we can see that the NMI this week move within 22% of the ESTLI (figure 2). This is significant as in the last 10 years the NMI has spent very little time closer than a 20% discount to the ESTLI. That was during the last big flock rebuild, in winter 2011 when mutton was close to record highs, and lamb had come off.

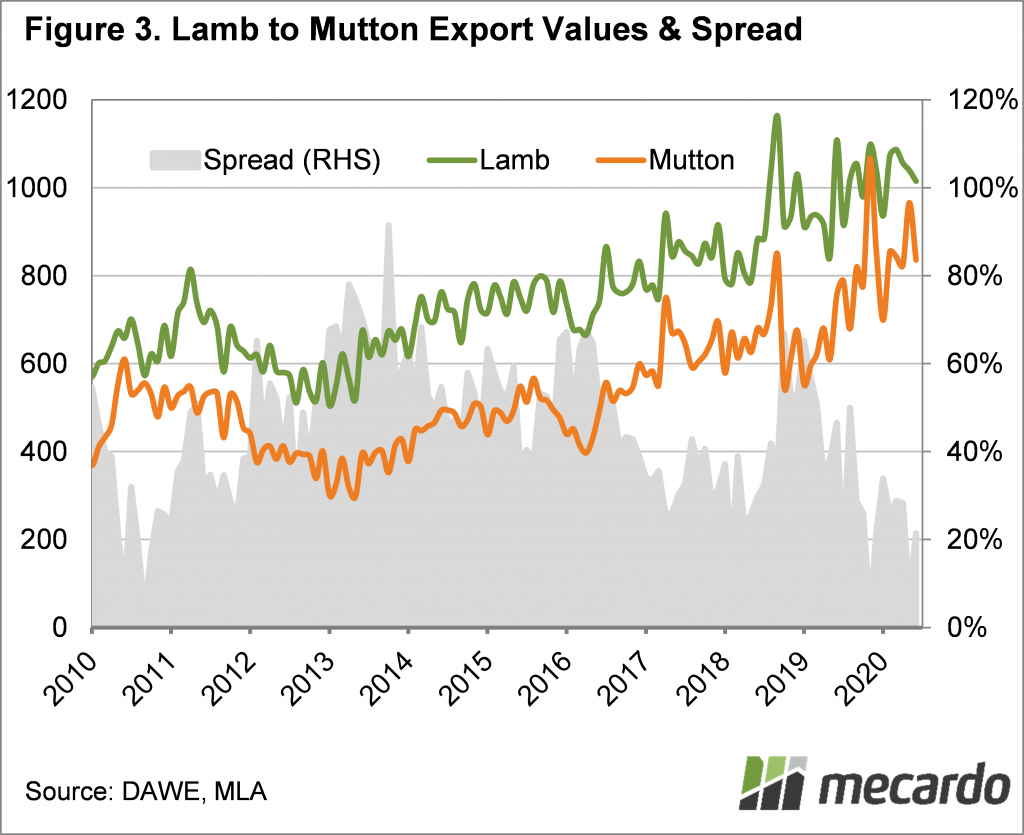

While we know that extreme tight sheep supply and demand from restockers for breeding stock is helping support mutton values, there are signs in export markets that mutton has been the star performer of the last two years.

Figure 3 shows that per kilogram export values for mutton have risen from an average of 440¢/kg in 2018 to 727¢ for the year to date. Mutton export values have gained 65% in just two years. Lamb export values have gained only 14% since 2018.

What does it mean?

Mutton supplies are down, but demand has been growing in the last 12 months, largely thanks to African Swine Fever and a lack of cheap protein in China. The ‘cheap protein’ of mutton hasn’t been afflicted like lamb, which requires high end demand to maintain strong export values.

The good news for lamb is that it won’t go below mutton, but there is some evidence that heavy lambs selling into export markets might be moving towards becoming more of a commodity market themselves. Tight mutton supplies might help keep lamb values from moving too far below 550¢ in spring.

Have any questions or comments?

Key Points

- The National Mutton Indicator has moved within 22% of the ESTLI, close to the tightest spread in 8 years.

- Tight supply is supporting mutton, but export demand is helping prices remain relatively strong.

- With mutton supplies unlikely to improve too much, strong mutton demand could support lamb prices in the spring.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, Mecardo