Australian grain-fed beef exports are on the rise, having increased by one third in the past decade. The biggest customer of Australian beef - Japan - makes up half of their Australian import volume with grainfed product. Australia’s beef export figures show how much more reliable the grainfed supply has been for our export markets during both a drought recovery and pandemic period.

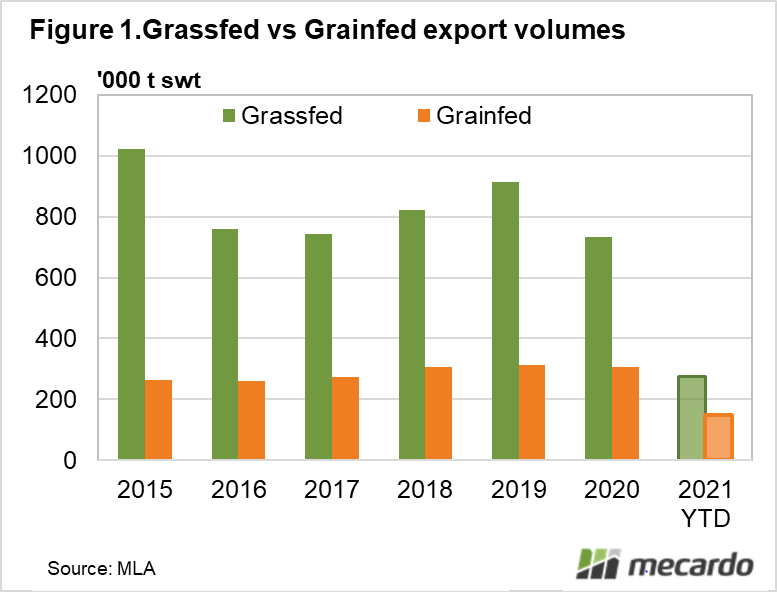

Grain-fed exports fell just 2% from 2019 to 2020, while grass-fed volumes were back 20%. For 2021 so far, total Australian beef exports have fallen 24% year-on-year, with grassfed product losing 31%, and grainfed only back 5%.

Grain-fed beef as a percentage of total exports has been on the increase in the past five years, rising from 25 % in 2016 to nearly 30 % last year, and tracking at 34% for the year-to-date. Grainfed export volumes have been rising year-on-year since 2017, and have climbed 30 % in the past decade, to reach 147,724 tonnes shipped weight last year. This was 30% of all Australian beef headed offshore, and so far this year grainfed product is making up 34 % of all beef exports.

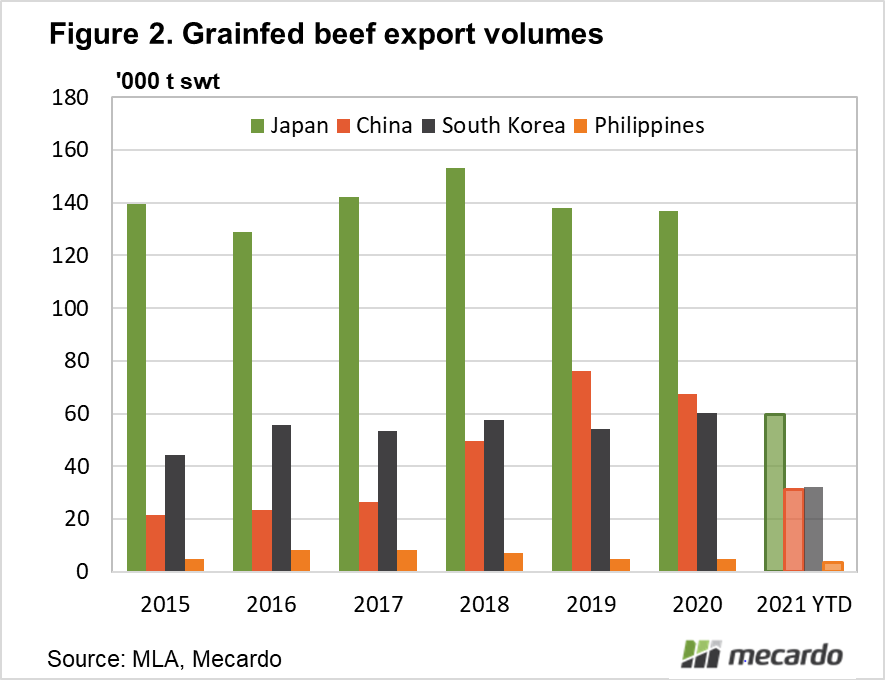

Grainfed exports to Australia’s top three markets have not been hit as hard as grassfed with this year’s supply constraints. Grassfed beef sent to Japan for the year-to-date is down 23%, compared to grainfed, which is just 15 % lower, and China has taken 50 % less grassfed, but only 20 % less grainfed. Grainfed beef headed to South Korea has actually increased significantly so far this year, up 20%, while the volume of grassfed product they have purchased from Australia is down 14 %.

Japan has long been Australia’s biggest beef customer, taking roughly a quarter of all exports for the past five years. Prior to that, and the rise of the Chinese protein demand, Japan was receiving up to 42 % of Australian beef (2006). Japan has also been Australia’s largest grainfed customer for the past two decades. Grainfed makes up 50 % of all Australian beef sent to Japan, and last year Japan received 44 % of Australia’s total grainfed beef export volume. At 136,824 tonnes shipped weight, this was the lowest volume of grainfed beef Australia has sent to Japan since 2014 – but only 1 % lower year-on-year. This year, total beef exports to Japan have dipped 19 %, with grainfed exports down 15 %.

What does it mean?

Australia’s grainfed beef export market is growing in-line with the growth of the domestic lotfeeding industry, and the year-to-date data so far in 2021 goes a long way to showing how crucial the product is to maintaining supply to our largest customers.

The top three grainfed beef export markets are also proving the most lucrative, with Japan, China and South Korea having the highest beef export value for Australia for the first quarter of 2021. Competition for the lucrative Japanese grainfed market is one to watch however, with the US closing in on Australia for majority market share, and a backlog of cattle in their lotfeeding system due to processor shutdowns during Covid-19.

Have any questions or comments?

Key Points

- Australian grain-fed beef exports have risen 30% from 2010 to 2020, with 25% of that rise occurring in the past five years.

- Grain-fed product made up close to 30 % of all Australian beef exports last year, and has accounted for 34 % for the year-to-date.

- Japan is Australia’s largest grain-fed beef customer, taking close to half of the total annual volume.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: Mecardo; Meat & Livestock Australia