With Canola trading at close to $1,100 / MT in China, and Australian shipments out of WA, SA and Victoria starting to make headway into the Chinese market again after a long hiatus, the future looks bright for Australian Canola as we regain market access, and Canada faces increasing biosecurity headwinds.

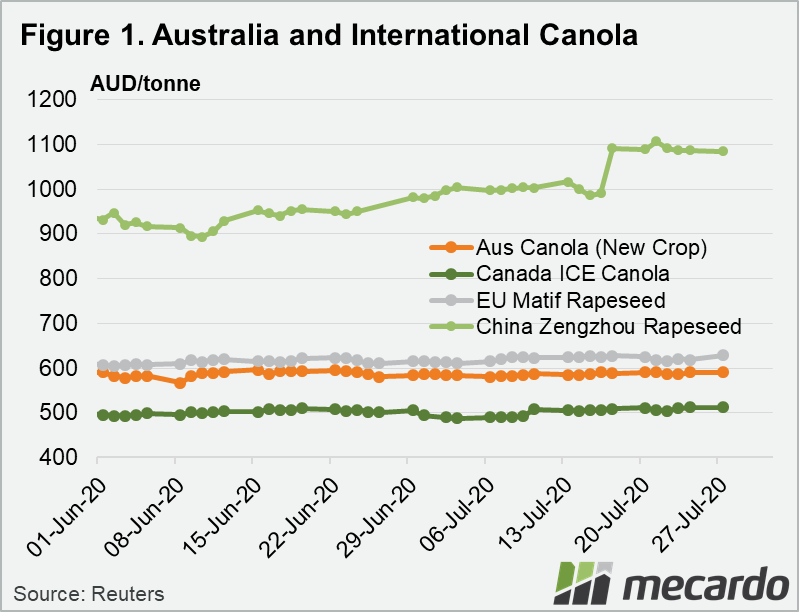

Over the past week, Canola futures prices in China has seen a strong rally, climbing more than 10%, to $1081AUD/MT, and is up more than 15% from the start of June (Figure 1).

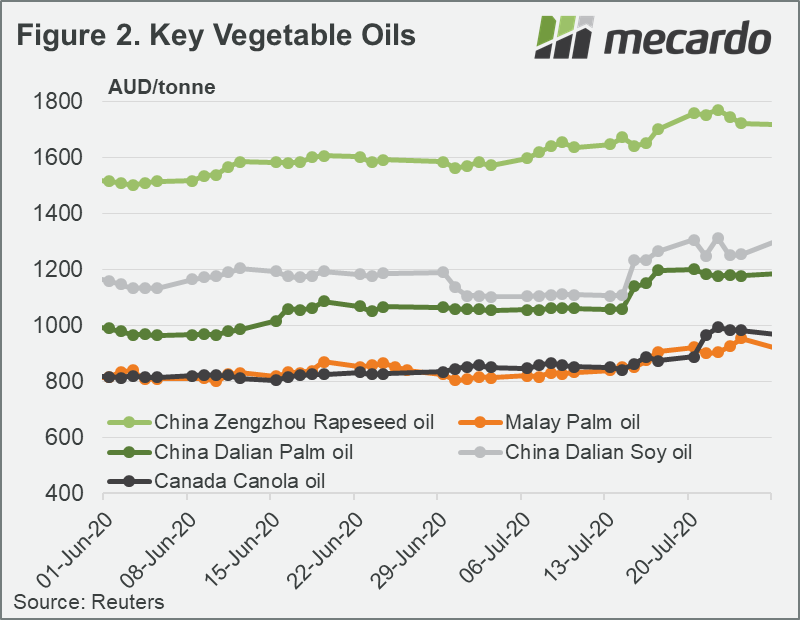

One of the key drivers behind the Canola rally has been substantial concerns in vegetable oil markets about COVID-19 related labour shortages in Malaysia, which supplies 26% of the world’s palm oil production.

Last week, the Malaysian Palm oil Association announced a forecast that the labour shortages caused by movement restrictions on Indonesian and Bangladeshi guest workers could reduce production by as much as 25%. This triggered a sharp rally in palm oil prices, dragging up other edible oils in its wake. Longer-term consequences are also possible as palm plantations are similar to other permanent cropping systems like vineyards and orchards, requiring careful manual pruning by skilled labourers each season to maintain productivity.

The large 25% spread between Malaysian Palm Oil prices and those within China on the Dalian exchange are suggestive of constrained supply of vegetable oils into the Chinese market, with the story even more extreme in rapeseed, or canola oil, with Chinese prices 70% above their Canadian equivalent (Figure 2).

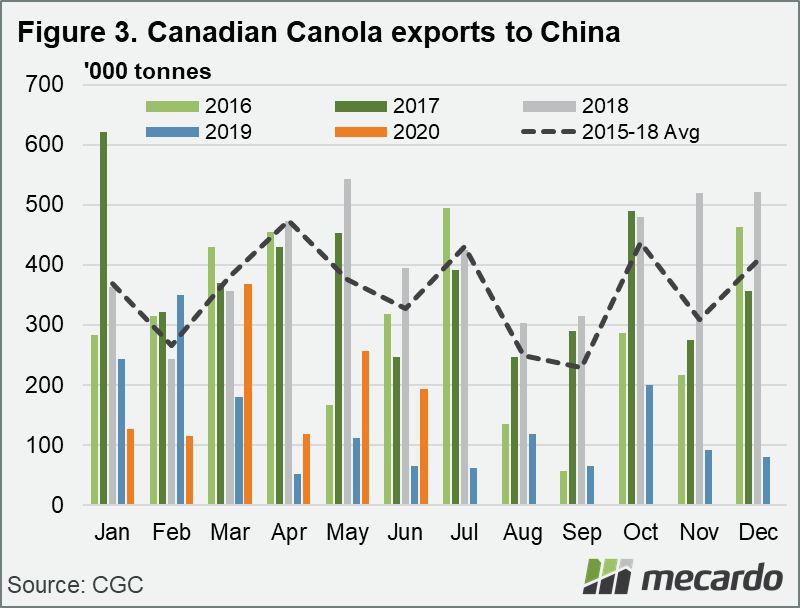

Since March 2019, Canadian canola has been subject to new, stricter Chinese biosecurity measures due to trade & political disputes, resulting in a decrease in export volumes from 4.8mt in 2018, down to just 1.5mt in 2019 (Figure 3). However, since March 2020, access restrictions were further increased, requiring less than 1% dockage, or impurities in shipments. Canada’s total export volumes have reduced 15% as a result, and some displaced canola has been redirected to Japan and the EU. The reduced Canadian export volumes to China, and higher prices have opened up space for new exporters to take market share.

Shipping and customs data indicate that since June 2019, 590,000 MT of Australian Canola has been exported to China. Most shipments have been from WA ports, but significant volumes have also been dispatched from SA and Victoria. Volumes were negligible prior to this, possibly signaling the start of a new period of renewed access and penetration into the lucrative Chinese market.

What does it mean?

The massive $500+ spread between the price of canola in China, and in Australia offers a huge opportunity for Australian exports of Canola. With shipments beginning to be well received by China, and Canada hobbled by biosecurity restrictions, a new era of positivity for Australian Canola exports, and potential to capture substantial premiums may emerge.

Have any questions or comments?

Key Points

- Canola is currently trading at $1071/MT on the Zengzhou exchange

- Australian shipments of canola into China are gathering momentum

- Canadian exports into China are subject to further biosecurity import requirements.

Click on graph to expand

Click on graph to expand

Click on graph to expand

Data sources: Reuters, ABARES, Canola Council of Canada, Canadian Grain Commission, Mecardo