If you are in the market for replacement females it could be a good time to strike, as supply puts pressure on the cow market as well as young cattle. It may be sounding a bit repetitive, but despite the herd still being in rebuild mode, cow turnoff numbers are up, and processing space remains hard to come by; much like most of the sectors across the livestock industry. Uncertainty in the market and maturation of the herd in some areas is diminishing restocking demand, while one of our major cow beef trading partners internationally, the USA, understands that Australian slaughter, and therefore supply, is on the rise.

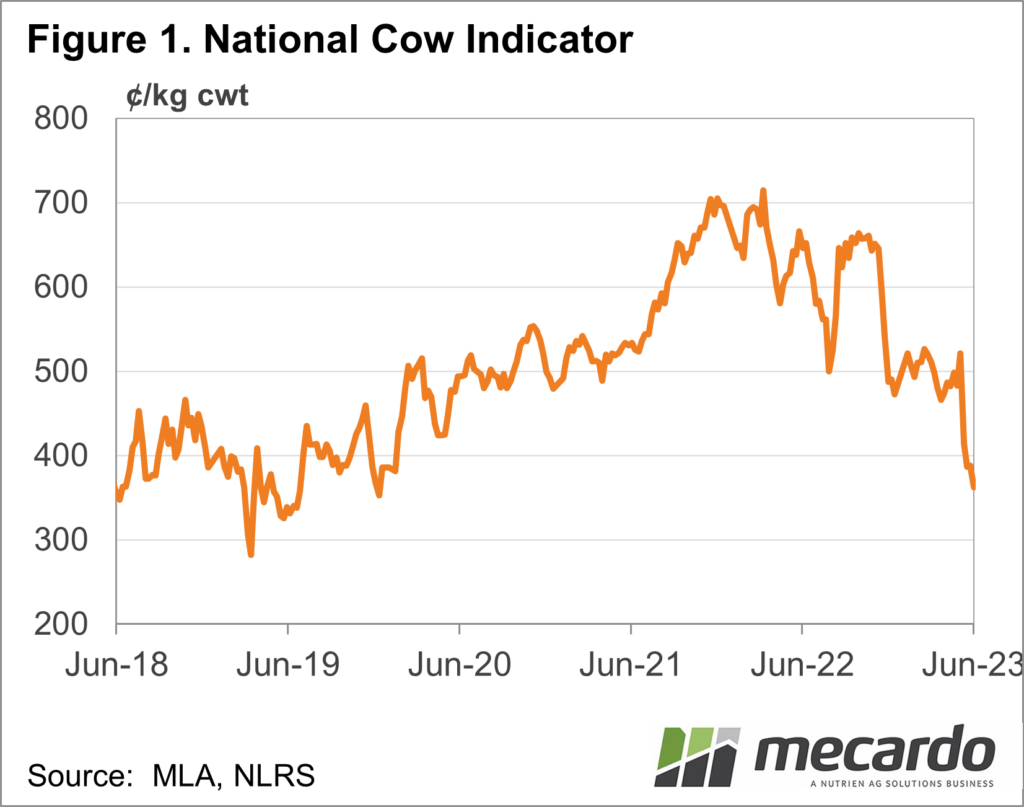

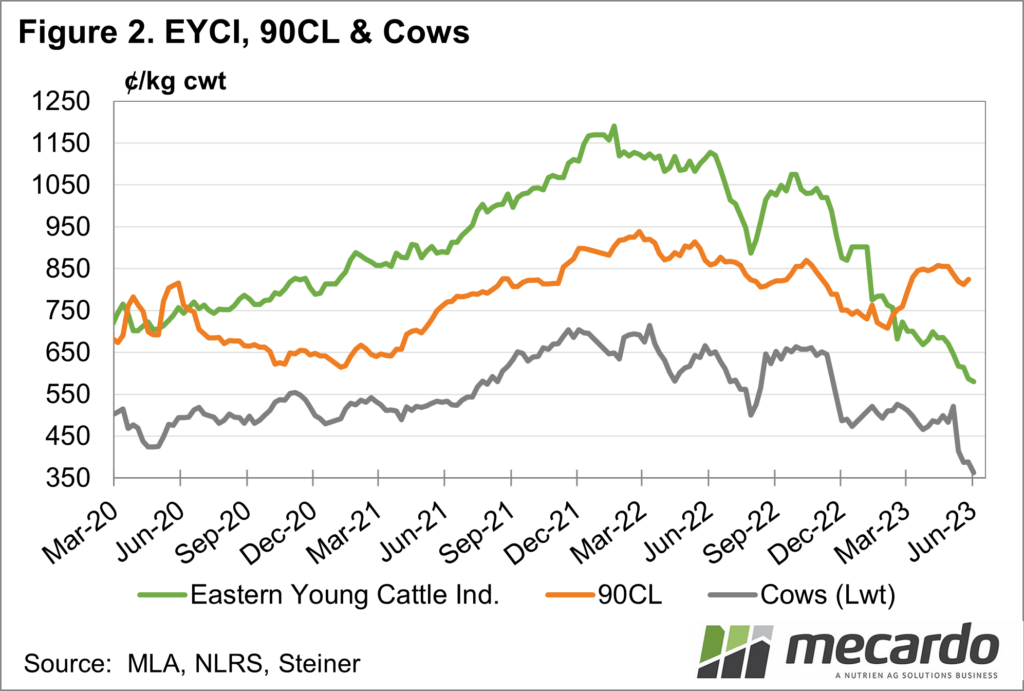

The national cow price averaged 363 ¢/kg carcass weight last week, which was 44% below year-ago levels. In comparison, the Eastern Young Cattle Indicator was 49% down. Looking further back, the price is 24% less than the five-year average, and in fact, it has only been lower for the corresponding week once in the past nine years, being 2018. It is worth noting that if we look at both the five and 10-year-average, the cow price usually hits one of its lower points for the year around this time, before climbing higher in winter and through spring.

Domestically, Meat and Livestock Australia expect “all cull females” out of NSW are set to increase in numbers, and while Queensland is holding onto theirs for now, drier conditions in the South are hindering demand. This takes us to restocker competition in the market or lack thereof. PTIC heifers and PTIC cows had clearance rates of just 12% and 19% on AuctionsPlus last week, averaging $1688 and $1171 respectively. Comparatively, the same week last year PTIC heifers averaged $2701/head and had a clearance of 49%, while cows cleared 81% and averaged $2765/head. For cows, this is a fall of 58% year-on-year.

