Meat and Livestock Australia’s (MLA) cattle industry projections were released last week, and the results confirmed that the herd is experiencing very strong growth. Supply and demand theory would suggest that stronger supply will lead to lower prices in coming years, but there is some positive news from overseas.

MLA’s cattle industry projections forecast the Australian cattle herd to continue to grow over the coming years, reaching 29 million head in 2024 and steadying from there. Obviously, plenty depends on the weather, but 30 million head looks to be the limit for the herd, unless cattle producers can get some country from sheep or grain industries.

Herd Growth results in stronger cattle supplies to processors, and MLA is forecasting cattle slaughter to hit 8 million head in 2025. Cattle slaughter has been higher in recent years, during herd liquidations, but the average over the last 20 years has been 7.6 million head. Stronger supply will no doubt put some pressure on prices, but in a global market, what happens overseas will set the base price.

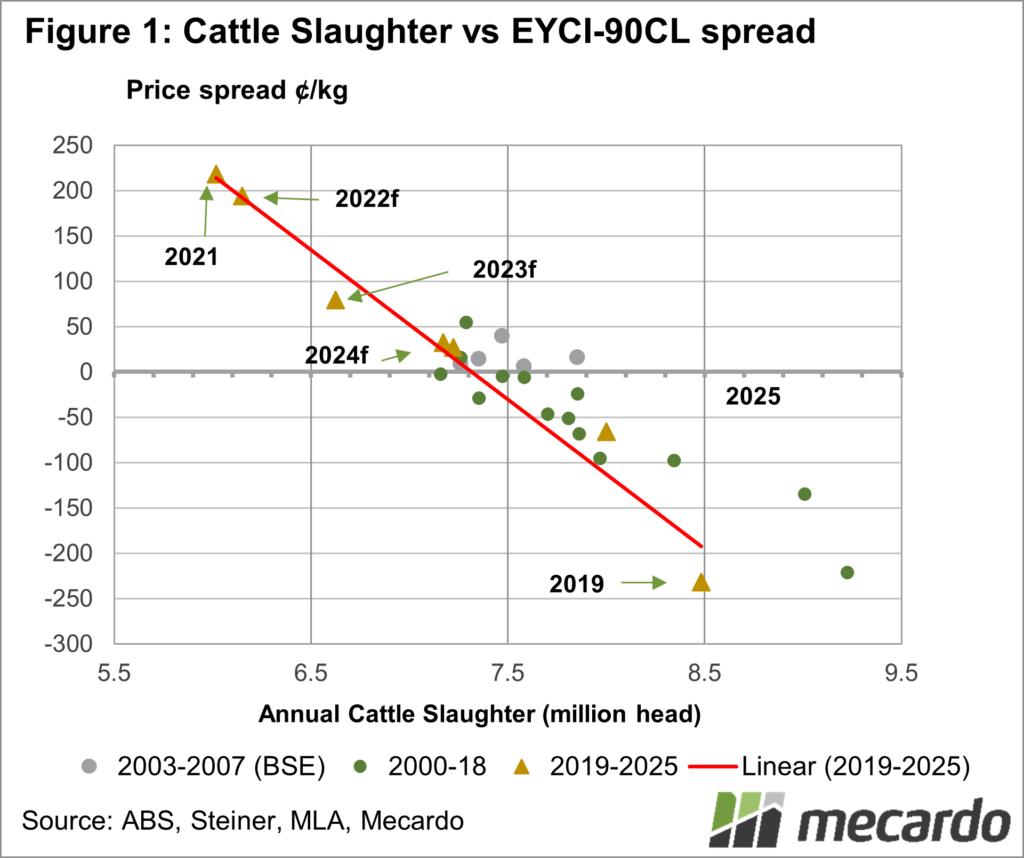

Long-time readers will be familiar with figure 1, which shows the relationship between Australian cattle slaughter, and the spread between the Eastern Young Cattle Indicator (EYCI) and the 90CL export prices. Essentially figure 1 shows that rather than impacting absolute prices, the level of cattle supply moves cattle prices relative to export beef values.

