Grain export information is often limited to anecdotal information around the pace of exports. There is data available from the Australian Bureau of Statistic (ABS), although a few months behind. We can take a look at how markets have shifted in recent years.

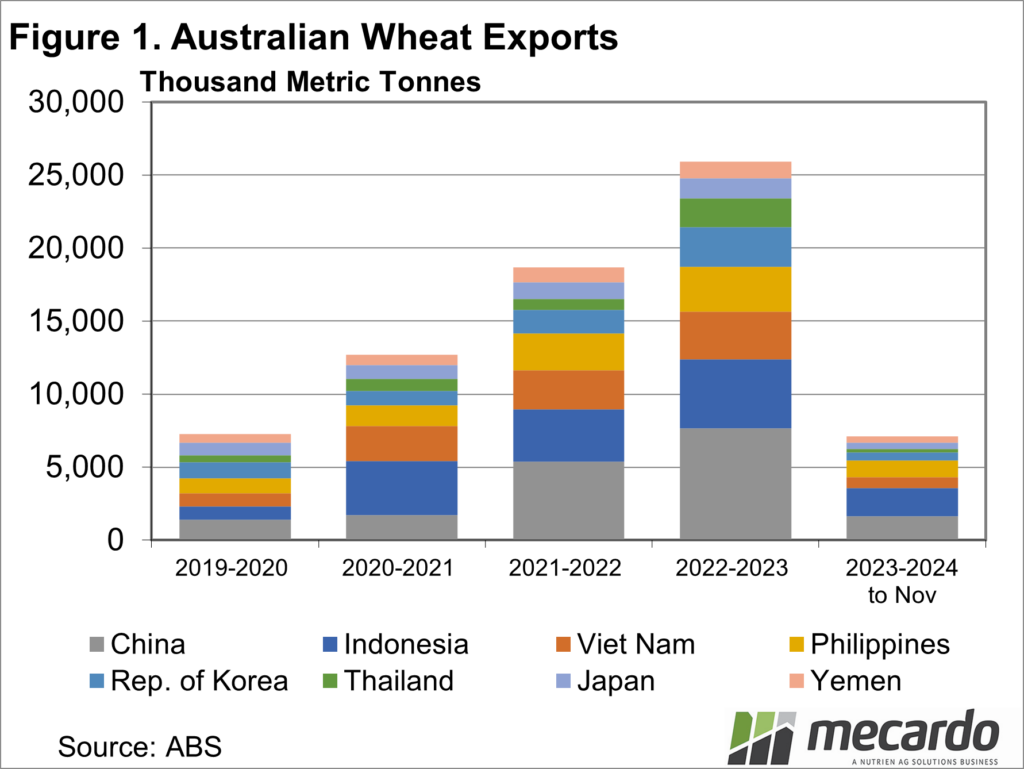

Australia has produced a lot of wheat in recent years, and exporters have done a good job finding markets for it. Figure 1 shows the growth in wheat exports over the past four years, with the 2023-24 column just for the year to November, hence comparably very low.

