It was nearly a month ago when we last looked at the wet weather impacts on price spreads in the grain market. Harvest has started in the north, but it hasn’t gotten any drier for much of the east coast. It’s worth another look at how the milling and feed wheat market is performing.

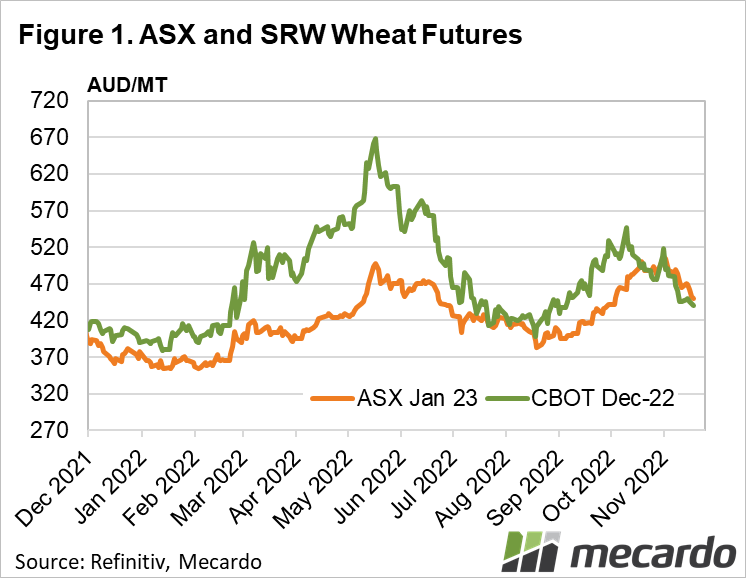

We’ll start with the international market. As outlined in the weekly comment on Friday, international wheat prices have been on the slide as some certainty around Black Sea supplies was attained. Figure 1 shows that in our terms, Chicago Soft Red Wheat (SRW) has fallen around $80/t since mid October, and now sits at $445/t.

Despite the constant rain, and lack of harvest pressure, ASX Wheat Futures have eased in line with SRW in the last fortnight. ASX Wheat is a delivered east coast APW specification, and the market is still expecting a reasonable supply of this in at least one of the Port Zones from Northern NSW down to Victoria.

Delving a bit deeper, it seems ASX wheat is priced at Newcastle at the moment, at $445/t. Geelong is a little stronger at $456/t, SA ports at $460 and Port Kembla, the worst affected by the weather, at $472/t at the end of last week.

The fact that APW is only at a small premium to SRW suggests the market is yet to get too concerned about meeting delivery deadlines. There is still time for the weather to dry out and grain to flow, but there is certainly a risk of a sharp increase in Australian prices relative to SRW.

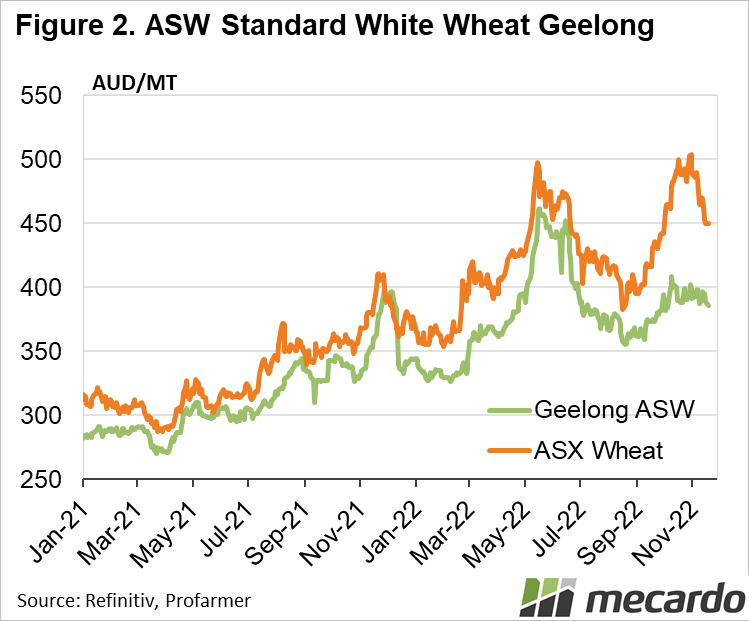

Figure 2 shows that low protein wheat, in this case ASW, didn’t enjoy the spike towards $500/t, and hasn’t fallen with the recent decline either. With supplies of weather affected wheat and feed wheat still expected to be very strong once headers finally get rolling, ASW has remained steady, at a strong discount to both ASX Wheat Futures, and SRW Futures.

Feed wheat prices, that is SRW, and SRWR in Victoria, have held at a around a $20 discount to ASW. A wet harvest will generally see a large spread open up, but it seems the fact that ASW is already at a heavy discount to international values means feed wheats can’t get much cheaper.

What does it mean?

Harvest is underway, with Graincorp reporting strong receivals in Queensland, and a start in NSW and Victoria, but it’s going to be drawn out this summer. Delivery deadlines will impact short term pricing, and create opportunities for milling wheats if the wet weather continues. Feed wheat upside seems unlikely, with downside requiring further falls in international markets.

Have any questions or comments?

Key Points

- Local APW prices have eased with falling international values in recent weeks.

- ASW and feed wheat remain at a heavy discount to both APW and international pricing.

- Delivery deadlines could see spikes in milling wheats, feed upside is limited.

Click on figure to expand

Click on figure to expand

Data sources: Reuters.

Photo Credit: Julia Pearse- ” Adam’s Farm gate”