If you thought beef was getting expensive at the supermarket, you were right. Rising cattle prices in 2021 have seemingly been passed on to consumers, with those preferring lamb enjoying a reprieve for the last twelve months. In domestic markets at least, it’s good news for lamb prices.

The Australian Bureau of Statistics (ABS) recently released their latest Consumer Price Index (CPI) data, and within the data we can find indices for beef, lamb and chicken. Meat & Livestock Australia (MLA) convert the indices to retail prices in cents per kilo terms.

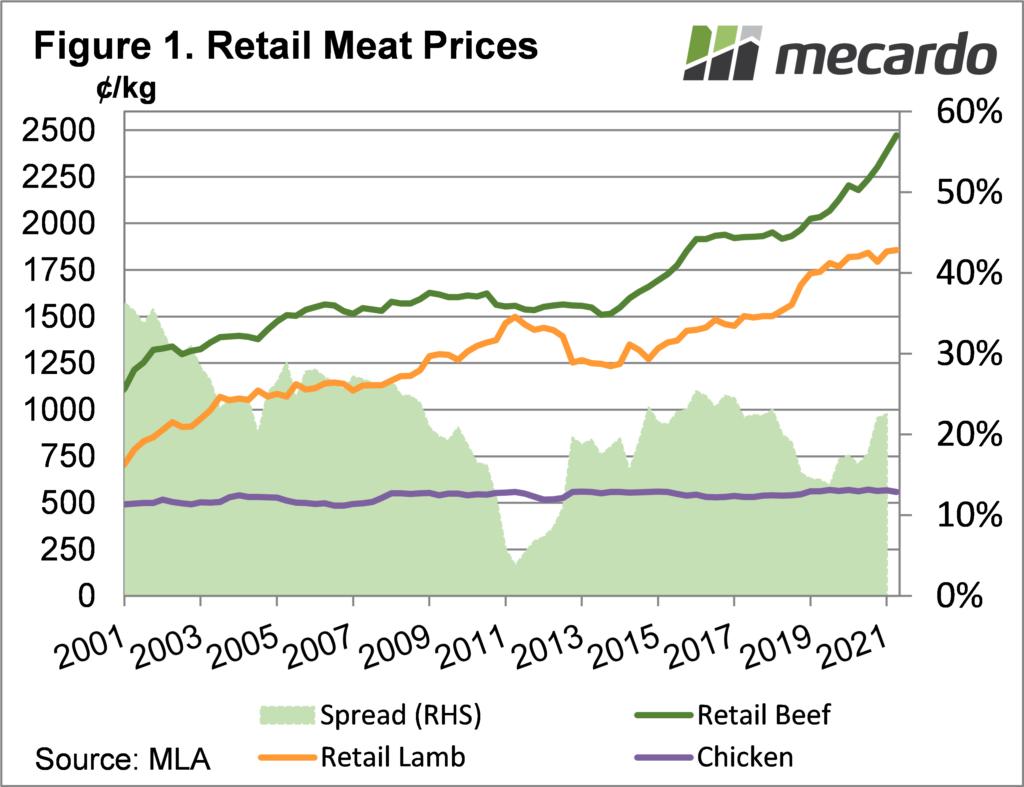

The most recent retail meat price data shows beef streaking ahead of lamb. Chicken is reliably steady and very cheap. Retail beef prices moved 3.6% in the June quarter, having jumped 13.5% in the last 12 months. The rise in retail beef prices hasn’t matched cattle values. Over the 12 months to the June quarter, yearling steers to processers rallied 18%, so retail values nearly kept pace.

The rise in beef retail prices has been relatively consistent since 2018, but lamb has stalled in 2020 and 2021. The stats for lamb retail prices are just a 0.4% rise on the March quarter, and a 1.8% rise over 12 months.

The shaded ‘spread’ series in figure 1 is the beef premium over lamb. Since hitting a low in September 2019 the beef premium to lamb has rallied 11 points to 24.9%. Beef is now at its strongest premium to lamb since 2017, and it has rarely been stronger post 2007.

