Faba beans have become a popular break crop in southern states, delivering not only a valuable export or feed commodity, but also giving nutritional benefits to soils. The previous season saw lower plantings and yields, but a boost in prices.

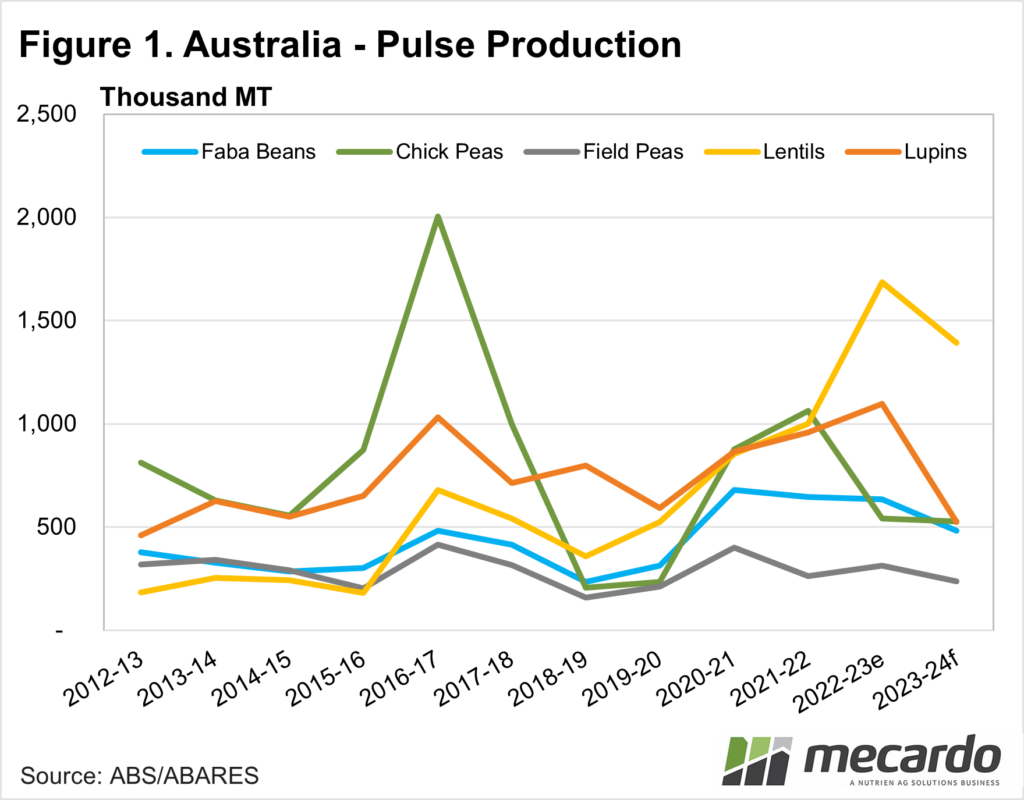

Pulse

production, in general, has lifted in recent years, with increased plantings of

lentils and faba beans in recent years. Faba

bean production has been strong since 2020-21, as increased plantings coincided

with good seasons. Over 600,000 tonnes

of beans were produced in the three years before the current season. This year bean production fell below 500,000

tonnes but was still the fourth-highest level on record.

After

reaching record-high production in 2022-23, lentil production took a hit from the

drier year as well. This was despite

further increases in plantings.

Chickpea

production is expected to remain relatively steady this year. Plantings were down, and yields were expected

to be better.

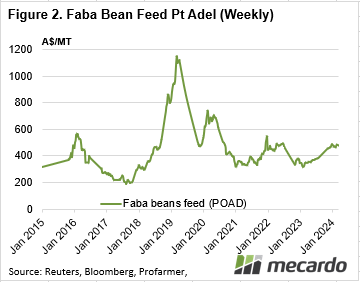

In terms of

price, series are hard to come by. The

best one we have is faba beans at Port Adelaide. Figure 2 shows the rising trend of bean

prices over the course of 2023, and into 2024.

Bean prices have gained $150/t since last harvest, largely on the back

of export demand.

A 45%

increase in price is probably the best performance from a cropping commodity

this year when other grains have been in decline.

Chickpea

prices are also stronger this year and look to have been strengthening

lately. Last week’s quote for chickpeas

delivered in Brisbane was $880/t, up from $830/t back in March. Compared to last year chickpeas are up around

$300/t, or 54%.

Lentil

prices have shown a little less volatility, but are very close to chickpeas at $880-900/tonne

at southern ports. Again lentils are up

strongly on last year, having gained $200/t on the back of tighter supply.

What does it mean?

Certain price relativities will encourage shifts in winter crop plantings. The better pulse prices this year, and lower cereal and canola prices are likely to see some movement towards pulses if the seasons and rotations allow.

Ongoing prices depend on how rainfall pans out over the cropping season, but given how prices have moved this year, it would be a brave grower to hold on to pulses through the winter.

Have any questions or comments?

Key Points

- Pulse production was down this year, largely due to poorer yields.

- While major crop prices are down, pulse values have rallied on last year.

- Strong pulse prices will likely encourage higher planted hectares this season.

Click on figure to expand

Click on figure to expand

Data sources: Refinitiv, Mecardo