ANZAC Day traditionally signals the start of the winter crop sowing program for Australia’s cereal producers. This year the start has been kinder than normal, with sowing rain arriving in many areas prior to the key date. With forward prices still at the top end of the historical scale, the question beckons, should we be managing prices, or letting it all float?

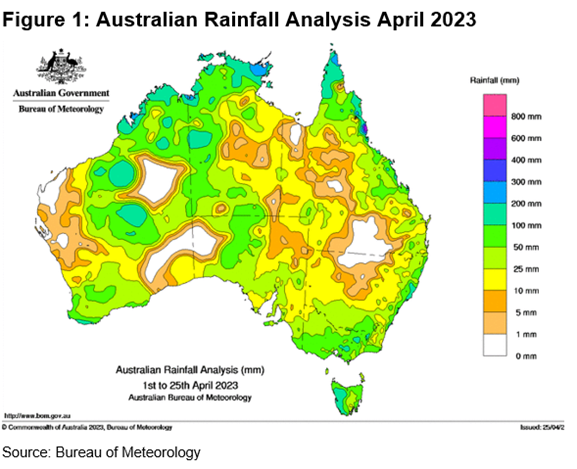

Figure 1 shows that April has been pretty good to croppers in large parts of Victoria and southern NSW, along with the WA Wheatbelt (figure 1). Above-average April rains before ANZAC day has hit which is great for those that started early, which seems to be most these days, but also for those waiting for moisture to sow.

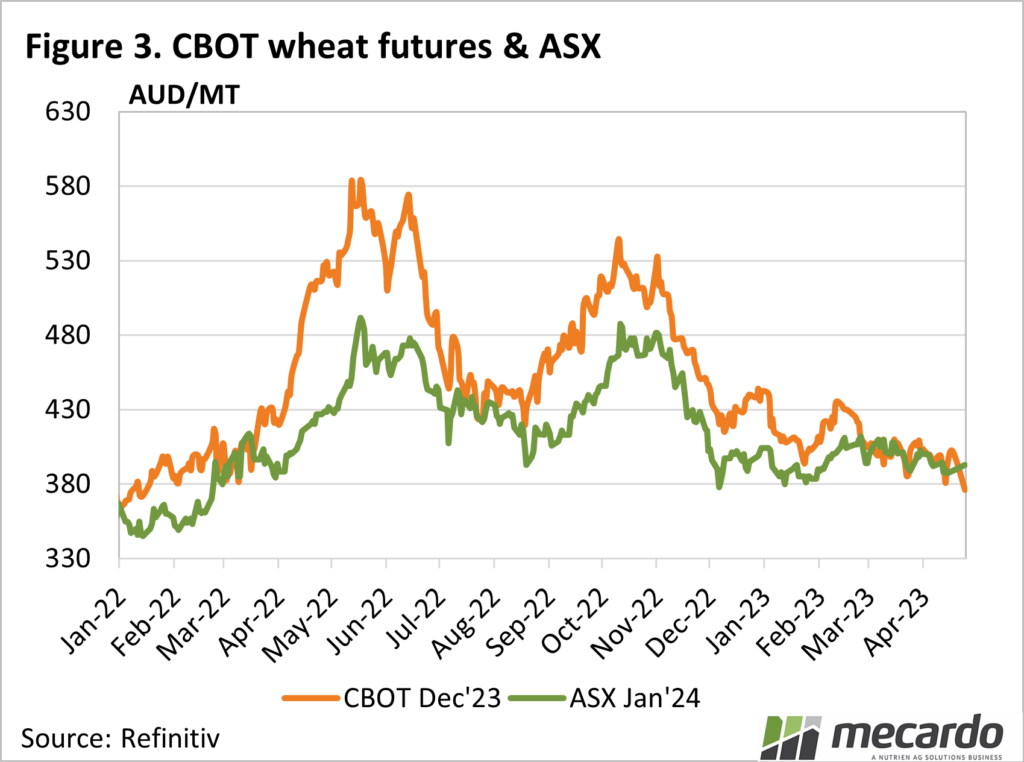

Grain marketing has historically followed a familiar pattern. Forward pricing, be it using swaps, futures, or physicals, has traditionally been done before sowing. The reasoning was that the uncertainty surrounding northern hemisphere crops coming out of dormancy, or spring crops being sown, has seen a premium built into the market.

