This week we take a look at the gross value, volume, and price of fine merino wool sold in the first half of this season. The fall in price levels for fine merino since mid-2022 tends to cloud the view of the fine wool market unfairly.

In May 2021 Mecardo looked at the relationship between price, volume, and gross sale value (GSV) for broad and fine merino wool. In this article, we focus on the sale results during the first half of the season for fine merino wool (18 micron and finer).

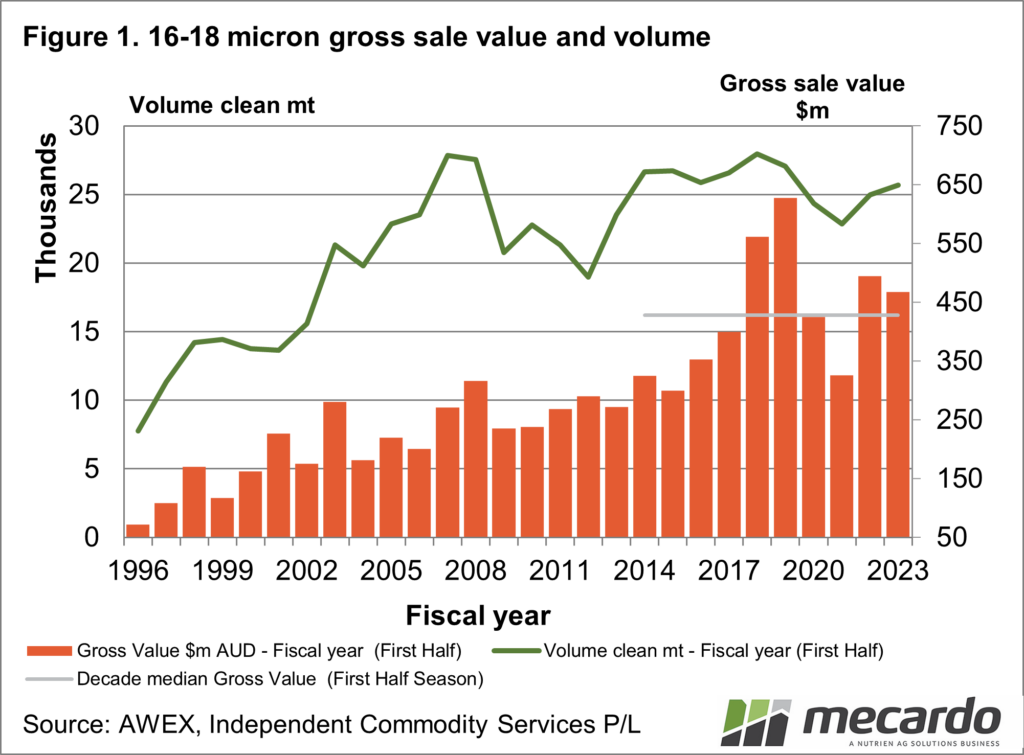

Figure 1 shows the volume (line) and GSV (bars) for 16 to 18 micron wool for the first half of the season (July to December) from the mid-1990s to the current season. In addition, the average GSV for the past decade is superimposed over the graph. The 16 to 18 micron category takes in all wool of these micron categories sold at auction and the dollar amounts shown are in Australian dollar terms.

The volume line in Figure 1 has been relatively steady for the past decade, consistent with the average merino fibre diameter stabilising a decade ago after trending lower from the early 1990s onwards. However, the gross value has been quite volatile during the past decade with high levels in the 2018 and 2019 seasons and a pandemic-induced low in the 2021 season. Keep in mind micron at that volume has been relatively steady for the past decade, the GSV for the first half of this season was the fourth highest of the past 28 seasons shown. Gross receipts for 16-18 micron for this season are tracking at high levels.

