The latest World Agricultural Supply and Demand Estimates (WASDE) were released last week by the United States Department of Agriculture (USDA). The WASDE sets the benchmark for the supply and demand of many commodities and always has the potential to move markets. This month was no different.

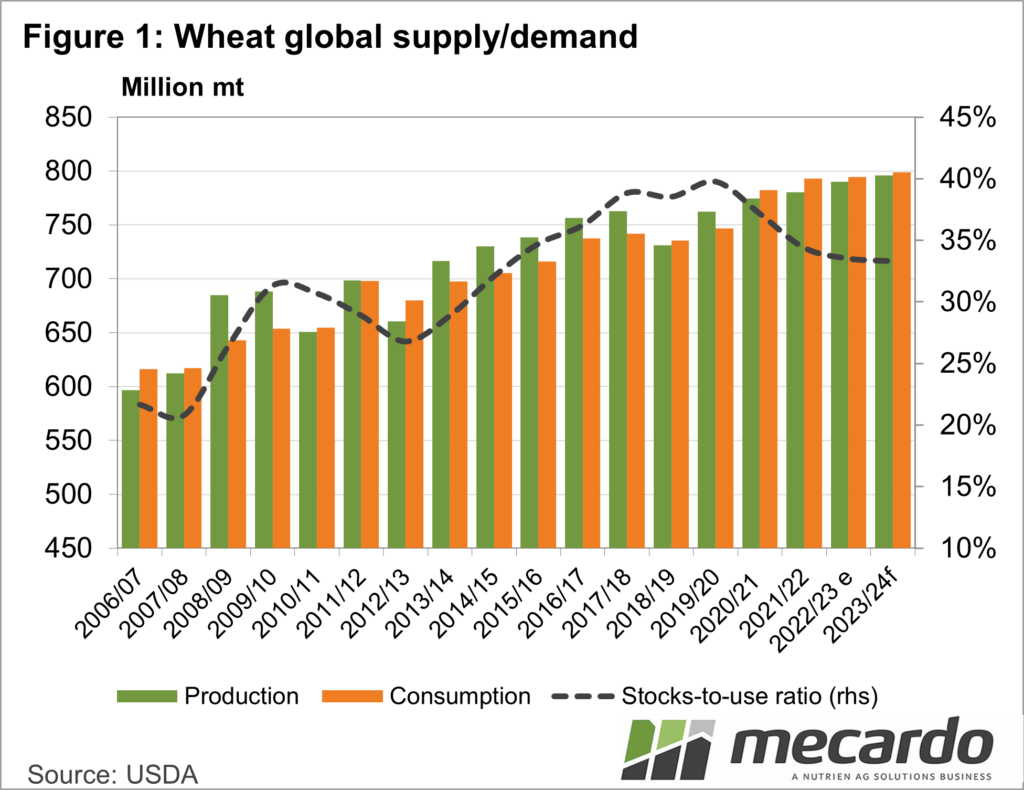

On the wheat front, the WASDE announcement led to some reasonably significant changes to the wheat supply. Total wheat production was reduced from 800 million tonnes, back to 796mmt, which equates to a fall of 0.5%. The WASDE also reduced wheat consumption, down 2mmt to 793mmt. Figure 1 shows that both wheat production and consumption are still expected to be at record highs in 2023-24.

Wheat production in the US was increased by 2mmt, which was more than offset by decreases in major exporters, the EU, Canada and Argentina. Interestingly, the USDA still have Australian wheat production pegged at 29mmt.

The ABARES Crop Report has wheat at 26.2mmt. A 3mmt decrease in world production would be enough to give the market a lift when the USDA comes into line with Australian estimates.

Soybean production took the biggest hit, losing 5mmt, but is still coming in well above last year at 405mmt. As outlined over the last couple of weeks, US soybean acreage has taken a hit, with most of the decrease in world production being due to this.

Other major exporters are all South American, and with the new season crop yet to go in the ground, there was no change in their expected production.

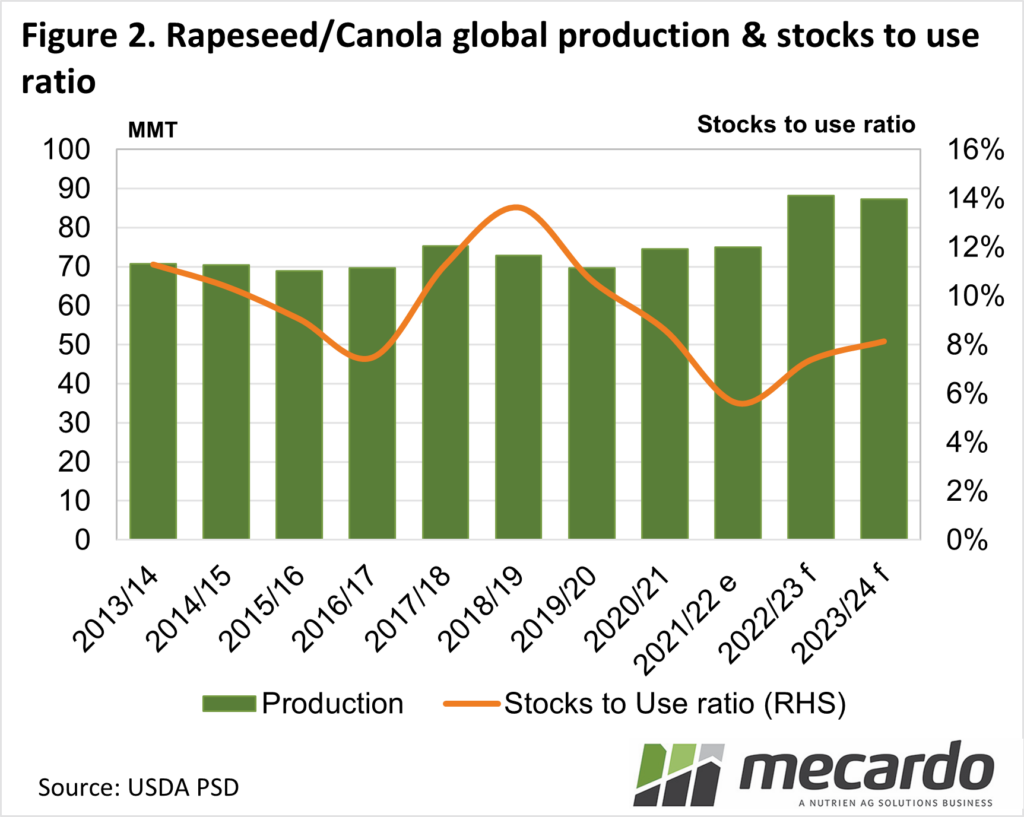

World rapeseed production was left largely unchanged. There is plenty of speculation that the Canadian crop might be smaller than expected given the hot dry weather being experienced there this summer.

What does it mean?

There might be some more cuts to come in some of the USDA’s forecasts, however, there are plenty of unknowns, mainly in South America. Markets have rallied post-WASDE, mainly in oilseeds which have been on a bullish trend. Wheat has also found some strength, but this is more due to issues around Ukraine and Russia, rather than concerns with production.

Have any questions or comments?

Key Points

- The latest WASDE made some cuts to wheat and soybean production.

- Markets found some support from the expected lower supplies.

- There is still plenty of uncertainty surrounding world grain and oilseed supplies.

Click on figure to expand

Click on figure to expand

Data sources: USDA, Mecardo