As outlined in Friday’s weekly comment, these days US crop condition still has a strong hold over market levels, but plenty of uncertainty is added by the questionable reliability of Russian grain exports.

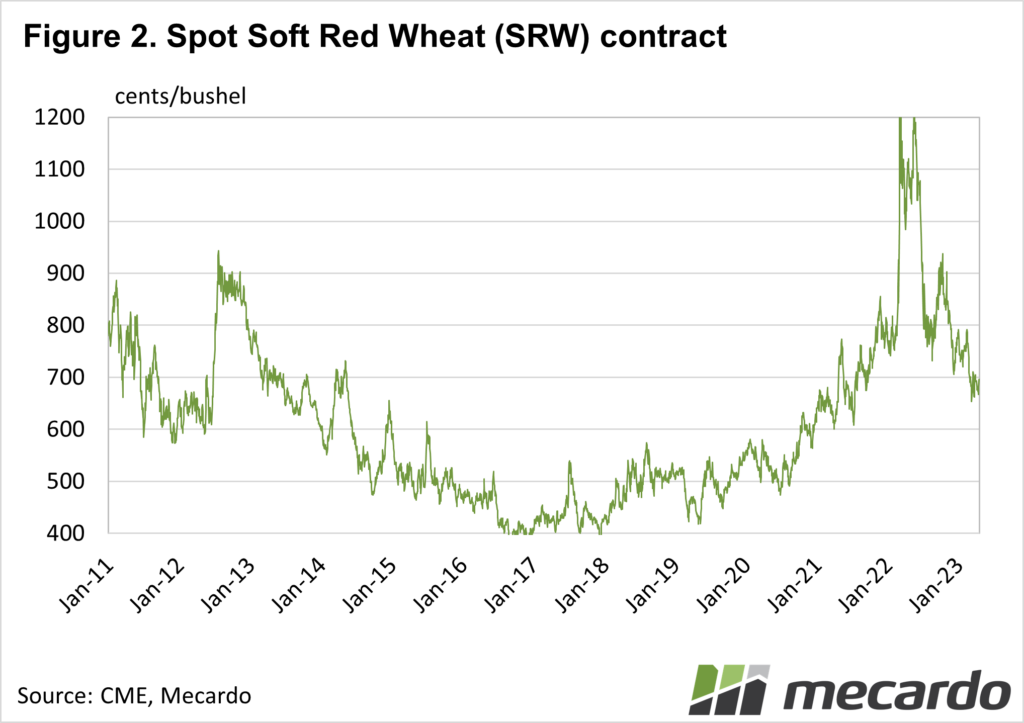

Chicago Soft Red Wheat (SRW) Futures eased on Monday and are now at their lowest levels since January 2021, a year before the invasion. With the USDA forecasting a 7-year high in total wheat plantings, and better forecasts for the remainder of the growing season, pressure was likely to come onto the market.

Figure 2 shows, however, that SRW is still priced well above any time between 2014 and 2021, so a big northern hemisphere crop could still see plenty of price downside.

In our terms, SRW is still priced at $380/t. Any price over $300 used to have growers locking some in early in the year. Rising costs and rampant volatility have seen many producers take a more cautious approach.

What does it mean?

The pricing window for wheat is still open, and the good start should be encouraging a close look at forward prices. It’s worth remembering that pricing 10% of the expected crop will still leave 90% open to price improvement. Like having a bit each way, a grower with some grain locked in can be pleased if the market falls, as they’ve done the right thing. They should be even more pleased if prices rise, as it improves the bottom line.

Have any questions or comments?

Key Points

- A good start in many cropping areas should have growers thinking about new crop pricing.

- Chicago SRW prices have been easing, but remain historically well-priced.

- It’s a good time to think about selling a small portion of expected production.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: CME, ASX, BOM, Mecardo