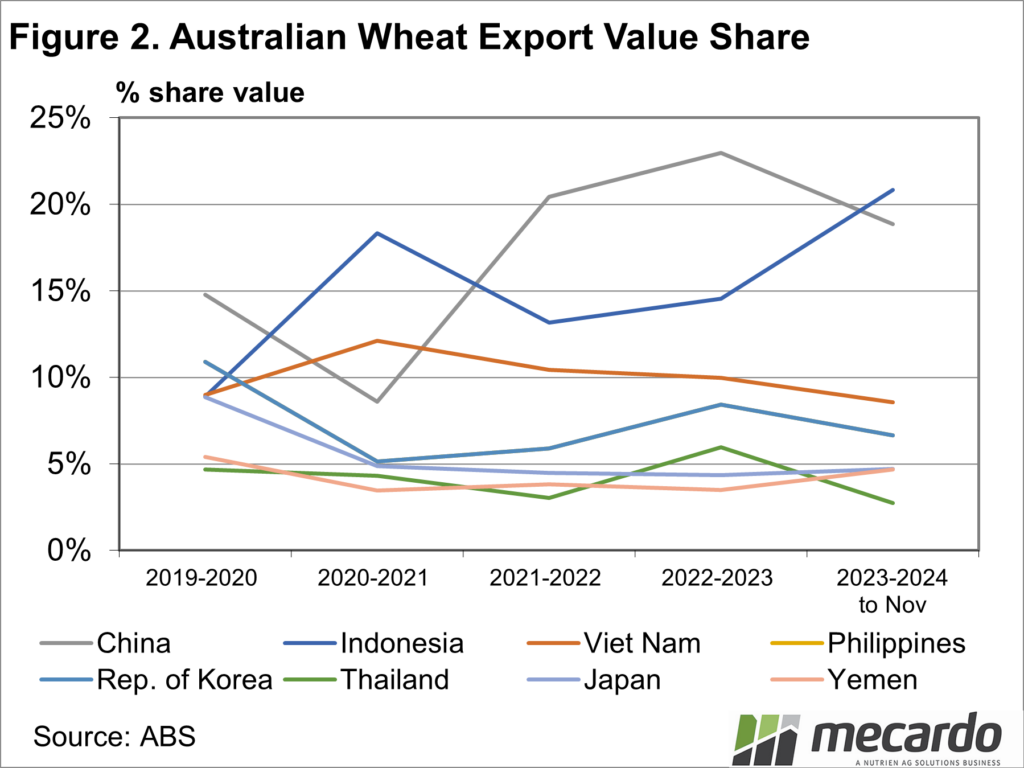

The largest growth in wheat exports has been in exports to China. Obviously helped by very strong supply, wheat exports to China grew 42% in 2022-23 when the crop was similar. Demand from China remains a strong driver of exports and therefore prices.

Indonesia has long been a major market for Australian wheat. The close proximity and huge population make Indonesia a profitable market, especially for Western Australian wheat. In 2020-21 Indonesia was our largest market.

South East Asia accounts for most of our wheat exports. This zone works as freight from Australia is cheaper than other major exporters. As freight costs increase, so does Australia’s advantage in these markets.

There is still plenty of wheat exported to the Middle East, with Yemen by far the largest market. It is likely hard wheat that ends up in the Middle East, as our feed wheat are unlikely to compete there.

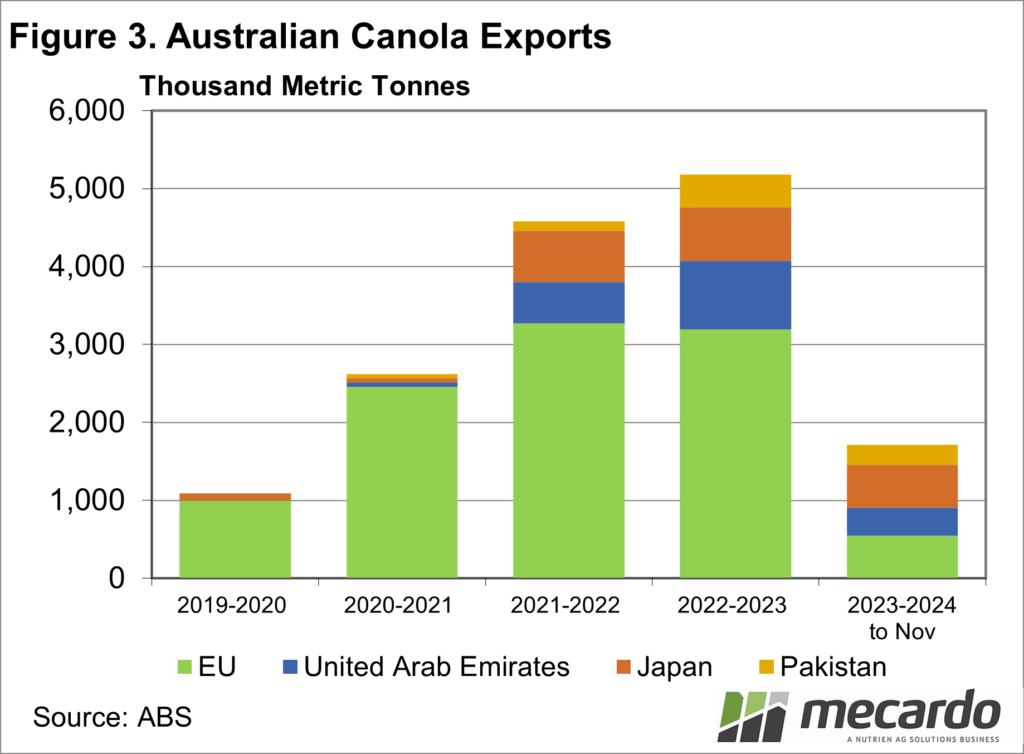

Figure 3 shows how the European Union dominates the canola export market. While the data doesn’t include all exports, we can see by value that the EU has taken between 50% and 80% of Australian canola every year for the last four years.

Canola exports to Japan and Pakistan have grown with increased supply over the past two harvests. This is positive diversification for when the EU has a big crop, or decrease in demand, like they did when cutting biofuel demand last year.

What does it mean?

Grains and oilseeds will always find market, being highly traded global commodities, and we can see in this data that Australian marketers are good at finding homes for wheat when we have big crops. Similarly, we see by basis improves with a small crop. There are lots of markets competing for our wheat, less so canola, when supply tightens.

Have any questions or comments?

Key Points

- Wheat and canola exports have grown strongly in recent years on the back of heavy supply.

- China and Indonesia dominate wheat exports, with proximity a key driver.

- The EU is by far the largest canola market, but others are growing.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: ABS, Mecardo