In recent articles Mecardo has looked at the merino clips of New Zealand and South Africa. The theme is continued in this article with a review of Argentine wool production for the 2021-22 season.

A quick summary of the Argentine flock shows there are 13 million sheep (plus or minus half a million in recent years) with 61% of the wool clip categorised as fine, meaning 24.5 micron and less. The flock fell to around 10 million a decade ago and has since slowly climbed higher. Two thirds of the wool clip is exported as wool top, so that overall 33% of wool exports go to Germany (mainly tops) with only 18% (mainly greasy wool) going to China. This data is available on the FLA website.

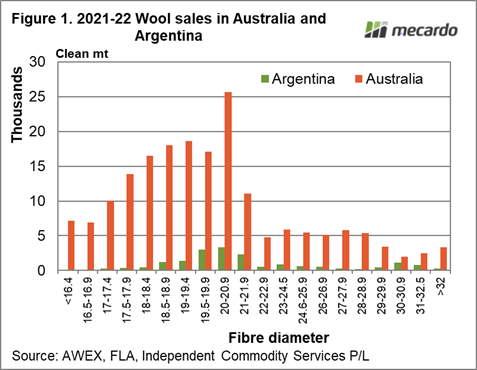

Figure 1 compares Australian wool sales volume and the reported Argentine wool production by Argentine micron categories (note the categories switch from half micron to full micron around 21 micron – hence the spike in the 21 micron volume) for last season. In clean terms the Argentine wool clip was 9.5% of the size of the Australian wool clip (all breeds) in 2021-22, so the Australian clip dwarfs the Argentine clip in most categories.

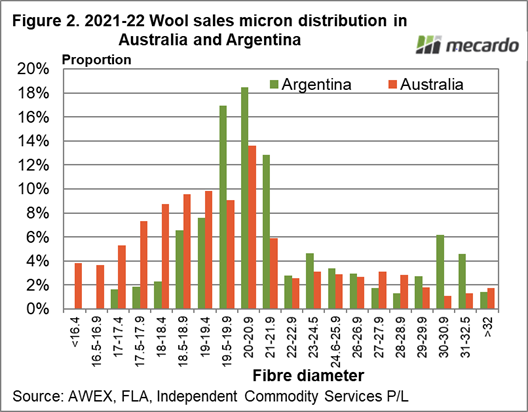

The second schematic, Figure 2, compares the fibre diameter distribution of the Australian and Argentine wool clips. For Argentina 19.5 through 21.9 micron are the big micron categories, with a secondary peak in volume for 30-32.5 micron crossbred wool.

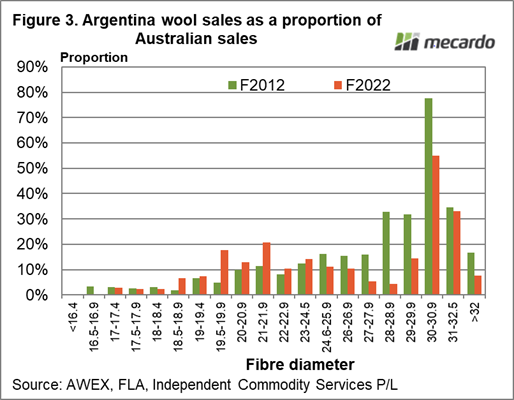

Using the Australian clip as a benchmark, the Argentine wool clip is expressed as a proportion of the Australian wool clip in 2011-2012 and 2021-22 in Figure 3. For the sub-19.5 micron Argentine production is very small (7% and less). In the broader side of the Australian merino production Argentine production is higher accounted for, with 13% to 21% of the 19.5 to 21.9 micron categories. During the past decade the relative proportion of the Argentine clip for 27-29 micron has fallen away, but remains substantial for 30-32.5 micron wool.

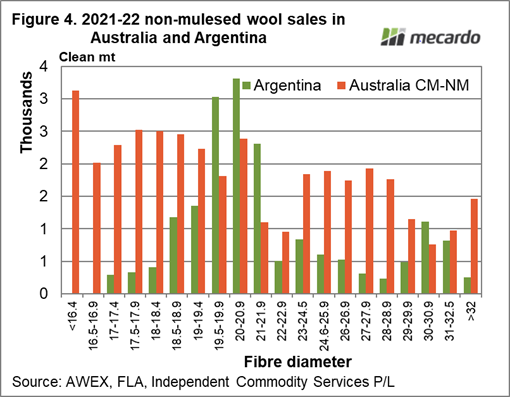

In Figure 4 the exercise is repeated with Australian volumes this time filtered for CM-NM (non-mulesed) accreditation. The Australian supply of CM-NM fine merino wool (sub 19 micron) still dwarfs the Argentine supply. However on the broader side (19.5 through to 21.9 micron) Argentine production exceeds the Australian supply by 63%, with the majority of this wool exported as wool top.

In June Mecardo, using IWTO data, looked at the international supply of quality schemes, in particular RWS, in key merino countries. Overall some 10% of the Argentine clip was accredited as RWS in the 2020-21 season and if this was applied to only the fine (merino) section it lifted the proportion to 25%. Using these assumptions the Argentine supply of RWS accredited 19.5 to 21.9 micron merino wool is 2.5 times that of Australia.

What does it mean?

While demand is always a tricky factor to monitor in markets, even in hindsight, supply is easier to understand and quantify. The development of firstly, non-mulesed accreditation and secondly, quality integrity schemes, as supply factors have complicated the understanding of greasy wool supply. Supply out of the smaller southern hemisphere merino producers is now much more important in light of these factors, as this article shows.

Have any questions or comments?

Key Points

- The Argentine wool clip has been around 10% of the Australian clip in entirety for the past decade.

- If you are a greasy wool procurement manager in the supply chain interested in CM-NM accredited wool then the Argentine clip is of definite interest, especially as a lot of it can be sourced as wool top straight from South America.

- If you are interested in RWS accredited merino wool on the broader side of 19 micron then Argentina is a must include.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: AWEX, FLA, ICS , Mecardo.