While cattle markets here have been in decline for much of the last year, things have turned around in the US. Following drought and herd liquidation, cattle markets have tightened significantly, and this spells upside for producers if supply can ease.

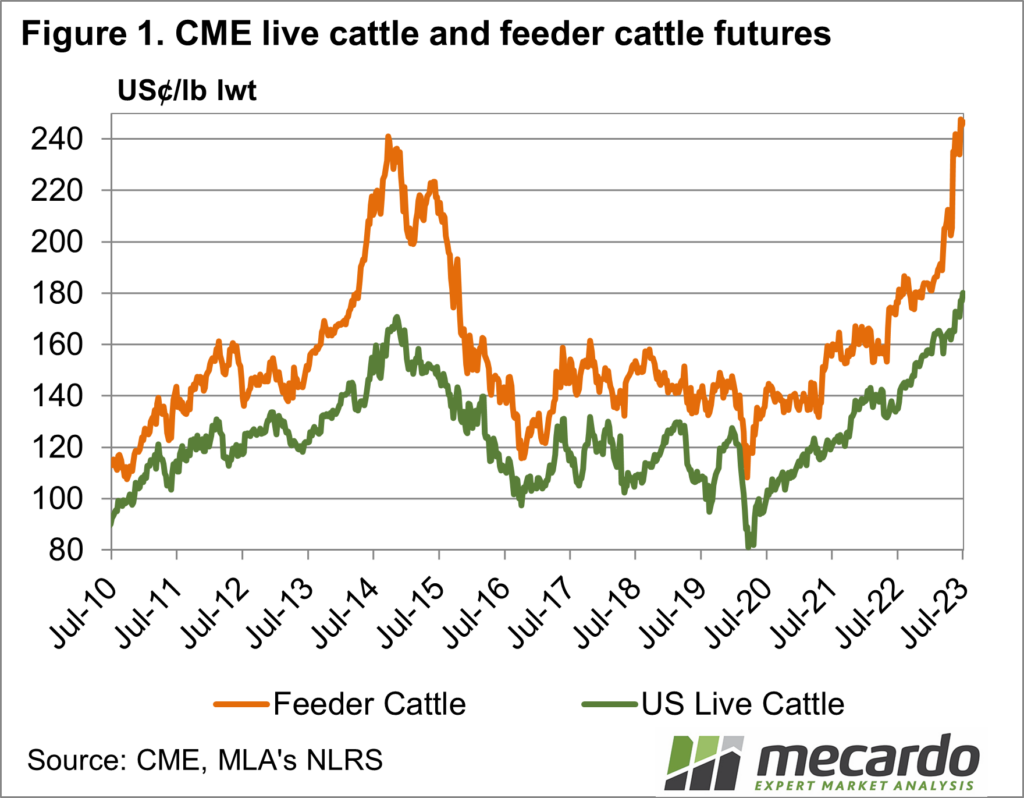

Regular readers will know we’ve been talking about global beef prices having a bullish bent for much of 2023. In the last three months, things have really taken off. Figure 1 shows CME Feeders and Live Cattle Futures, which have reached new record highs in the last week.

Live cattle futures, which are equivalent to a heavy grainfed steer, are up 31% on this time last year. Feeder cattle futures are up 36%. The rally has been quite exceptional.

The US cattle herd has been in decline for the past few years, with drought across much of the breeding area seeing heavy liquidation and lower prices. Here we had protection from lower global prices with the extremely tight local supply.

