Today’s article is in response to a reader request for percentile analysis of crossbred wool by micron as done for merino wool last week. In this article we look at price levels, and the price differences for full length crossbred fleece by micron from 25 to 35 micron.

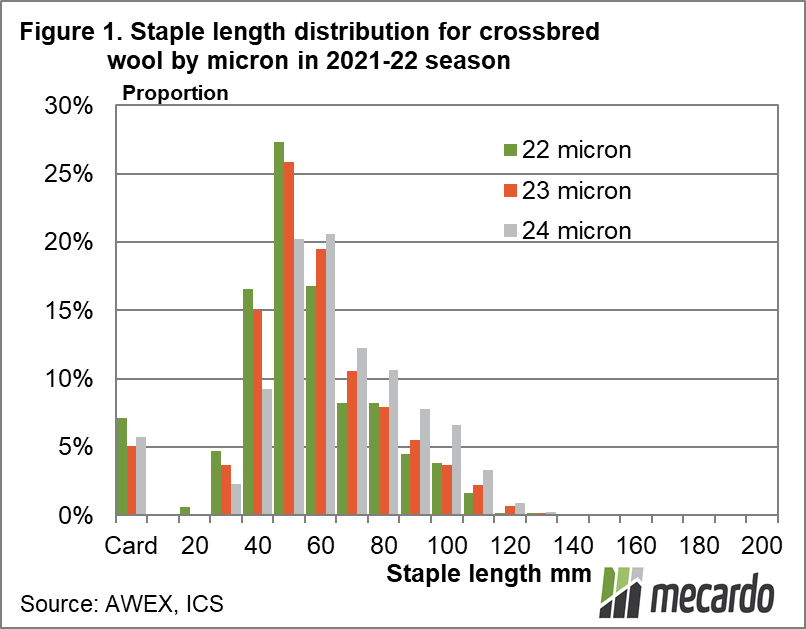

The original request asked for the various crossbred micron category price differences to 22-23 micron be looked at, that is the discount by micron from the finer edge of the crossbred micron distribution. While a reasonable request, it raises some practical problems as most of the finer crossbred wool is lamb wool and consequently has a short staple length. Figure 1 shows the staple length distribution for crossbred wool (22 to 24 micron) sold last season, with 10 mm increments in the staple length (note cardings where no staple length is estimated is set to zero and is denoted as Card in the graphic). The main staple length is in the 50-60 mm range, with only 10% of crossbred 22 micron wool in the 90 mm and longer lengths. As the fibre diameter broadens the proportion of long wool increases but remains at low levels for the 22-24 micron categories.

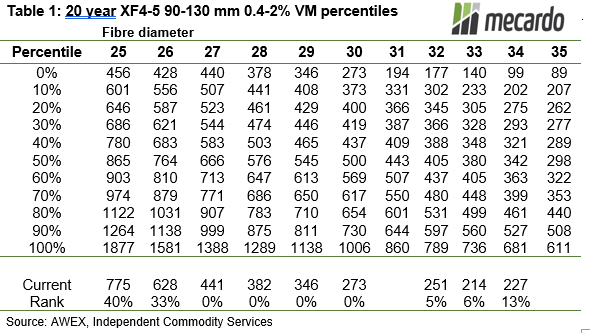

Table 1 provides a percentile table for eastern Australian (there is not much produced in the west) 90-130 mm length crossbred fleece (0.4 to 2% vegetable fault), along with the prices from last week (first week of November 2022) and the weekly price rankings. It is not a pretty story with rankings from 27 micron and broader generally being at their lowest levels in decades or close to it.

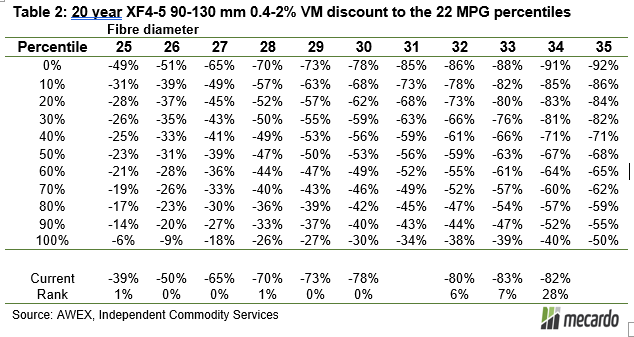

As Figure 1 shows, there is not much 90-130 mm length fine crossbred wool produced, so the 22 MPG has been used as the base price series instead when calculating discounts by micron category. Table 2 shows the percentile breakup for the past two decades of discounts by micron to the 22 MPG. The issue with using the 22 MPG is that it is a merino index. Typically (but certainly not always) a 22 micron crossbred fleece will sell for around 90-95% of 22 micron merino. However this basis can range up to parity and down to 85%. On the positive side the 22 MPG is regularly quoted and is a more stable base for calculations than the infrequent 22 micron full length crossbred fleece.

The story from Table 2 is similarly dismal as Table 1, with the percentage discounts nearly all tracking close to 20 year lows.

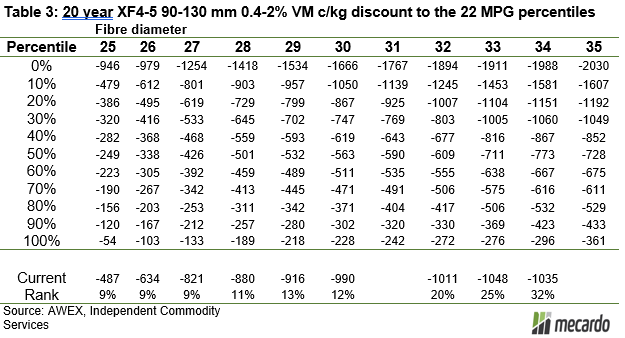

Table 3 repeats the exercise of Table 2, in cents per clean kg terms. The ranking for current discounts are marginally better for the 25 to 30 micron categories, and pick up for the broader 32-34 micron categories. Discounts for crossbred fleece are generally extremely wide, reflecting very cheap price levels for crossbred wool relative to merino prices and also to manmade fibre prices.

What does it mean?

Todays’ fresh examination of the data confirms the view that crossbred prices are in the doldrums, at depressed levels. For anyone thinking the low percentile rankings is an indicator of higher prices to come, keep in mind that percentiles have no forecasting ability. It would be very good if they did. So, yes, crossbred prices will improve at some stage but we do not know when. Weaker fine merino prices may help as there has been a negative correlation between fine merino premiums and crossbred discounts during the past decade.

Have any questions or comments?

Key Points

- Price levels for crossbred fleece from 27 micron and broader are at or close to 20 year lows.

- The price discounts for full length crossbred fleece compared to the 22 MPG are also at or close to 20 year lows in percentage terms.

- In cents per kg terms the discounts for 32-34 micron are trading at an appreciably higher rank (20th to 30th percentile).

Click on figure to expand

Click on figure to expand

Data sources: AWEX, ICS