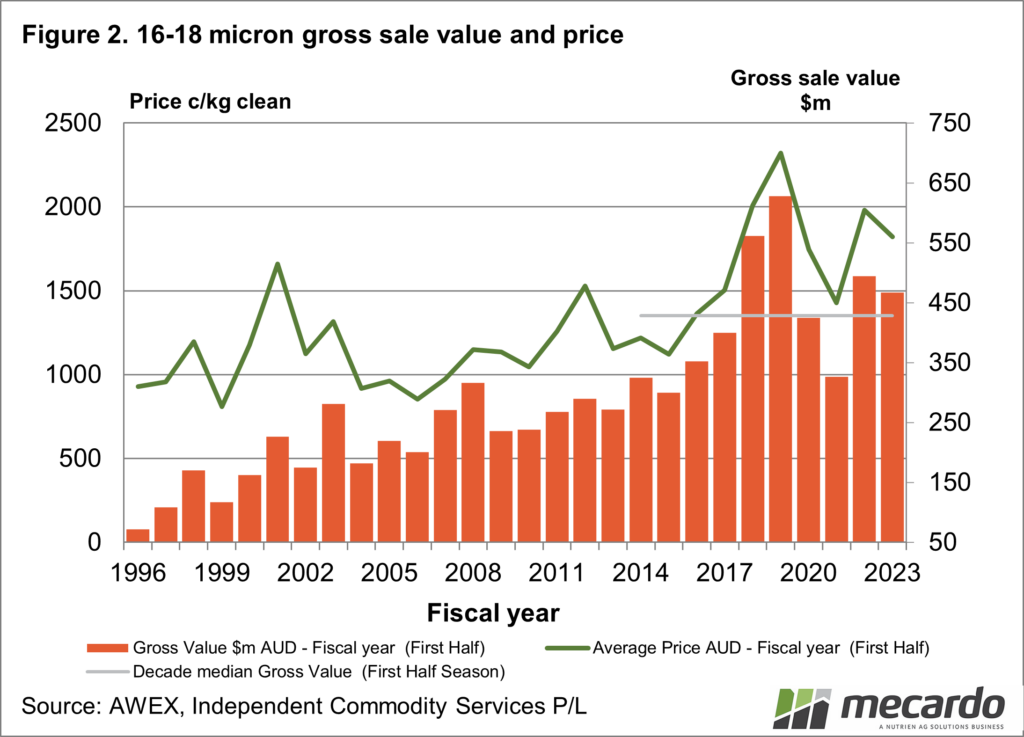

In Figure 2 the volume series is swapped for an average price series (all categories of wool in the 16 to 18 micron range). Whereas the GSV for 16-18 micron has very little correlation with volume during the past decade it has a very high correlation with price, which implies that the demand side of the market is a key driver of the GSV.

