New records are being set for young cattle, while slaughter cattle are back close to the highs set last year. The most common question being asked now is ‘how long will it last?’ The answer, as always, is ‘it depends’, but we can get an idea of where prices might head when grass fever wanes.

Over the medium and long term, Australian cattle market levels are set by international beef prices. They can get out of whack for a period, when supply is too strong or very weak, but eventually our export markets, and market forces, will drag our prices back in to line.

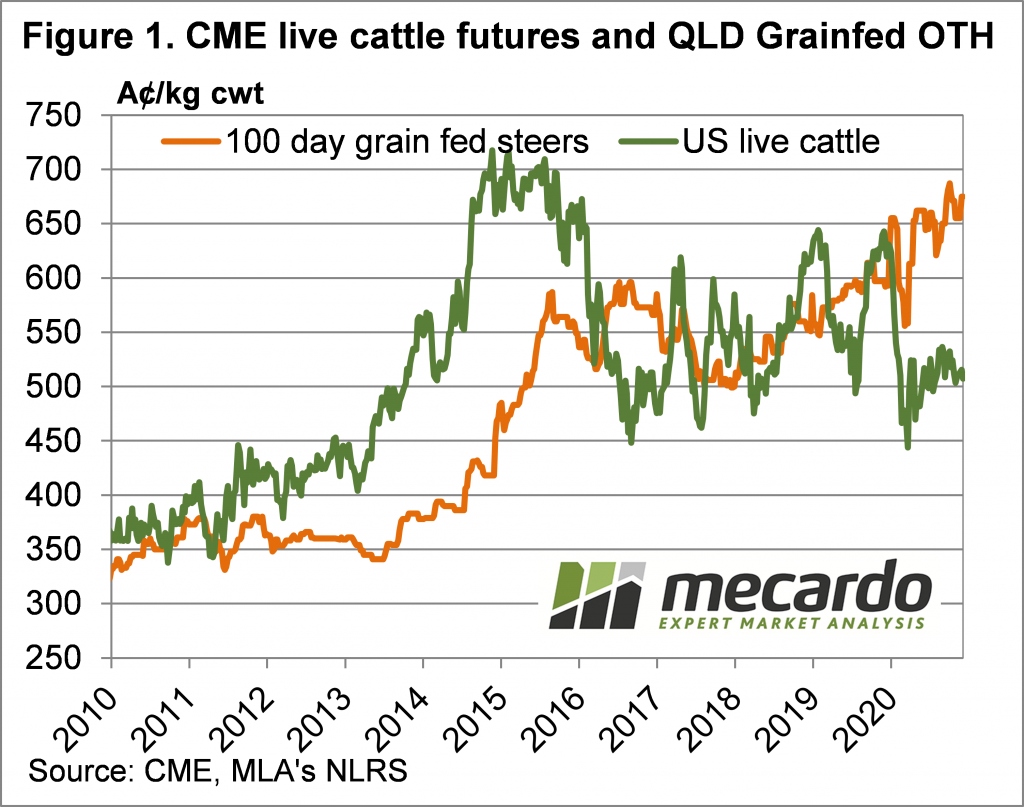

Figure 1 should be of some concern for cattle producers. This time last year, Aussie finished cattle were at record highs, but with US Live Cattle Futures at similar levels, our export beef wasn’t expensive. At least not compared to the last five years, from 2012-2016 our finished cattle were at a heavy discount to the US.

Since the COVID-19 induced price crash in the US, where a lack of slaughter space saw Live Cattle Futures lose 30%, our cattle have been expensive. Figure 1 shows the Queensland 100 Day Grainfed steer is now 31% above Live Cattle Futures.

With our beef competing in high value markets like Japan and South Korea, with US beef, at some stage prices are likely to converge.

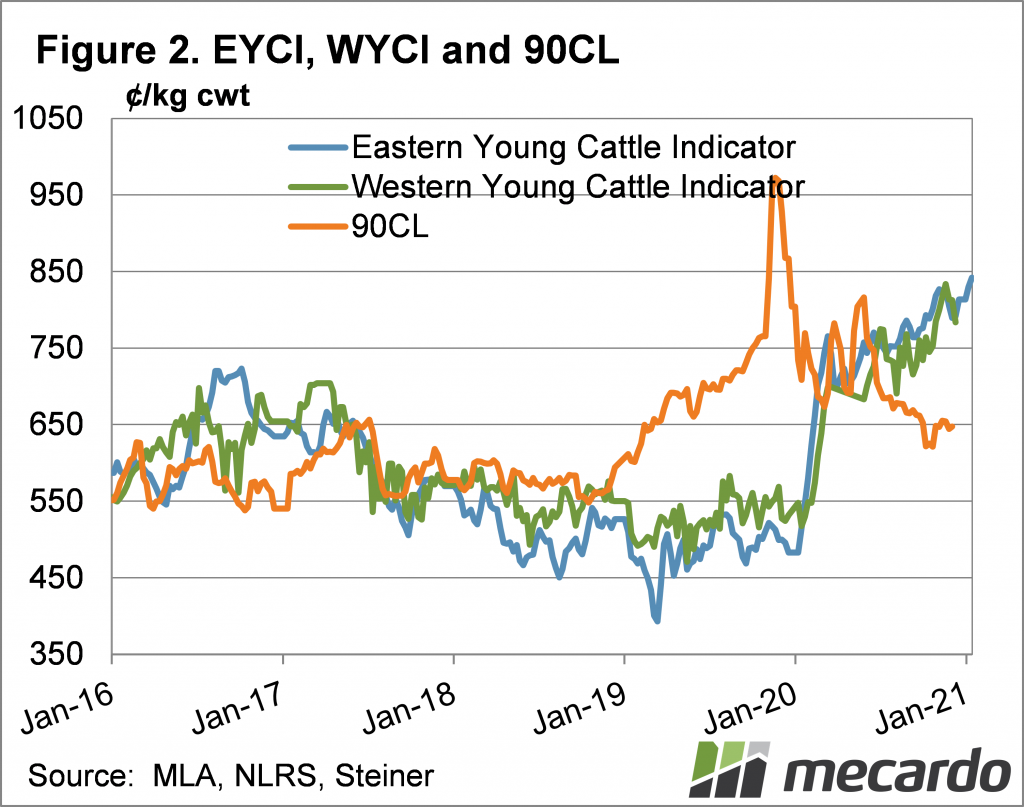

Another measure of value we like to look at is the 90CL Frozen Cow versus the Eastern Young Cattle Indicator (EYCI). With 90CL being one of our biggest beef export, it stands to reason that the price will help drive how much processors can pay for cattle, which then flows back through the supply chain.

Figure 2 shows how the 90CL has been slipping lower, while the EYCI, and its WA counterpart, the WYCI, have been heading higher. Again, market forces will pressure Australian young cattle prices back towards 90CL values, which are now 25% behind the EYCI.

What does it mean?

The good news is there is time for improvement in international beef values before grass fever stops supporting the market. Rising feed prices in the US, and other parts of the world will start to edge finished cattle prices higher, but the stronger Aussie dollar is part of the problem, and who knows where that is going.

The test for the market will come when seasonal conditions deteriorate, with autumn being a key risk period.

Have any questions or comments?

Key Points

- Record cattle prices have Australian values at extreme premiums to US prices.

- Export beef prices remain weak relative to Australian cattle values.

- There is plenty of downside if and when seasonal conditions deteriorate.

Click to expand

Click to expand

Data sources: MLA, Mecardo