A week is a long time in commodity markets. Last week we looked at wheat values and whether it was worth growers making a start on selling. With the rapid declines in Chicago wheat over the last week, grain consumers might be questioning whether they should be looking at securing a portion of their buy price for the new harvest.

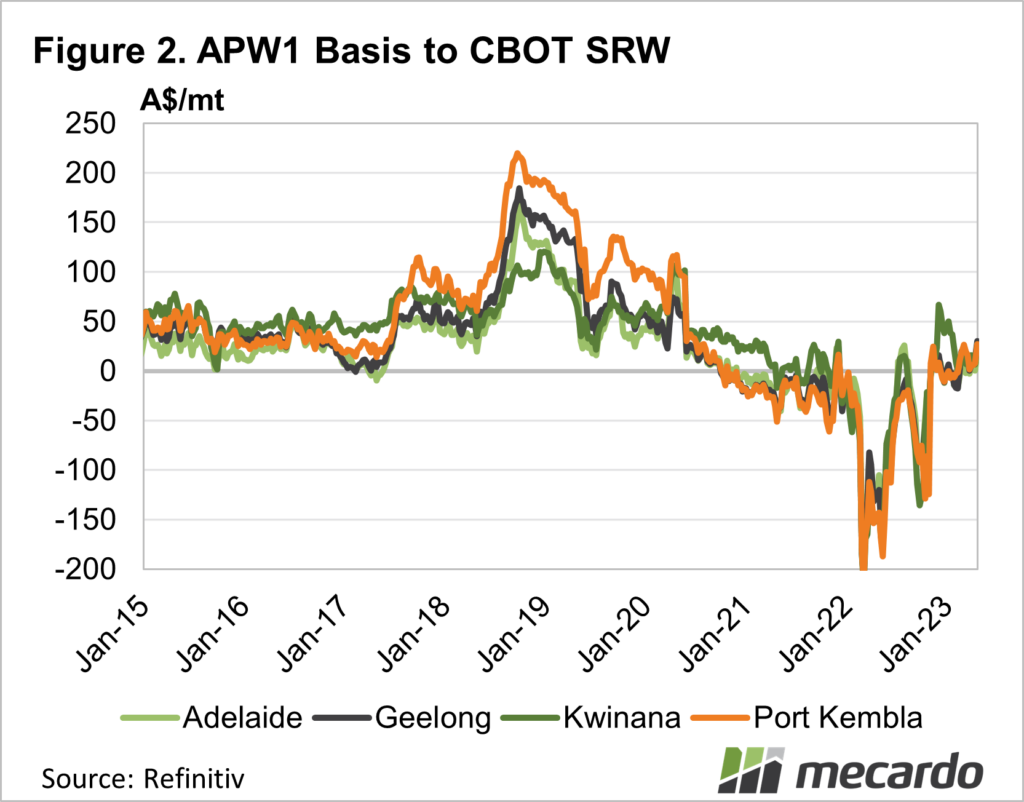

While grain producers are often advised to leave ‘basis’ open, it can be the opposite for consumers, who are exposed to large amounts of basis risk in some seasons. ‘Basis’ is the difference between the local price of wheat and the international benchmark. Chicago Soft Red Wheat (SRW) Futures are usually used as the benchmark, while local prices can be anything, but we usually use port values.

