After a couple of years in the doldrums mutton exports have ramped up considerably in 2023. The latest figures for May show that the significant lift in sheep slaughter, and cheaper prices, is seeing mutton exports rise to levels not seen in over 20 years.

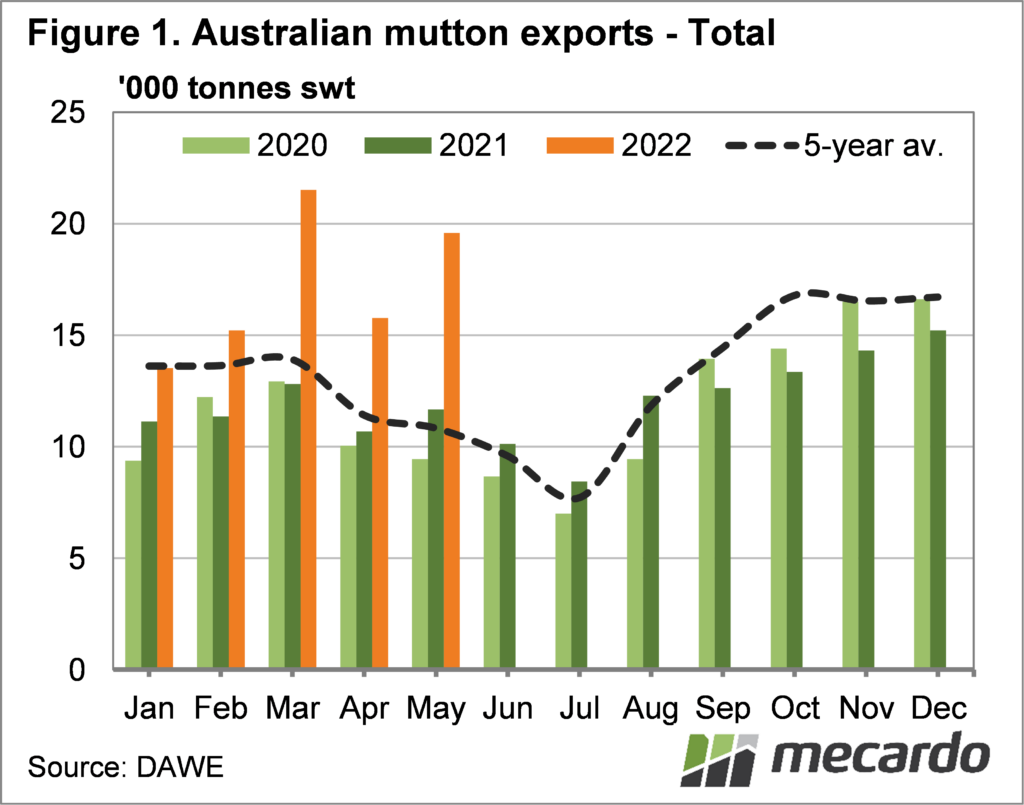

Australian mutton exports in May 2023 were 68% higher than May 2022, posting the second highest number for the year, as shown in figure 1. The strong levels were no doubt driven by better supply, with sheep slaughter rates for the year to date up 51%, seeing plenty of product available for export markets.

We can see in figure 1 that mutton exports started the year a little ahead of 2022, but jumped significantly in the autumn. China is the largest market for mutton, taking 44% of our mutton for the year to date. Malaysia is the next largest, receiving 10% of our mutton.

Middle Eastern countries have increased import volumes of Australian mutton, but have lost market share, falling from 19% last year to 15% this year. Saudi Arabia are the largest Middle Eastern market, taking 5% of our mutton. In May volumes to Saudi Arabia nearly doubled compared to last year.

