Pulse crops don’t take up a lot of area compared to cereals and canola for winter cropping regions, but they are important in the rotation. We thought with the high price of nitrogen, pulses might have gained some ground this year, but it looks like they were trumped by high canola values.

The five main pulse crops grown in winter cropping zones are lentils, chick peas, field peas, faba beans and lupins. While the markets for the various pulse crops are different, the crops are generally used as a break from cereal, and to fix nitrogen for future crops.

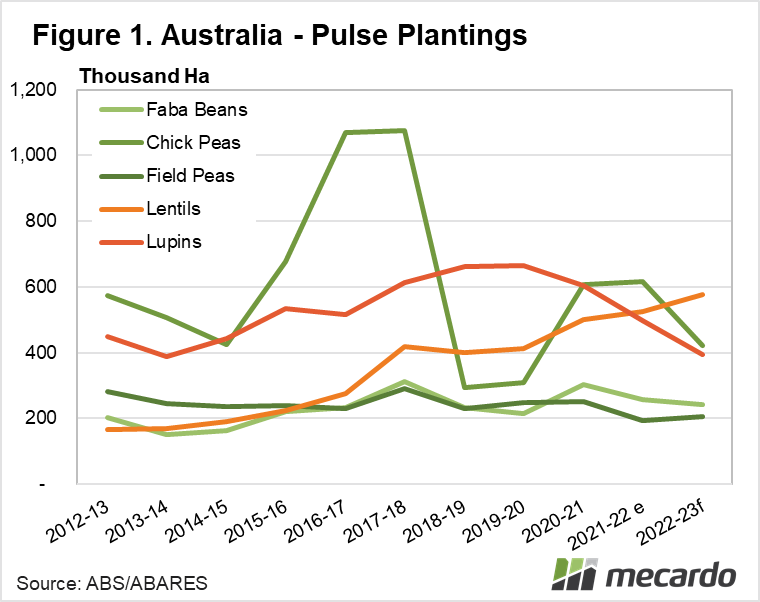

Lentils have this year overtaken lupins as growers favourite pulse to plant, but it hasn’t been a direct switch. Hardly any lentils are grown in WA, which is expected to plant just 2% of Australia’s total lentil area. In WA lupins are the focus, with 68% of the total areas planted to lupins being in WA.

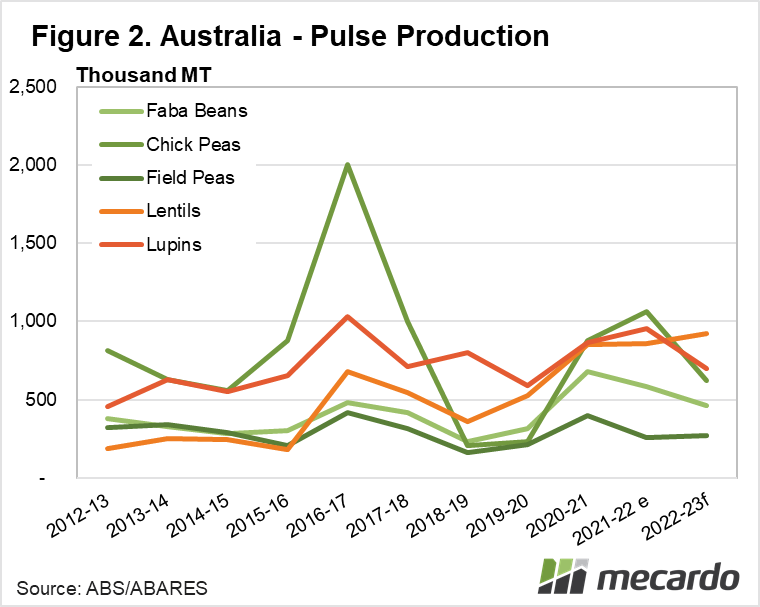

WA has had a strong lift in canola plantings this year, and this has come at the expense of lupins. WA lupin area is expected to be 23% lower this year, wiping 27%, or 200,000 tonnes off production.

Lentil production mainly comes from Victoria and South Australia, which this year are expected to plant 45 and 50% of the total areas respectively. Figure 1 shows total lentil area is forecast to reach a record this year, driven by an 8% increase in Victoria, and an 11.5% increase in SA.

Chick peas plantings have fallen below lentils, but they are not generally planted in the same areas. Most chick pea production is in Queensland and NSW. Chick pea prices aren’t strong enough relative to cereals and canola, and as such they are losing ground.

Figure 2 shows faba beans have enjoyed two big years in a row, and this has led to lower prices and a 6% fall in plantings this year. The fall is mainly due to a massive 76% fall in Queensland, which has had 2 strong years in a row. A 13% lift in expected faba bean production in Victoria will be offset by a 37% fall in SA, as yields are expected to decline from last year’s record of 2.4t/ha.

Field peas are the poor cousin in the pulse department with production expected to be relatively steady. A 13% fall in WA is forecast to be offset by an 8% lift on the east coast.

What does it mean?

Total pulse production is expected to fall 20% this year thanks to a decline in both area and yield. It seems the price differential between pulses, especially ones mainly destined for stockfeed, and canola, has seen grower opt to buy the nitrogen and grow canola.

In terms of prices, it’s hard to see too much upside if the good season continues on the east coast. Protein rich feed demand will likely remain steady, and yields similar to last year might see tonnages as strong. In WA the big drop in lupin plantings might offer some support to prices when harvest comes around.

Have any questions or comments?

Key Points

- Pulse crops take up less area but remain important in cropping rotations.

- Lentil production is expected to reach a record in 2022-23.

- Very strong canola prices at planting have shifted some areas out of other pulses.

Click on figure to expand

Click on figure to expand

Data sources: ABARES