With Meat and Livestock Australia’s (MLA) Cattle Industry Projections dropping last week it gives us our first look at what cattle supply might look like for the rest of the year and into coming years. Cattle supply is not the only driver of cattle prices, but it is a key one, and when we combine it with export prices we can find some potential price points.

The Cattle

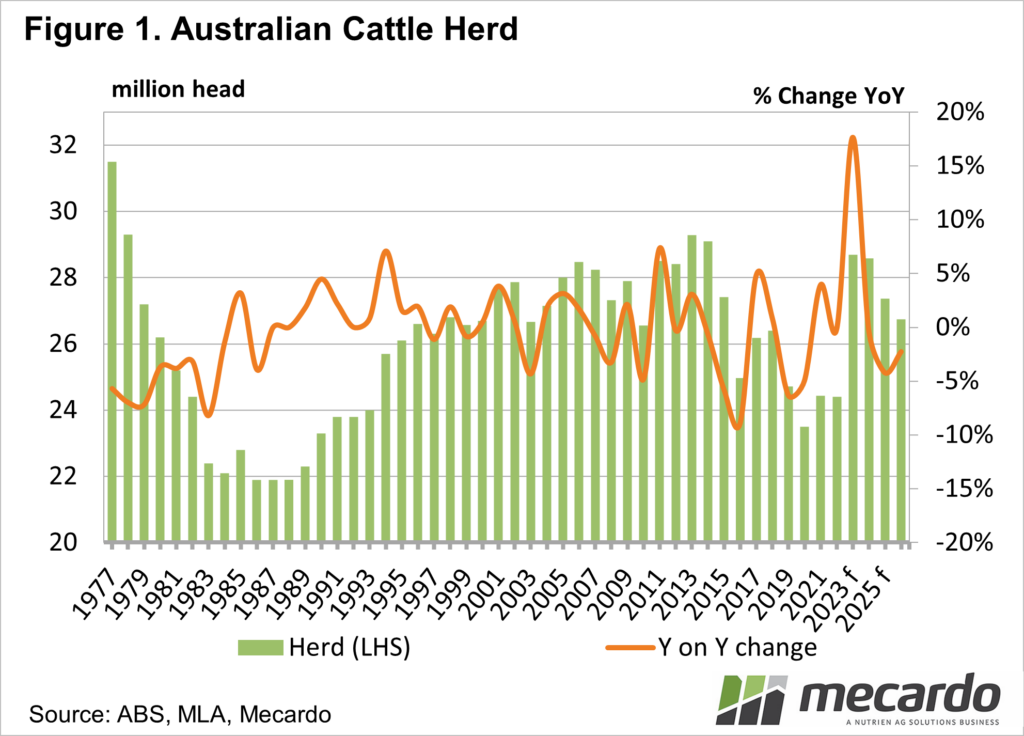

Industry Projections paint a picture of strong supply. With the rampant herd rebuild of 2021-2022, the

size of the herd has rapidly bounced back to levels not seen in a decade. With MLA pegging the 2023 herd at 28.7

million head, the increase was 17.6% in just one year.

Figure 1

shows MLA expect the herd to stabilise in 2024 before falling into liquidation

in 2025 and 2026.

With a

larger herd comes stronger supply. The

increase in cattle slaughter from 2022 to 2023 was 20%. MLA is forecasting another 12% jump in 2024

as the herd moves into liquidation mode, with slaughter stabilizing at around

8.2 million head per year in 2025 and 2026.

We know

that in general rising supply equals weaker prices. We have indeed seen this over the past 12

months in the cattle market. However,

beef is a global commodity, and Australia only accounts for a small portion of

world beef production. As such, our

prices can depend just as much on demand in international beef export markets.