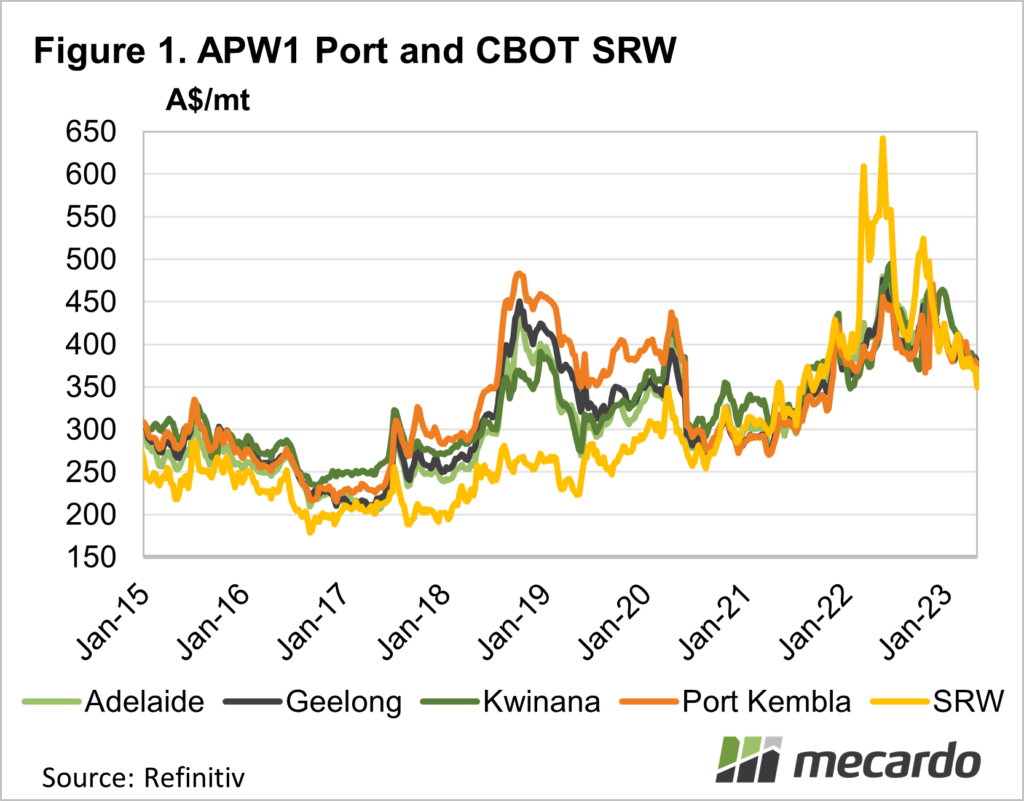

Figure 1 shows APW prices at Australian Ports for the last 8 years and SRW. Generally, local prices follow SRW closely as we usually export a majority of our wheat, and it competes with SRW for buyers.

During drought, Australia doesn’t produce an exportable surplus of wheat, and local supplies become tight. In 2018/19, and during droughts before that, wheat moved to the import parity price. That is, what it would cost to bring wheat in from another country. This price was at a significant premium to SRW.

Grain producers want to leave the basis open to take advantage of drought premiums for the grain they do produce. Consumers want to have basis locked in, as it is a key price risk for them.

SRW prices are currently near $350/t in our terms. Not particularly cheap over the last 8 years, as shown in Figure 1, but the cheapest they have been in 14 months.

Local wheat prices are close to SRW, as is new crop, with the market pricing in another reasonable crop. While the season looks good now, the lurking El Niño could see local prices move higher, and basis risk makes feed grain more expensive for consumers. In 2018-19 increasing basis added $200/t to wheat in NSW.

If a consumer had hedged on SRW, their eventual net price would have been $200 higher than expected. The opposite happened when the US price went crazy with the war in Ukraine, anyone who had bought SRW made a much larger profit than the extra cost of grain here.

What does it mean?

Wheat futures were lower post WASDE report release as the cuts to US demand led to marginally higher stocks than expected. The CBOT Dec-22 wheat contract fell 1.6% in AUD terms. With the outlook for soybeans remaining tight and in high demand, this will support oilseed fundamentals into 2022.

Have any questions or comments?

Key Points

- Wheat prices have been falling, and are now at a 14-month low.

- Grain consumers need to manage basis, and can’t just hedge on international markets.

- Hedging using physical forwards or ASX Futures will protect against El Niño induced price rises.

Click on figure to expand

Click on figure to expand

Data sources: ASX, CME, Refinitiv, Mecardo