It is easy to be Australia centric when thinking about Merino supply but the other major southern hemisphere wool exporters are important supplies of Merino and non-Merino wool also. With this in mind this article takes a look at South African Merino volumes.

The South African wool market is well reported by Cape Wools SA. South African auction sale data for this article has been sourced from the Cape Wool SA website.

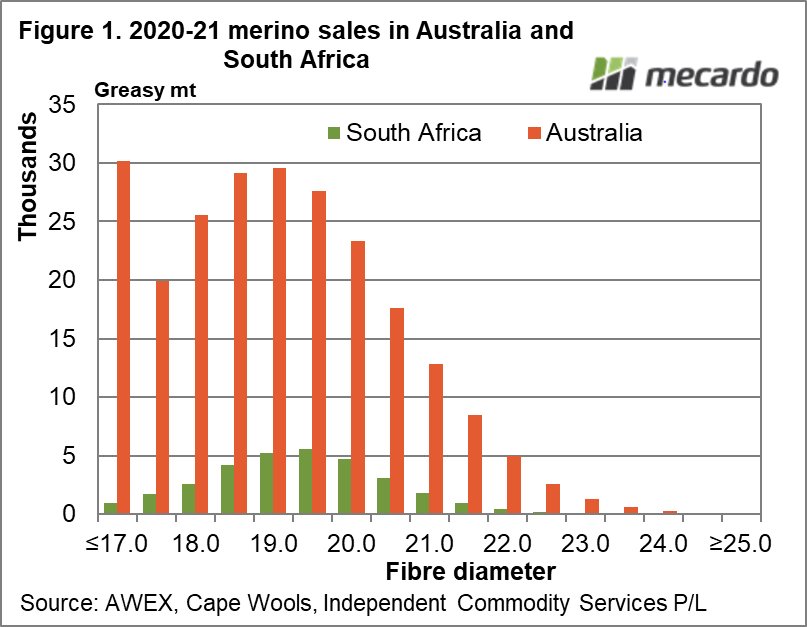

Figure 1 puts the South African Merino clip from last season in context to the Australian clip. Wool sales are used, as this is the data provided by Cape Wools SA and the data is organised along the half micron categories used by Cape Wools SA. The South African Merino clip has an average fibre diameter around 19.5 micron, which is half to one full micron broader than the Australian clip in recent seasons. In terms of volume the South African Merino volume is around 13% that of the Australian clip in greasy terms. This disparity in overall volume is clear in Figure 1.

There is a caveat to looking at this simple comparison of total volume by micron category. The supply of South African Merino wool by staple length is relevant because the length of the South African clip is shorter due to more frequent shearing. As such, South Africa supplies more broader Merino wool than Australia.

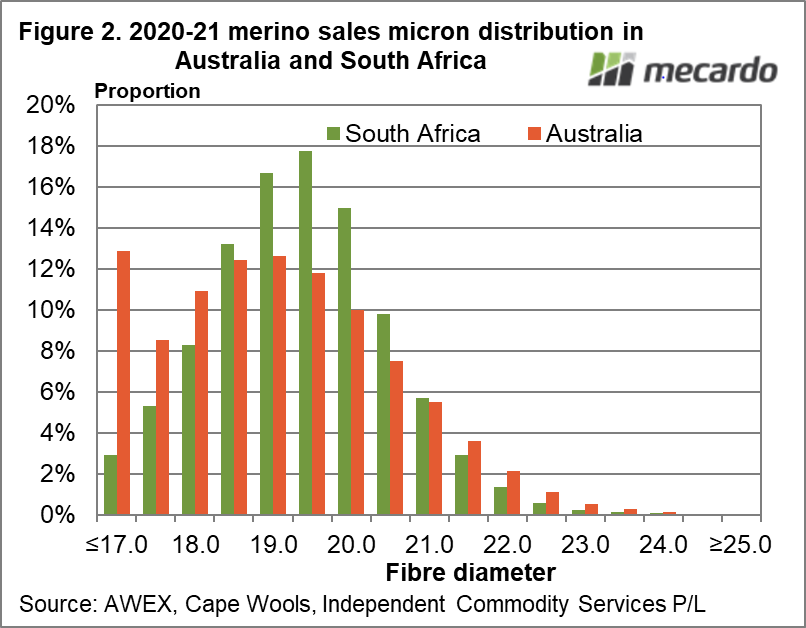

Figure 2 shows the micron distribution of the Merino clips in South Africa and Australia for last season (2020-21). The slightly broader South African clip shows up with a greater proportion of 19-21 micron wool and much less sub-17 micron wool.