We know that both beef and lamb prices are largely driven by export market forces, but the domestic market is still the largest single market for both meats. Beef and lamb are now both priced at a huge premium to chicken, but in the red meat battle it looks like lamb has the most upside.

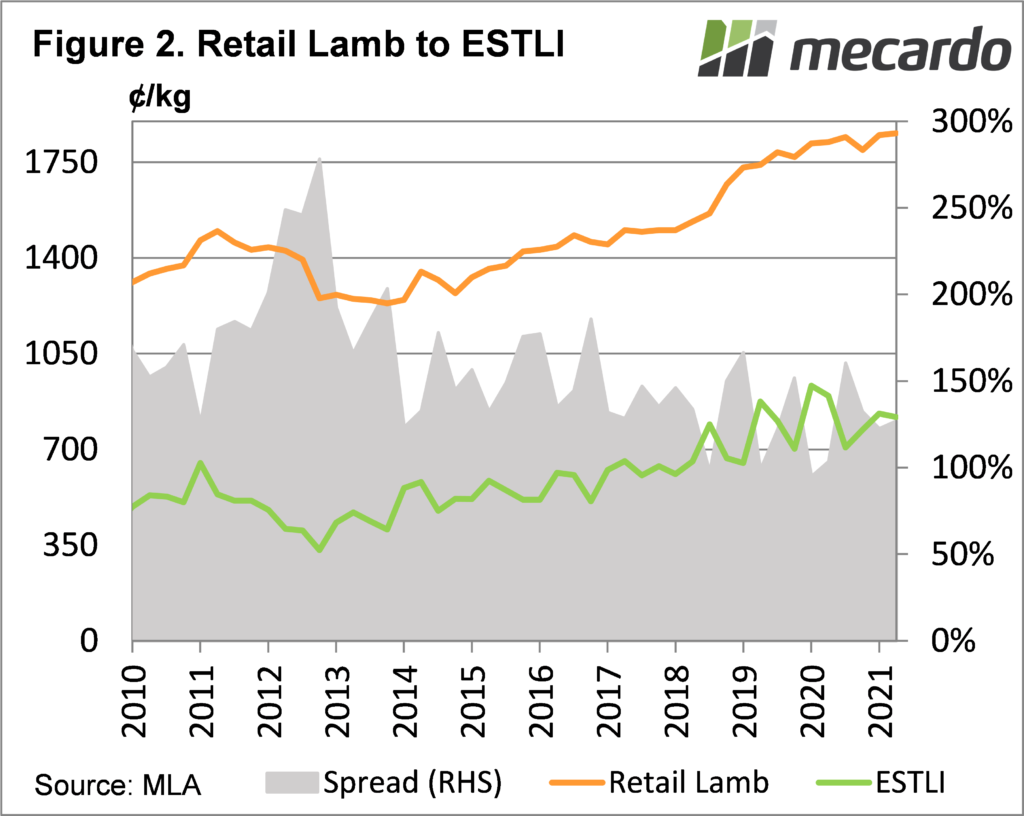

While saleyard lamb prices have been at historical highs over the last two years, retail prices rises have largely matched them. Figure 2 shows the latest data having retail lamb prices at a 127% premium to the Eastern States Trade Lamb Indicator (ESTLI). The higher the premium, the more upside there is for lamb. At the moment it’s around the middle of the range.

What does it mean?

We’ve been looking at plenty of negative factors which might impact lamb prices over the coming months. But there is nothing wrong with demand, and with beef getting so expensive some demand might shift towards lamb. Obviously this is a medium term impact, and will be supportive of price, but supply is going to be the main driver over the coming months.

Have any questions or comments?

Key Points

- Retail beef prices have rallied to new record highs, while lamb has been relatively steady.

- The rising premium for beef over lamb at retail level might offer some support for lamb demand.

- Lambs in saleyards are not expensive relative to retail, but supply will be the main driver in the short term.

Click to expand

Click to expand

Data sources: MLA, ABS, Mecardo