It has taken a little while but it seem the market has finally worked out it’s going to be hard work getting canola to the silo this year. Having been tracking sideways at a significant discount to international values, last week they spiked.

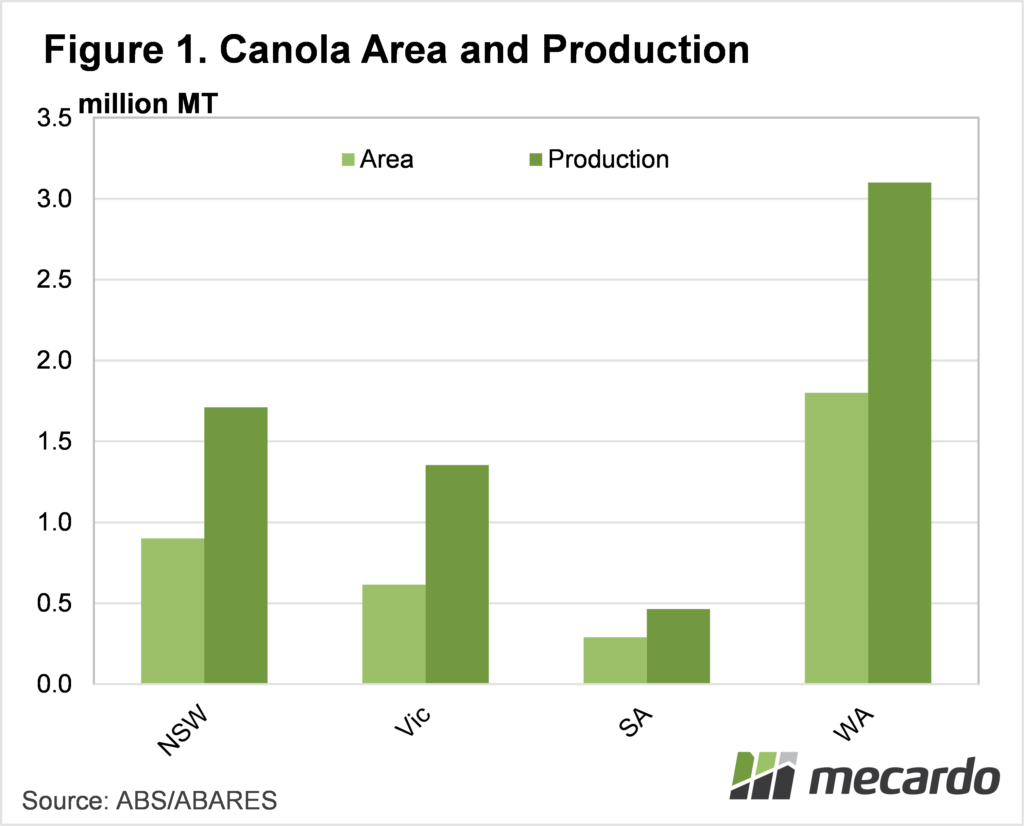

The Australian Bureau of Agricultural and Resourse Economics and Sciences (ABARES) area and production forecasts for canola give us an idea of how much of Australian, and east coast production might have been affected.

Figure 1 shows that NSW and Victoria are forecast to combine to produce 3 million tonne of canola in 2022-23. South Australia has been less impacted by flooding, but is still wet, while WA should produce somewhere near the forecast 3mmt.

It’s hard to know how much the rain and flooding will affect the eventual tonnage of canola, but we do know it will delay harvest significantly. With forward contract delivery windows drawing ever closer, not to mention shipping deadlines, the need to get canola in is getting stronger.

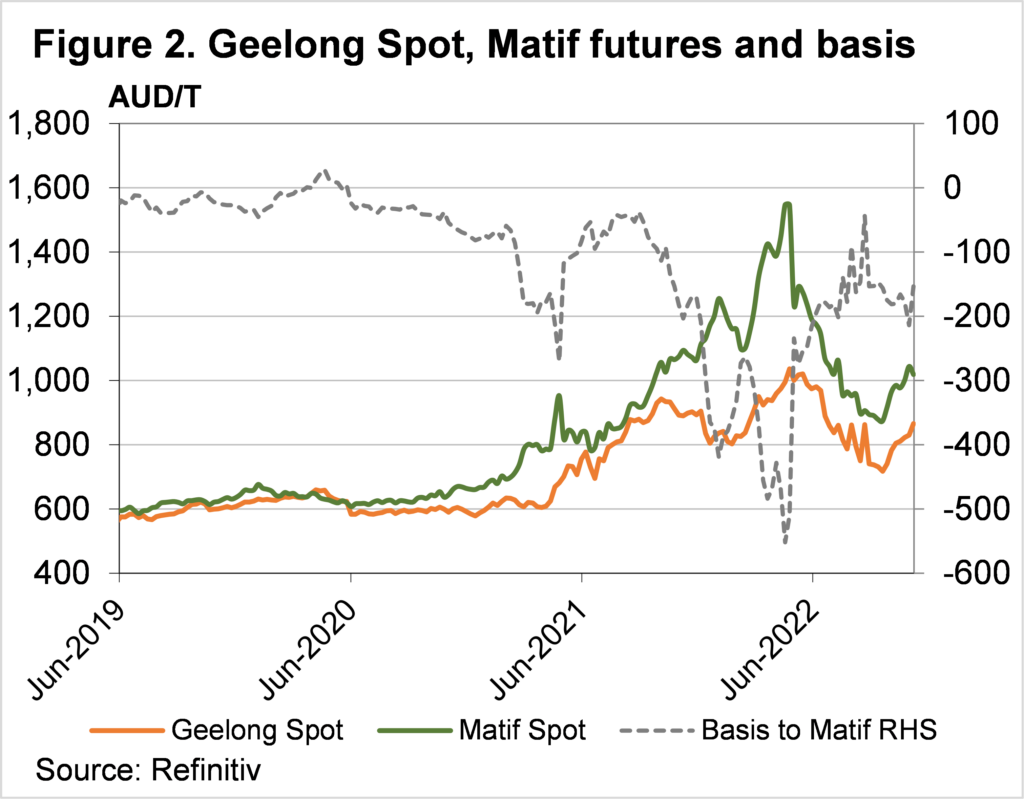

Hence last week we saw canola prices start to move. Figure 2 shows the Geelong canola prices, along with MATIF Rapeseed futures, and the spread between the two. Geelong canola has rallied from a low of $717/t in mid September, but until last week it was in line with improving MATIF values.

With local price at a $170-200 discount to MATIF, our canola was still relatively cheap. Last week we saw canola prices spike independently of MATIF, indeed it was against the trend. While MATIF lost ground, Geelong canola gained $20/t to hit a five month high of $865/t.

The rally in canola prices took the spread to negative $150/t which is still historically low. Australian canola does usually trade at a discount to MATIF due to shipping costs, but it’s more like $50/t.

What does it mean?

With another wet week forecast canola prices are likely to have more upside, as the harvest window is pushed back again. Prices can feasibly rally another $100/t before they start getting expensive relative to MATIF, and the closer we get to delivery deadlines, the more support prices will get.

Have any questions or comments?

Key Points

- Most of the east coast canola is in the wettest states of Victoria and NSW.

- Canola prices spiked last week independently of MATIF, as delivery pressure approaches.

- With more wet weather on the way, canola values are likely to see more upside.

Click on figure to expand

Click on figure to expand

Data sources: Reuters