We finally saw a significant rally in wheat prices last week, and while it didn’t last, it did provide the opportunity for growers who used a cash and call option strategy, or a cash and buy futures or swaps, to cash out their derivatives to close out the trade. In this article we’ll look at the possible results, and whether the cash and call is still a relevant strategy for those still holding grain.

Obviously it’s impossible to analyse the results of any grain marketing strategy without making some assumptions. We started talking about the cash and call in mid-January, so we’ll take the average physical price for mid-January to mid-February, and the average CBOT futures, swap and call option value for the same period.

On the close out end, we’ll use the price received last Friday, which was just off the peak seen on Thursday.

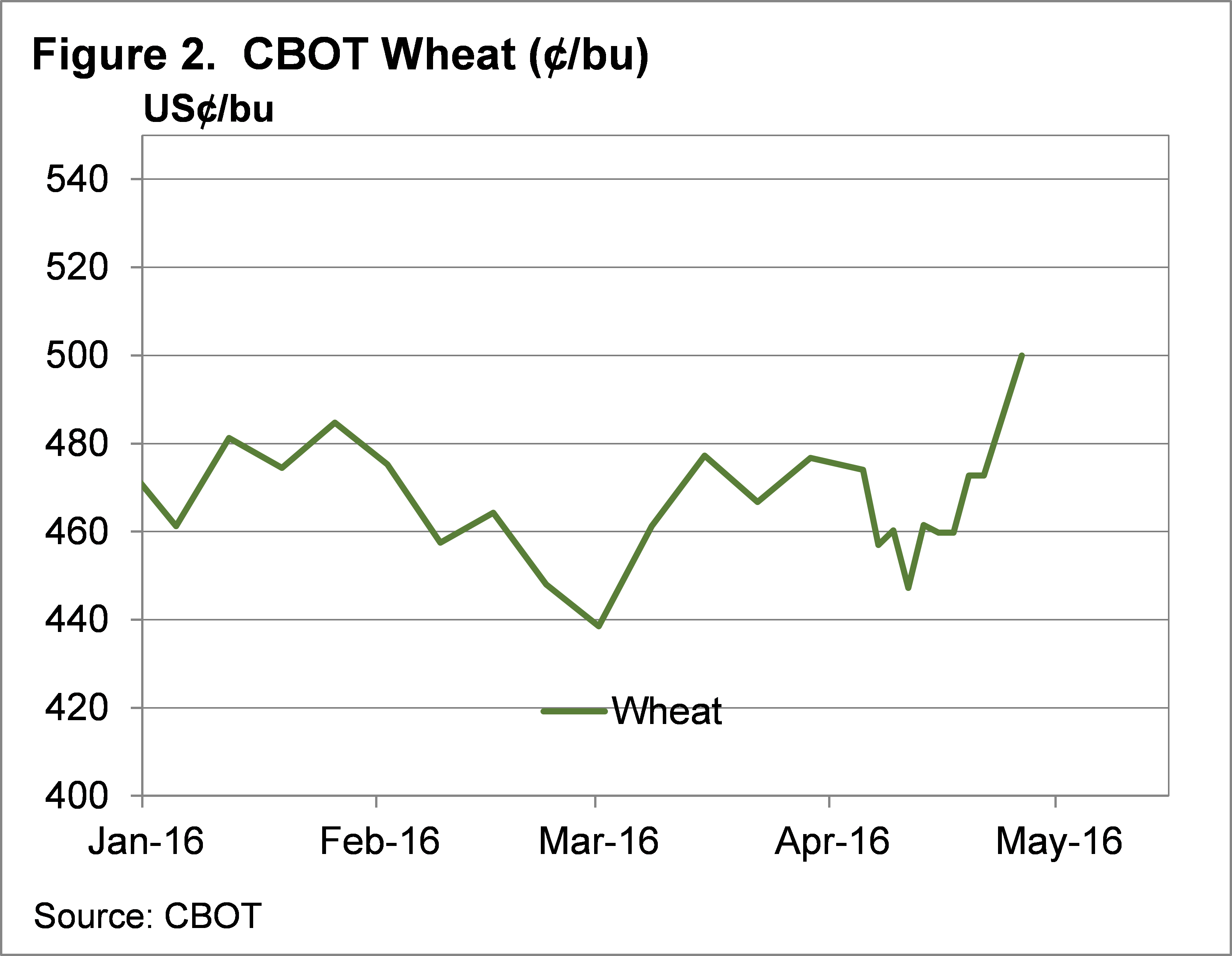

The average APW wheat price from mid-January to mid-February was $275/t port in the track market. The average July CBOT price was 480¢/bu, which when combined with the AUD was at $252/t.

Call option values are harder to calculate, but let’s assume a call option with a strike of 490¢/bu cost around 15¢/bu ($5.50/t), and $12/t if AUD cover was included, and it was done through bank swaps.