During years of tight supply the EYCI sits at a premium to export beef, like in 2021 and 2022. During herd liquidation, the EYCI trades at a discount to the 90CL price, with 2019 being a prime example.

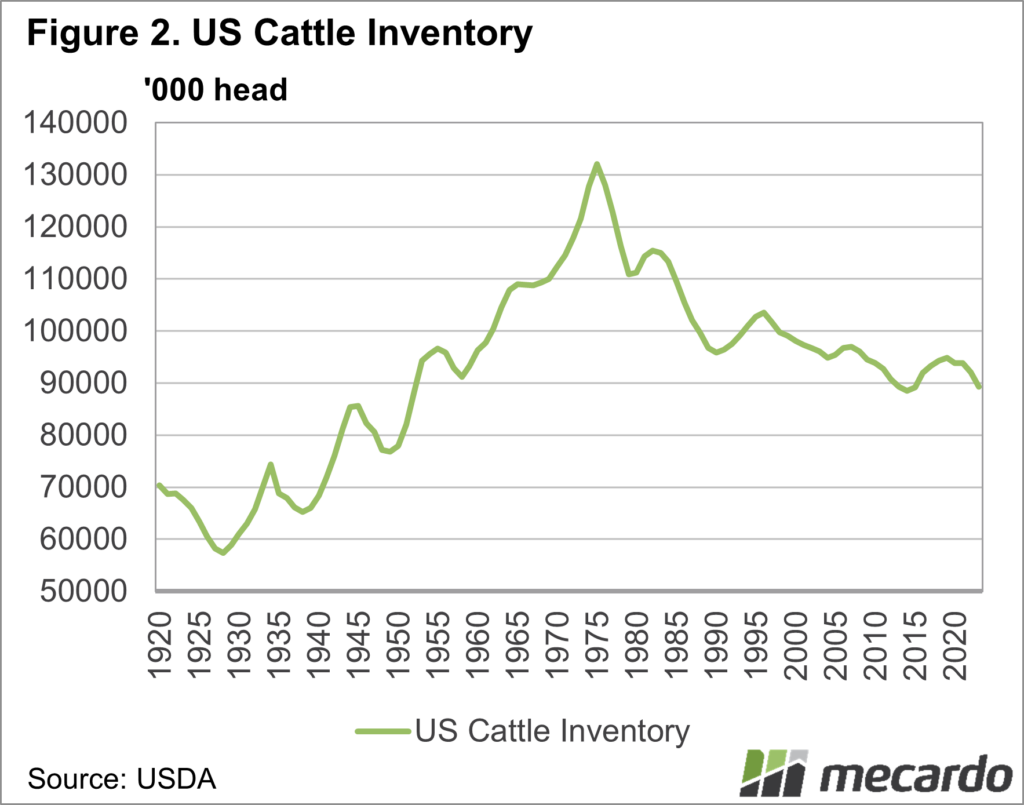

So how do we know where the 90CL is heading? We don’t really know, but we can get an idea from the US cattle herd. Drought has seen the US herd fall again, with the liquidation being part of the reason the 90CL price has eased over the last year. Figure 2 shows the US Cattle Inventory as of July 1st, 2022 back under 90 million head, and close to the lows of 2014.

With a return to normal seasons, the US herd will move into a rebuilding phase; with a subsequent decrease in beef supplies and an increase in demand for imported beef. The US is one of our biggest export markets, so support should come for the 90CL.

What does it mean?

Australian cattle producers have been fortunate to be in a rebuilding phase while the US was in liquidation. As cattle supplies increase, we’re likely to see export demand improve. Providing we don’t go back into El Niño, cattle prices should find support at current levels, or maybe a little lower. Improving export prices will provide upside over the medium term.

Have any questions or comments?

Key Points

- The increasing cattle herd will put pressure on prices relative to export values.

- The US Cattle inventory was pegged at a year low for the first of January.

- Tighter supply out of the US should support both cattle prices here and export prices.

Click on figure to expand

Click on figure to expand

Data sources: MLA, ABS Mecardo