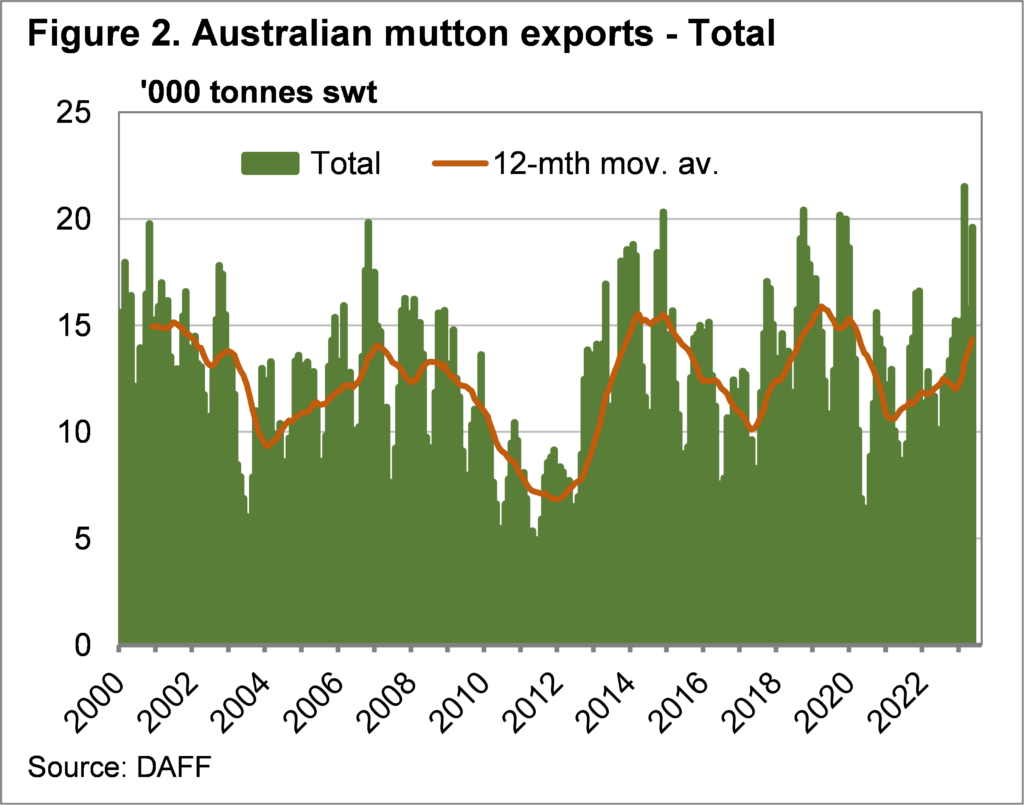

Figure 2 shows just how strong mutton exports have been in the last quarter. March was the strongest mutton export month in over 20 years, while May was not far behind. The 12 month moving average line is on the way up, but still a little behind the drought-driven peaks of of 2019 and 2014.

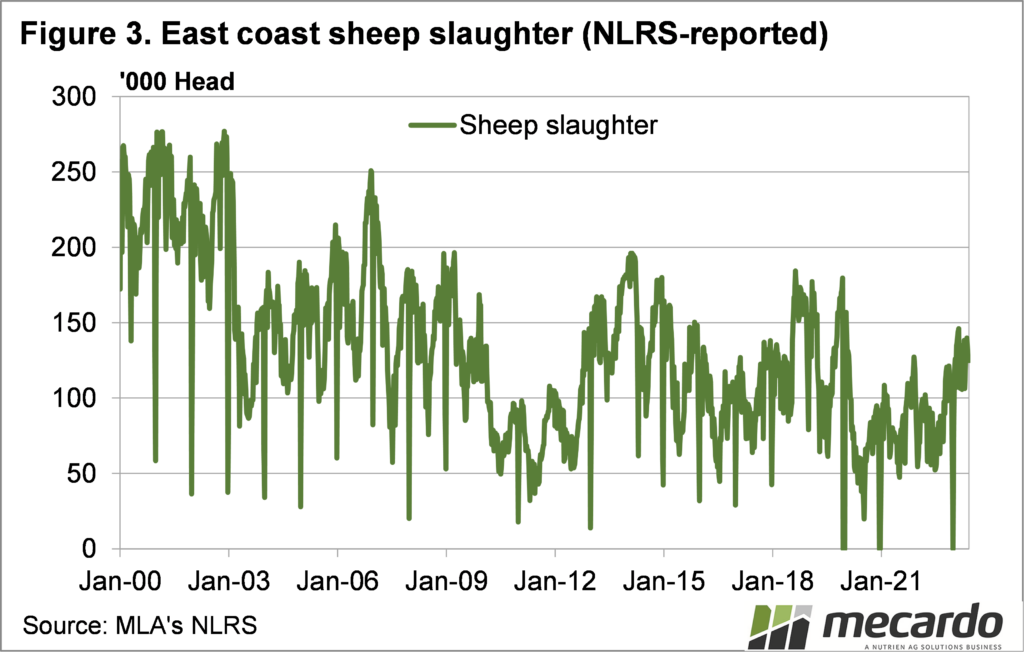

It’s interesting to look at sheep slaughter versus exports. Back in the early 2000’s sheep slaughter was running between 200,000 and 250,000 head per week (figure 3). This year we have seen a lift, but sheep slaughter is only between 120,000 and 140,000 head. Even compared to 2014 and 2019 sheep slaughter is lower.

Yet we are exporting more mutton in the last few months than we have for 20 years. Sheep carcase weights are well up, reflecting the better condition of sheep hitting processors, but also the shift to heavier meat breeds and the increase in cast-for-age ewes hitting the market this year.

What does it mean?

We looked at lamb a fortnight ago, concluding it’s good see an increase in exports, as it means the extra supply is finding a home. The story is similar for mutton. The cheaper price of mutton has more going into China and the Middle East, where there is strong demand for cheap protein.

This will help to support sheep prices, which while cheap at the moment, should find some strength with any decrease in supply.

Have any questions or comments?

Key Points

- Mutton exports have increased strongly in the last year into all markets.

- The increased sheep supply from Australia is finding homes in Asia and the Middle East.

- Strong demand for cheaper mutton should support prices in the face of higher slaughter.

Click on figure to expand

Click on figure to expand

Data sources: DAFF, MLA, ABS, Mecardo