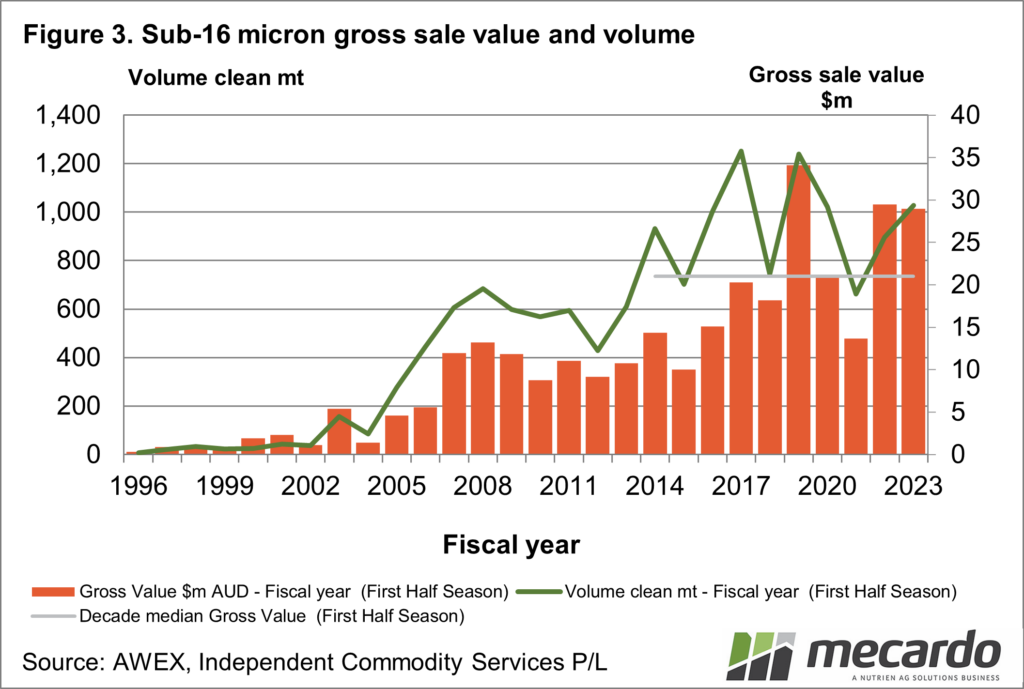

To round out the look at GSV for fine merino wool, Figure 3 repeats the format of Figure 1 for sub-16 micron wool (anything finer than 16 micron sold at auction). The remarkable rise in volume from around 25 tonnes clean per season in the 1990s (hence the massive prices at the time) to anywhere between 700 and 1200 tons clean per season is the standout change. With the rise in volume, there has come a rise in GSV, although this remains relatively small, with a peak of around $30-35 million Australian dollars. While volume is volatile when viewed season to season, the trend in volume looks to have steadied a decade ago. This is in line with other changes in fibre diameter and micron volumes seen in the Australian merino market. Note that the sub-16 micron categories enjoyed their third highest GSV in the first half of this season.

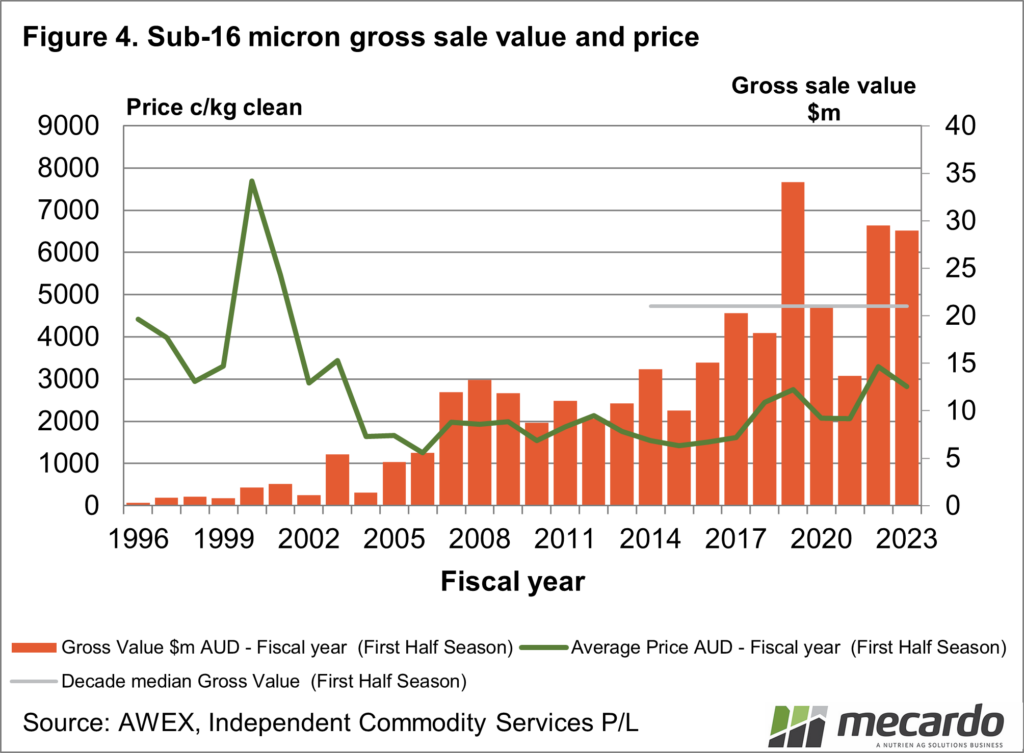

Figure 4 swaps out the volume for the average sub-16 micron price (all categories). Once again price is more strongly correlated to GSV than volume.

What does it mean?

Lower price levels for fine merino wool since mid-2022 have tended to colour perceptions about the state of the fine merino wool market. Gross sale values for the first half of the season, when compared to the past decade show a different story, with the sales value of fine merino tracking at high levels.

Have any questions or comments?

Key Points

- Gross sale receipts for 16-18 micron wool in the first half of this season were the fourth highest on record.

- For sub-16 micron wool gross receipts were the third highest on record.

- Increased volumes have helped to push prices lower (leading to a natural human reaction of disappointment) but the GSV levels are excellent.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: AWEX, ICS, Mecardo