The greasy wool industry tends to think of quality effects on price as additive, somewhat like building a “lego price model” – add for good quality, deduct for poor quality. Clearly, this is not applicable across all types; spinner-style dags are just dags. The application of premiums (say for RWS) depends a lot on the underlying wool quality, it is not a simple additive model, and in addition, these premiums vary as this article will show.

In May last year, Mecardo looked at RWS premiums for early

2023, noting that premiums of 3-5% were being paid for good-quality wool. Wool

of lower quality might receive premiums, which on average were lower (read

more here). Last December Mecardo looked at how premiums for RWS wool have

varied in recent seasons and also the quite different adoption of RWS

accreditation between micron categories in Australia (read more here).

One of the confusing issues surrounding RWS-accredited wool

is the wide variation in premiums paid, both within sales and across time. As

noted in December RWS premiums have experienced a lot of change in recent

years. They burst onto the scene in the spring of 2020, at the same time that

Cape Wools began to publish weekly premiums recorded in the South African

merino market (available here).

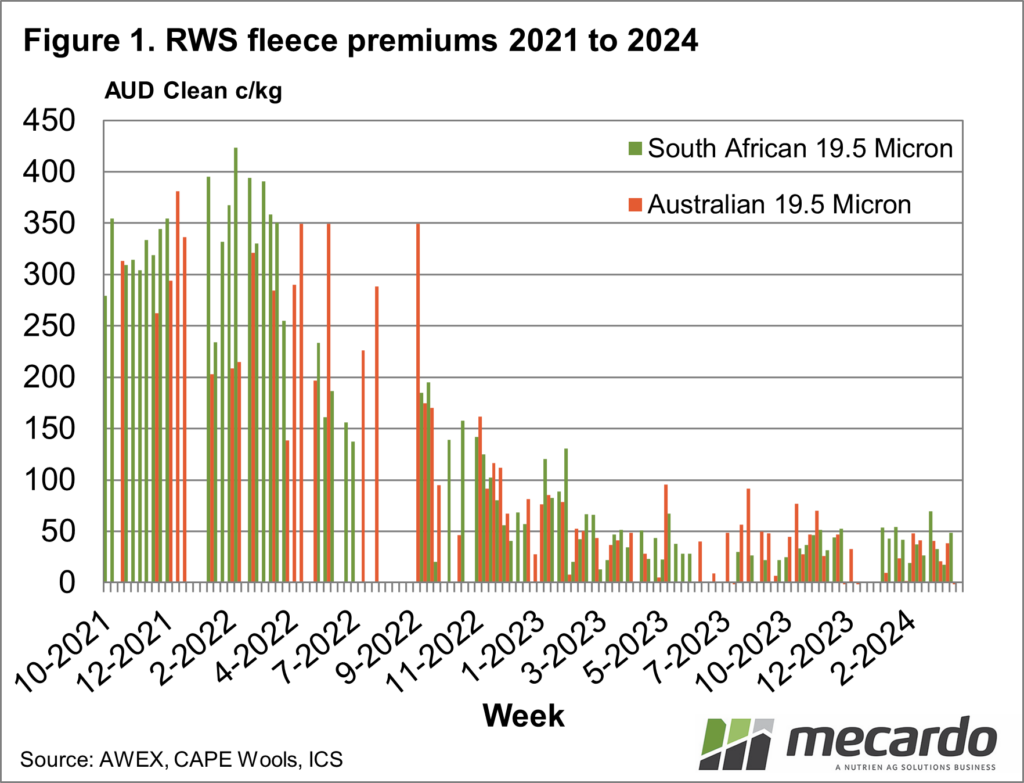

Figure 1 shows weekly published premiums for 19.5-micron fleece in South Africa

and a calculated premium in Australia for 19.5-micron merino fleece, beginning

in the spring of 2021 and running to March 2024. The emergence of large

premiums in late 2021 through 2022 stands out, as does the shrinkage in the

premiums through 2022 into 2023.