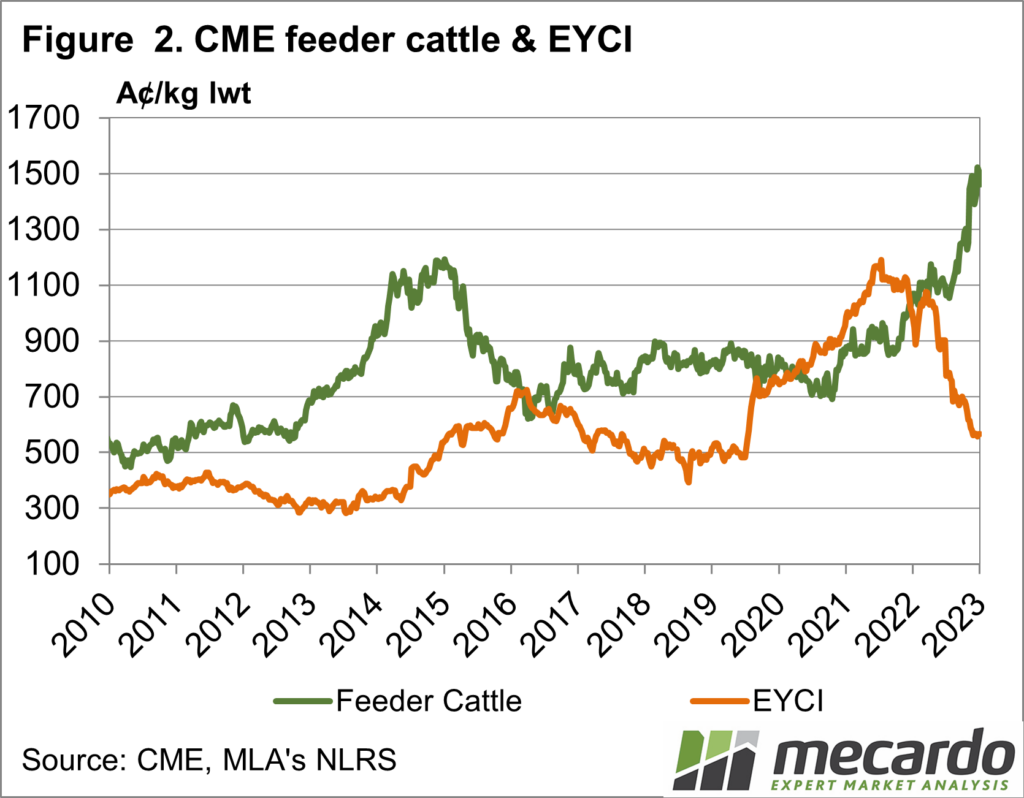

Figure 2 shows CME Feeder Cattle Futures and the Eastern Young Cattle Indicator. These two markets almost seem like a mirror image in the last 12 months, remarkable when prices are supposedly related in theory.

The US is one of the world’s largest producers and consumers of beef and is both a major customer of and competitor with Australian beef producers. The last time the US market rallied like this, in 2014, local drought meant we didn’t ever catch up, at least until US prices had come off their peaks.

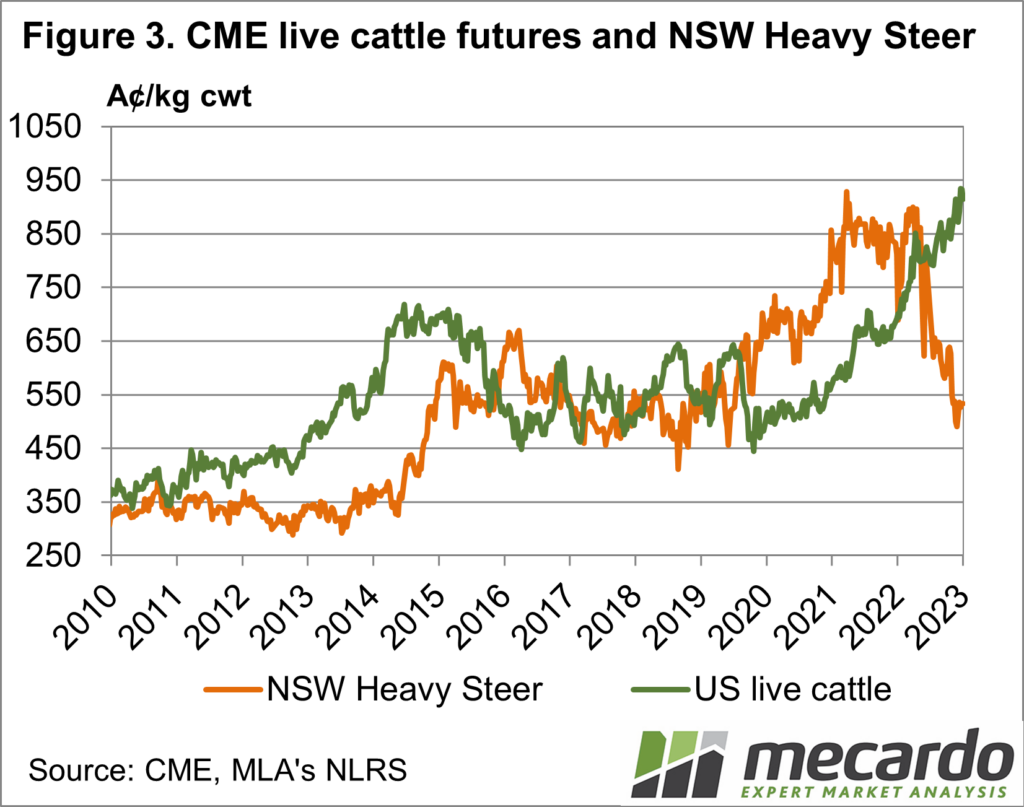

Figure 3 shows a similar picture for CME Live Cattle and NSW Heavy Steers. Prices here have weakened significantly, despite the rally in the US. Australian cattle have gone from very expensive relative to the US to extremely cheap in the space of 18 months.

The fact that Australian cattle are now cheap in international markets means further downside is limited, as long as seasonal conditions don’t deteriorate into full-blown drought.

What does it mean?

For Australian cattle producers to take advantage of record US cattle values either local supply has to tighten, or more slaughter space needs to be created. While east coast slaughter is currently running at a three-year high, it was 30% higher than it currently is in 2019. The capacity to lift rates is likely there if labour can be found.

Have any questions or comments?

Key Points

- US Cattle Futures hit record highs last week as supply tightens.

- Australian cattle prices are moving in the opposite direction due to strong supply.

- Cattle prices should find support and possible upside if more slaughter space is created.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: CME, MLA, Mecardo