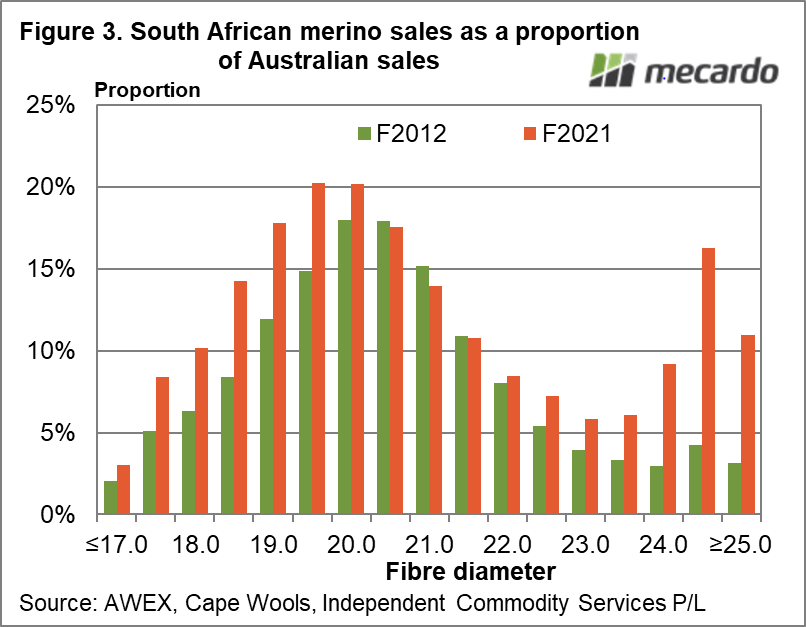

In Figure 3 the South African Merino clip is expressed as a proportion of the Australian clip (sales data) by micron category for last season (2020-21) and a decade before that (2011-2012). The reduction in very broad Merino wool (24 micron and broader) in Australia in recent seasons has led to an increase in the relative size of the South African supply. A decade ago the average Merino fibre diameter was 20 microns. The reduction to 19.5 micron has helped lift the relative size of the South African clip for 19.5 micron and finer wool, but the South African clip remains of little consequence for sub 17 micron supply.

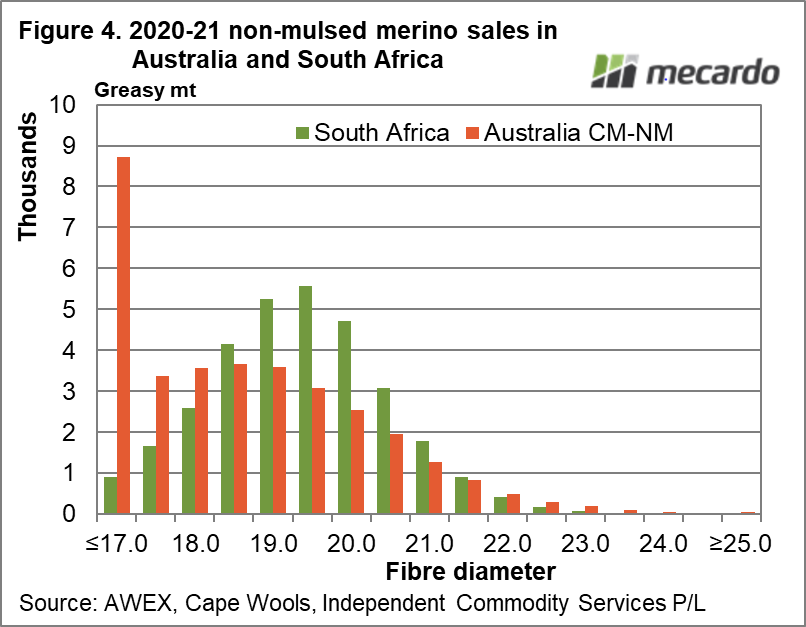

The core South African Merino micron category volumes, extending out to 21 micron, are 14% to 20% of their Australian equivalents. When other quality criteria are overlaid the relative volumes change, as was noted above with regards to staple length. The other quality issue is non-mulesed status. Figure 4 is a copy of Figure 1 with only the non-mulesed (CM & NM) Merino sales in Australia shown. The picture changes dramatically, with South African volumes matching or exceeding the supply in Australia from 18.5 micron through to 21.5 micron.

What does it mean?

In a world or lower sheep numbers, especially in Australia, it will pay to understand the Southern Hemisphere supply as opposed to the Australian supply of Merino wool only. A good example of this is to look at the supply of non-mulesed Merino wool. While the South African Merino clip overall is only 13% (give or take a bit between years) of the Australian clip, when it comes to non-mulesed Merino wool it matches Australia for supply.

Have any questions or comments?

Key Points

- In total volume terms the South African Merino clip is about 13% of the size of the Australian Merino clip in greasy terms.

- The South African Merino clip is slightly broader (19.5 micron versus 18.5-19 micron) than the Australian Merino clip.

- For 18.5 to 21 micron the South African Merino clip is 14% to 20% of the comparable Australian micron category volumes.

- When a non-mulesed filter is overlaid on the Australian data, the South African merino volumes generally match or exceed Australian volumes for 18.5 micron and broader.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: AWEX, Cape Wools, ICS