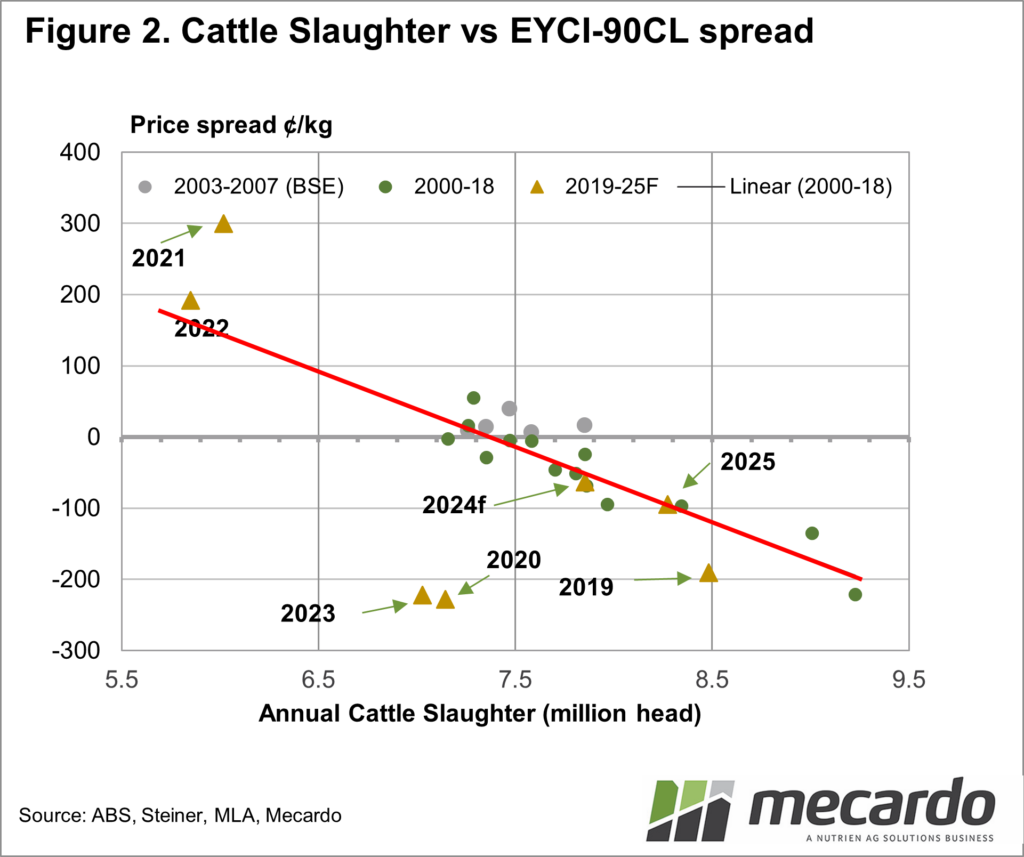

Figure 2

shows how our cattle prices relate to both local cattle supply, and the 90CL

Frozen Cow beef indicator (90CL). The

90CL price gives a broad indication of the price of manufacturing beef exported

to the US.

The scatter

chart in Figure 2 shows the relationship between annual cattle slaughter and

the price spread of the Eastern Young Cattle Indicator to the 90CL export beef

indicator. Essentially, when cattle

slaughter is high, the EYCI trades at a discount to the 90CL, and when

slaughter is low, we get a premium.

Figure 2

shows that 2023 was way off the trendline, with the EYCI discount to the 90CL

at more than 200¢. We see deviations

like this when slaughter space is limited, driving prices abnormally low. At the slaughter forecast for 2024, the chart

suggests the EYCI should move back to a 60¢ discount.

What does it mean?

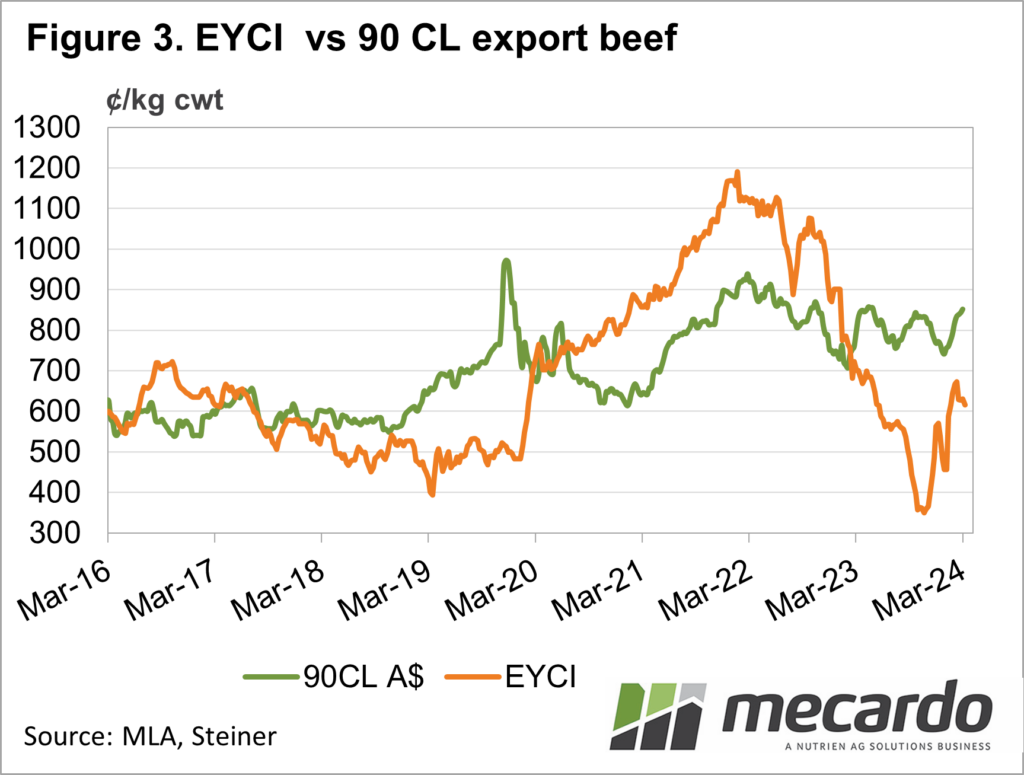

The EYCI is currently still priced at a more than 200¢ discount to the 90CL (Figure 3). Again, this suggests that local supply is overwhelming demand, and pushing prices lower than they should be. The beneficiaries of the negative spread are processors, just as they wear the losses when supplies are extremely tight.

If and when it rains in the south, we would expect the EYCI to move towards the 90CL, with an upside of 150¢/kg cwt not out of the question. .

Have any questions or comments?

Key Points

- MLA’s cattle projections show a strong lift in the herd and forecast slaughter.

- Rising slaughter generally sees cattle prices decrease relative to export beef values.

- Current cattle prices are highly discounted compared to 90CL even when accounting for strong slaughter.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: ABS, MLA, Steiner, Mecardo