There are only two major sheepmeat exporters in the world, with Australia and New Zealand accounting for over 85% of global lamb and mutton exports. As such, we like to keep an eye on what’s happening in New Zealand, and it would seem competition for export markets continues to wane.

The kiwi sheep

population has been on the decline for decades.

After remaining relatively steady through the 2000s, the dairy boom saw

more and more country converted to milk production.

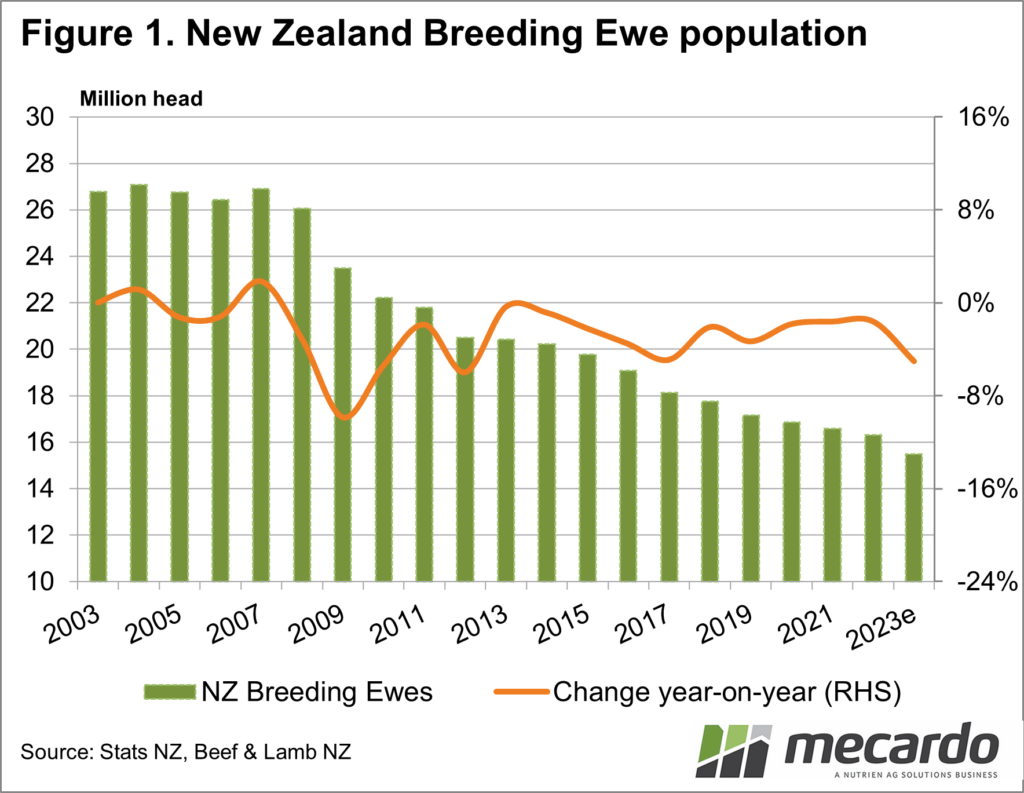

Figure 1 shows the New

Zealand breeding ewes flock has been in constant decline since it last

experienced growth in 2007. The 5% year-on-year

fall in the NZ breeding ewe flock in 2023 has seen over 11.5 million ewes

exiting the system over the last 20 years.

The new low in 2023 was 15.5 million head.

To put NZ numbers into

perspective, Australia’s breeding ewe flock is estimated at around 36 million

head, with around 14 million head being breeds other than merinos.

