It would be fair to say that the strength of wool prices during the past couple of weeks has caught many by surprise, not simply analysts sitting on the sidelines guessing what is going to happen. To better understand what has gone on this article takes a look at the apparel fibre background to the greasy wool market.

As Mecardo articles in the past have outlined, fibre prices are bound together through blending/substitution and fashion. While the level of correlation between prices of different apparel fibres varies, they follow the same general cycles and trends.

Forward bids for greasy wool did pick up that the market would be firm last week, but exporters as a rule were not expecting rises of 10%. There is a mechanism for this to happen, with many Chinese processors buying on indent through selected Australian exporters, rather than seeking quotes for wool from exporters. In this case they directly instruct the exporter what to buy and what to pay.

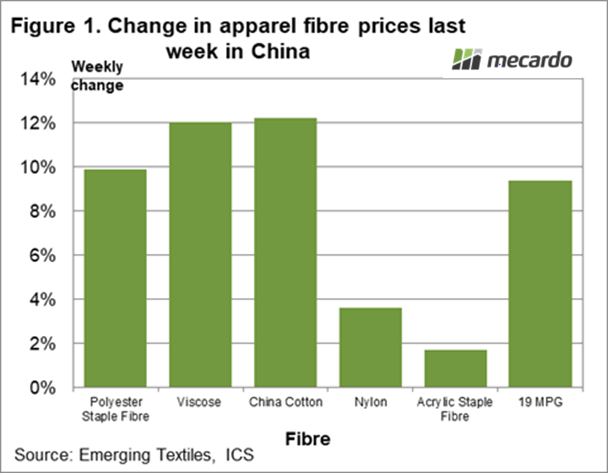

It seems that in the past week most of the apparel fibre complex in China changed tack, from weathering the COVID-19 storm as best as possible, to switching to production which requires re-stocking. Figure 1 shows the weekly change in US dollar prices for a range of apparel fibres in China, along with the 19 MPG from the eastern Australian auctions. In US dollar terms the 19 MPG rose by 9.4% (10% in Australian dollar terms) which was matched or exceeded by polyester staple fibre, viscose and cotton. Nylon and acrylic staple fibre experienced smaller prices rises. Merino price rises were in good company last week.

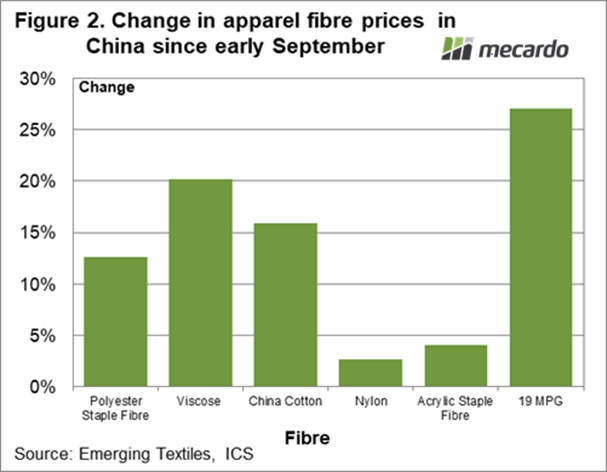

Figure 2 takes a slightly longer view, looking at US dollar price changes since early September for the same apparel fibres shown in Figure 1. For this period merino prices have out-performed the other fibres, after over shooting to lower price levels early in the season. Even allowing for the out performance of the merino prices, polyester, viscose and cotton have lifted by 13-20%. It has been a general lift in apparel fibre prices in China during the past month.

Have the price rises been caused by rises in raw material prices? Figure 3 looks at the changes in feedstock prices for polyester, nylon and acrylic for the past week and past month in China. In the past week feedstock prices did lift for polyester and nylon but when looking at the past month their rises were quite small, except acrylic feedstock prices which lifted by 11%. It seems the correlation between feedstock and apparel fibre prices in the past month has been a weak one. Raw material prices are not explaining the rise in apparel fibre prices.

What does it mean?

Apparel fibre markets in China have picked up during the past month, with the greasy wool market following the general apparel fibre complex. Merino prices have outperformed the other fibres, but from a relatively lower base. Such a backdrop to the recent rises in merino prices suggests the market will hold most of the recent rises and additionally hints that the market has quite likely seen the worst of the COVID-19 downturn.

Demand still remains weak in Europe and America so for anyone looking for prices to return to 2018-19 levels soon, it will be best to change your price ideas.

Have any questions or comments?

Key Points

- Merino price rises during the past week were matched or exceeded in China by polyester staple fibre, viscose and cotton.

- Price rises during the past month amongst apparel fibres have been supportive of higher merino prices.

- The rise in manmade apparel fibres in China have not been driven by rises in raw material inputs.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: Emerging Textiles, ICS , Mecardo