Further afield, beef exports from Australia to the US were up 60% year-on-year for the month of May and have increased 23% for the year to May. Another supplier of lean manufacturing beef to the US, New Zealand, has sent 14% more beef so far in 2023. At 825¢, the 90CL US imported beef price is currently 16% higher year-on-year, but according to the Steiner Consulting Group, demand isn’t as strong as predictions for the year envisioned. The US is also watching rising Australian slaughter carefully, as well as forecast drier conditions, and banking on more supply at less cost later in the year.

What does it mean?

The AuctionsPlus joined female figures tell us several things, the first being the very much diminished restocker demand, and the second being how far the value of that market has fallen. It also gives insight into the seller’s situation, demonstrating current seasonal and recent trading conditions are allowing producers to hold onto surplus stock when they are not willing to meet the current market. Unfortunately, there is little indication of an improved kill price for cows in the short to medium term, which will push those cattle onto the market if things get tight on-farm, being either grass or cash.

Have any questions or comments?

Key Points

- National cow price has dipped to 363¢/kg, its lowest point since December 2019.

- Despite the herd still being in rebuild, the supply of cull females is set to increase and restocker demand may diminish.

- US imported beef prices are up year-on-year, but trading at a discount to domestic products as the US anticipate increased supply, especially from Australia.

Click on figure to expand

Click on figure to expand

Data sources: MLA, Steiner Group, Auctions Plus, Mecardo