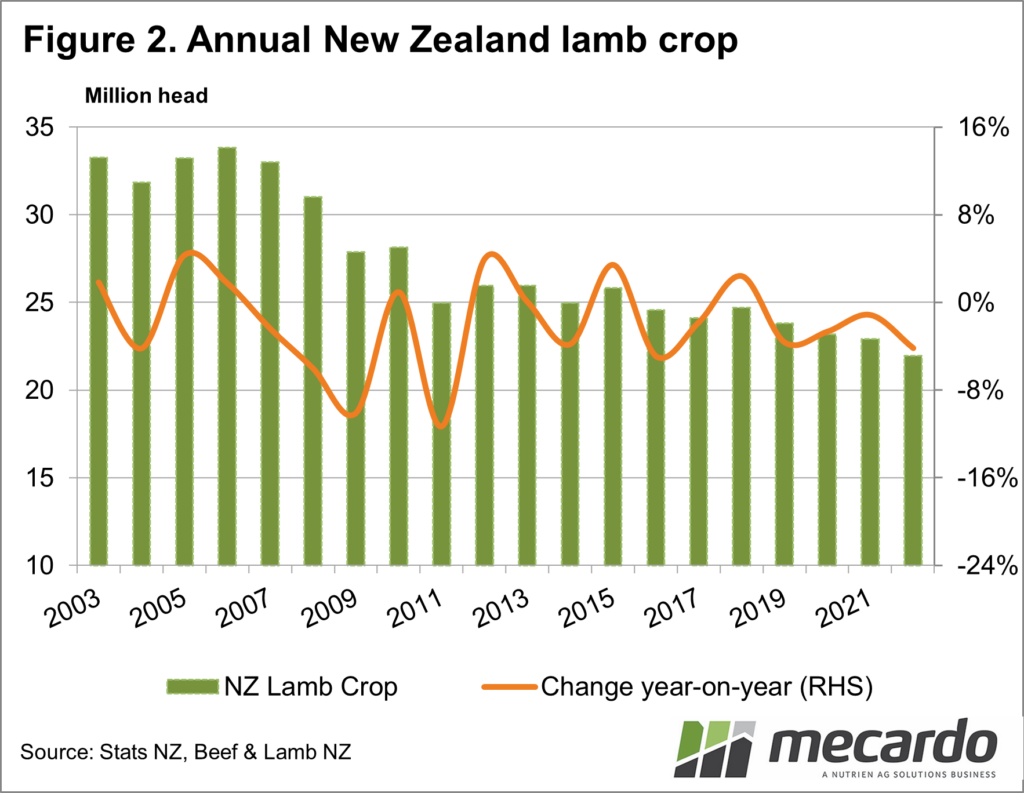

Productivity

improvements have seen a slower decline in the NZ lamb crop, although we don’t

have numbers for 2023 yet. Figure 2

shows NZ lamb crop has also been in decline, but some years have bucked the

trend.

We can see, however,

that 2022 was a new low for lamb production in NZ, with the crop coming in at

21.9 million head, down 4% on 2021. With

fewer breeding ewes counted in 2023, we can expect further reductions in the

lamb crop this year.

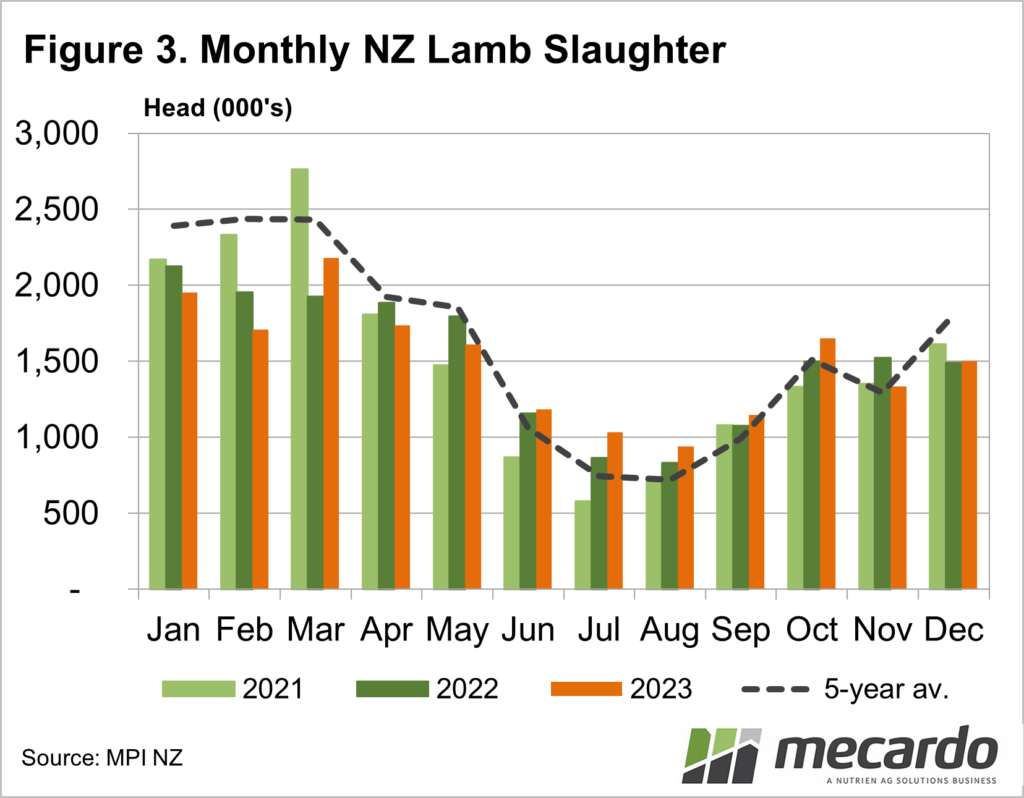

NZ lamb slaughter is

much more seasonal than here in Australia.

Figure 3 shows that we are now in the middle of the peak slaughter

period for NZ lamb. This can have an

impact on export demand here, with plenty of product available across the

ditch.

With a likely lower

lamb crop in 2023, growers here can hope for some support from export markets

over the coming months. We can also that

a lack of supply out of NZ in winter helps support our prices in most

years.

What does it mean?

While it’s bad news for the New Zealand lamb industry, and the countries that rely on their exports, a shrinking flock in New Zealand is good for Australian lamb producers. The weaker the supply out of NZ, the more buyers have to come to Australian exporters for product, supporting our prices.

Have any questions or comments?

Key Points

- Australia and New Zealand account for over 85% of global sheepmeat exports.

- The NZ breeding ewe flock continued to shrink in 2023, with fewer lambs produced.

- Weaker lamb supply from NZ is positive for export and saleyard prices here.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: Stats NZ, MLA, Mecardo