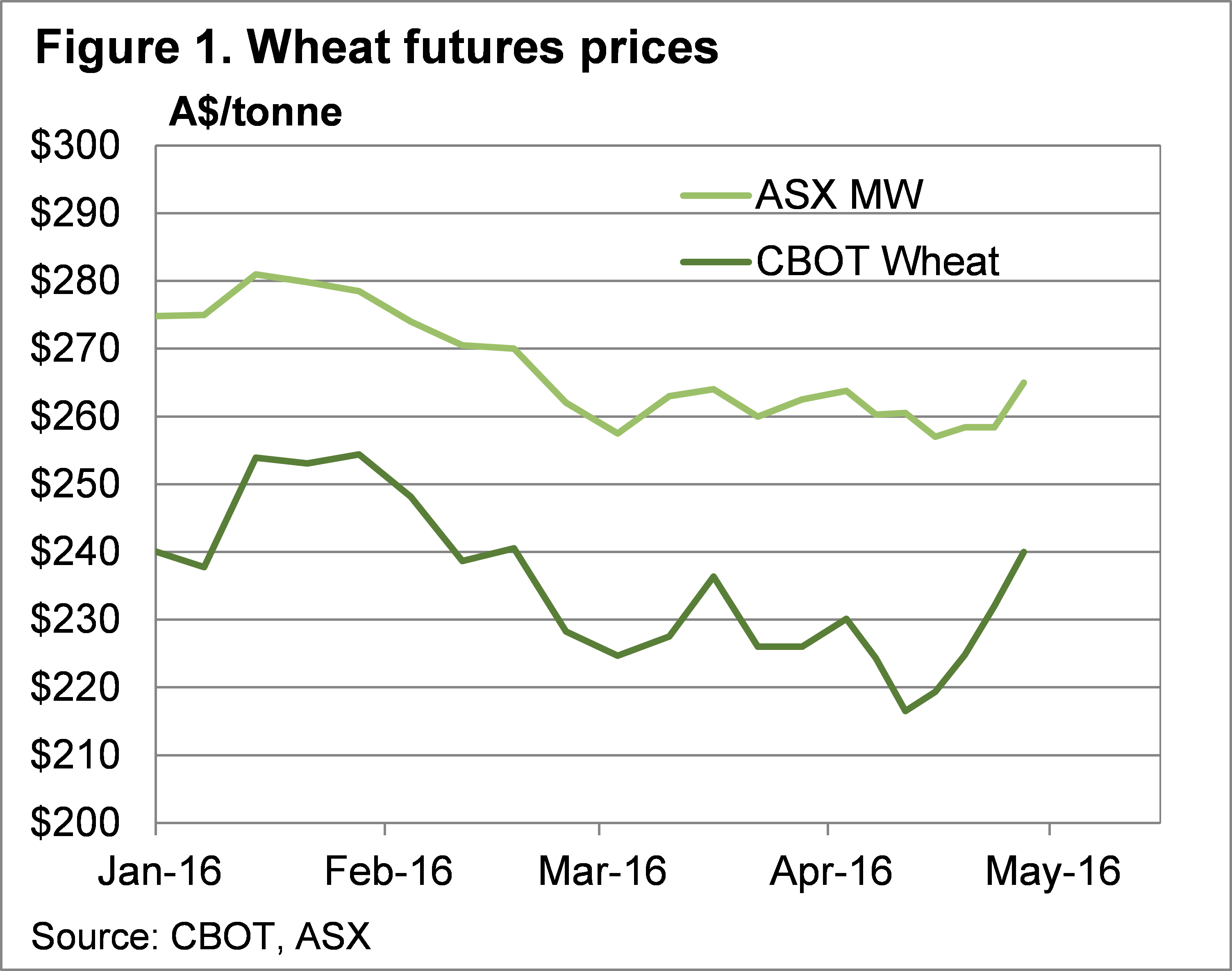

Figure 1 shows that derivative contracts would have been well out of the money for much of the time since mid-February, but the strong rally last week largely pushed them into the money, but with the rising Aussie dollar, hedging in US terms has given a better result (figure 2).

Figure 3 shows the various strategies and the net result from each. This time the best result has come from the riskiest strategy, which left the Aussie dollar open. The 10% appreciation in the AUD since February has more than offset the increases in CBOT wheat, so the derivative leg of the strategy in AUD terms has resulted in a loss. However, the avoidance of storage costs has seen the cash and call, or cash and buy swap see a marginally better result than holding physical.

Those who simply bought CBOT futures in US terms leaving the Aussie dollar open have achieved a $10 profit on the derivative to add to the original price, while the call option in US terms returned just 30¢/t.

What does it mean?

It won’t surprise any growers to see that simply selling physical at harvest has given the second best result out of these strategies. The best result, that of replacing physical with CBOT wheat futures and leaving the AUD open takes a certain amount of market knowledge, and is probably too risky for many, but it’s worth including for the learning experience.

In the current market the cash and call strategy is still applicable, especially given CBOT has fallen over the weekend, and physical prices have held some strength. This time it would probably be worth taking some cover against the AUD falling (ie using swaps in AUD or selling equivalent amount of AUD), as there is apparently a reasonable chance the currency could ease over the coming months, which would see wheat prices rise in our terms, but not necessarily in US terms.

Have any questions or comments?

Key Points

- The recent spike in wheat prices gave an opportunity to close out swaps or call options bought to replace physical wheat.

- The rising Australian dollar has more than negated increases in CBOT wheat prices, with the best results when leaving the AUD open.

- There is still opportunity in cash and call strategies, as last week showed the market can still rise quickly, or the AUD fall.

Click on graph to expand

Click on graph to expand

Click on graph to expand

Data sources: CME, Trade, Mecardo