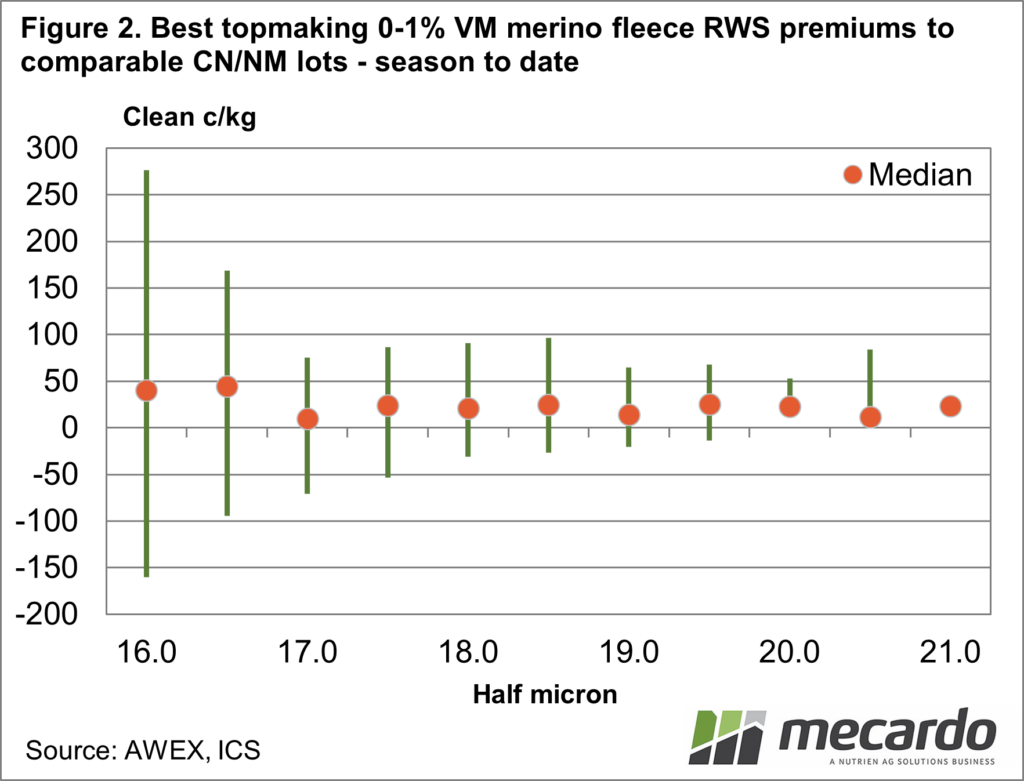

So, where do RWS premiums stand at present? It is not a

simple story of a standard premium to be added to the base price of a lot. In

Figure 2 the median RWS premium (to comparable non-mulesed wool) by half micron

from 16.0 to 21 micron for weekly data for the season to date is shown. The

bars for each half-micron category show the 90th (high) and 10th

(low) percentile of the premium calculated. They provide a perspective on the

variation in the price effect for RWS accreditation, which is quite wide.

Basically, the median premiums have been between 20 and 45 cents per clean kg

across the micron range this season, with significant variation around this

level.

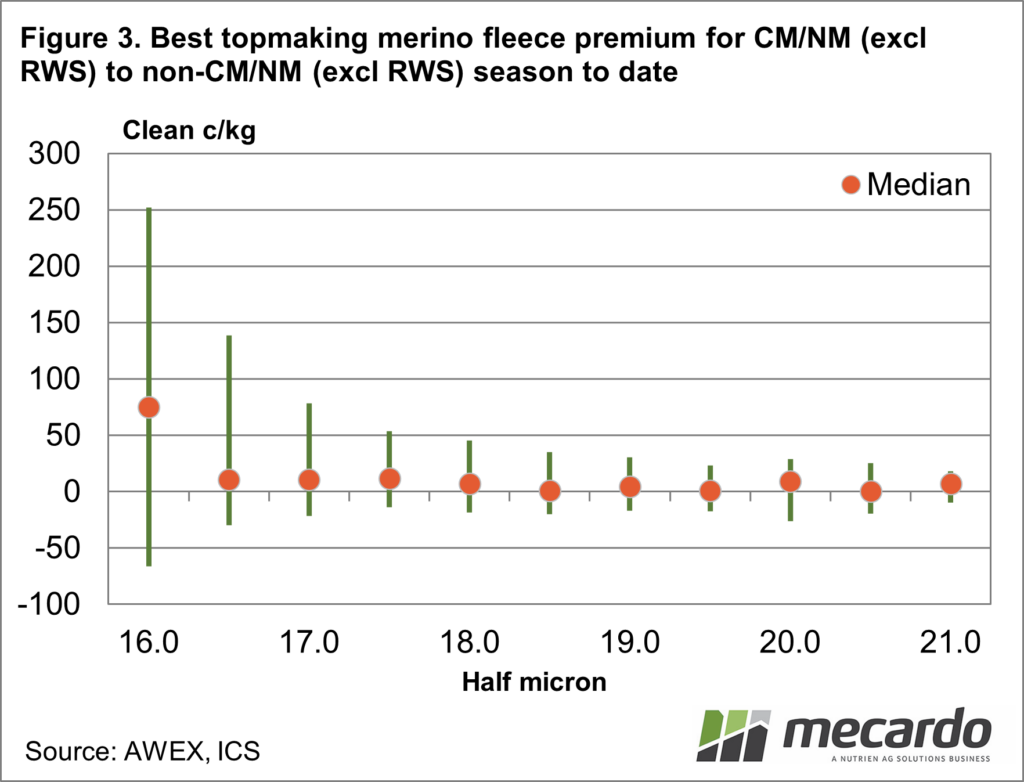

Note in Figure 2; the base price for comparison is

non-mulesed wool. Figure 3 looks at the premium for non-mulesed fleece (good

quality) compared to comparable non-declared/mulesed fleece wool. The graphics

are presented in the same format, a median premium with variation bars. The

median premium is typically around 10 cents per clean kg, with significant

variation about this level.

What does it mean?

The use of five-year (or ten-year) price percentiles, especially the median (50%) price is a common way of sorting through the noise of market movements to identify underlying price or relative prices. This technique assumes that a market structure has been relatively constant through the period being studied – there might be seasonal variation but there has been no structural (permanent) change.

In the case of RWS premiums, there have been major changes in premium levels during the past three years, which prompts caution in using historical data to project future premiums.

Have any questions or comments?

Key Points

- The reduction in RWS premiums seen through 2023 has persisted in the first quarter of 2024, which makes sense given that economic conditions in Europe are poor.

- RWS premiums are relatively even across the main micron categories.

- Premiums for CM-NM wool are also even across micron categories.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: AWEX, Cape Wools, ICS, Mecardo