With the export beef market again on the up, history tells us that our cattle prices should be following. Local supply is the issue, and the latest lotfeeding numbers add to the view that there are a lot more cattle waiting for slaughter.

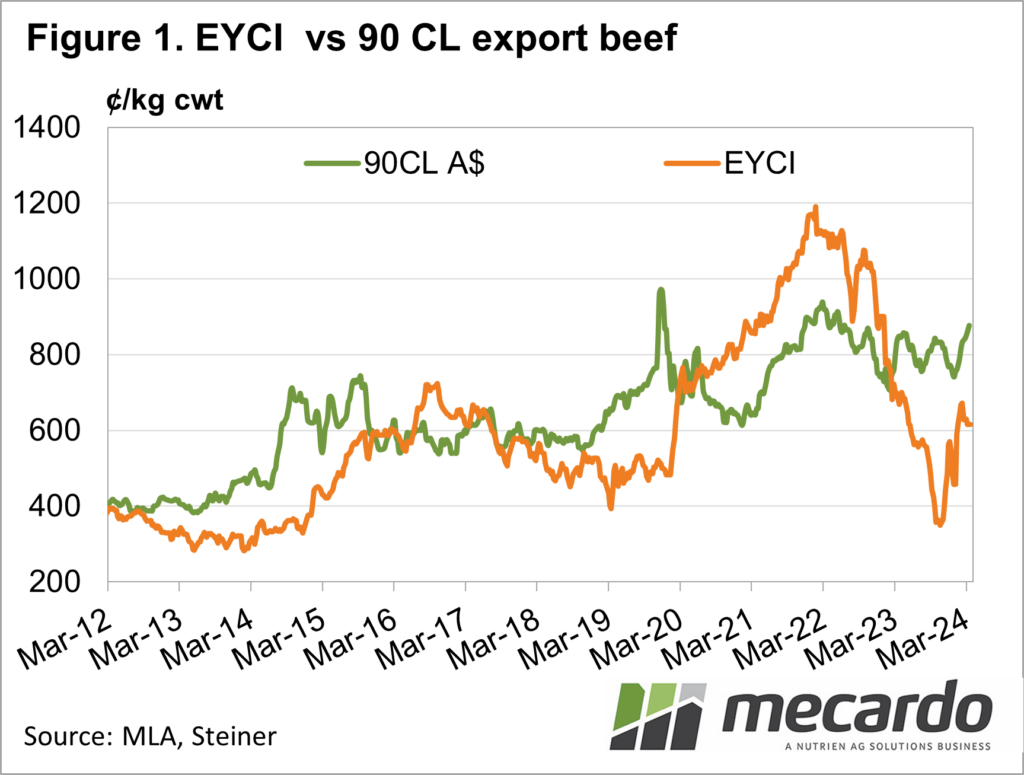

Friday’s

market comment (read

here) looked at the rising price of

90CL export beef prices, which are headed back towards 900¢/kg swt. We know that a herd rebuild is underway in

the US and that tightening supply is driving cattle and beef prices, which then

flows into our export values.

We have

seen this before. Way back in 2014, we saw

a price surge in the US, and prices here remained flat at weaker levels. Figure 1 shows it took until the end of 2014

for the local price rally to start, and it continued for nearly two years, despite

export prices coming off peaks.

Figure 1

shows we have already seen a very strong rally in local prices from the depths

of last spring. We need to take a look

at supply trends to see if there is more to come.

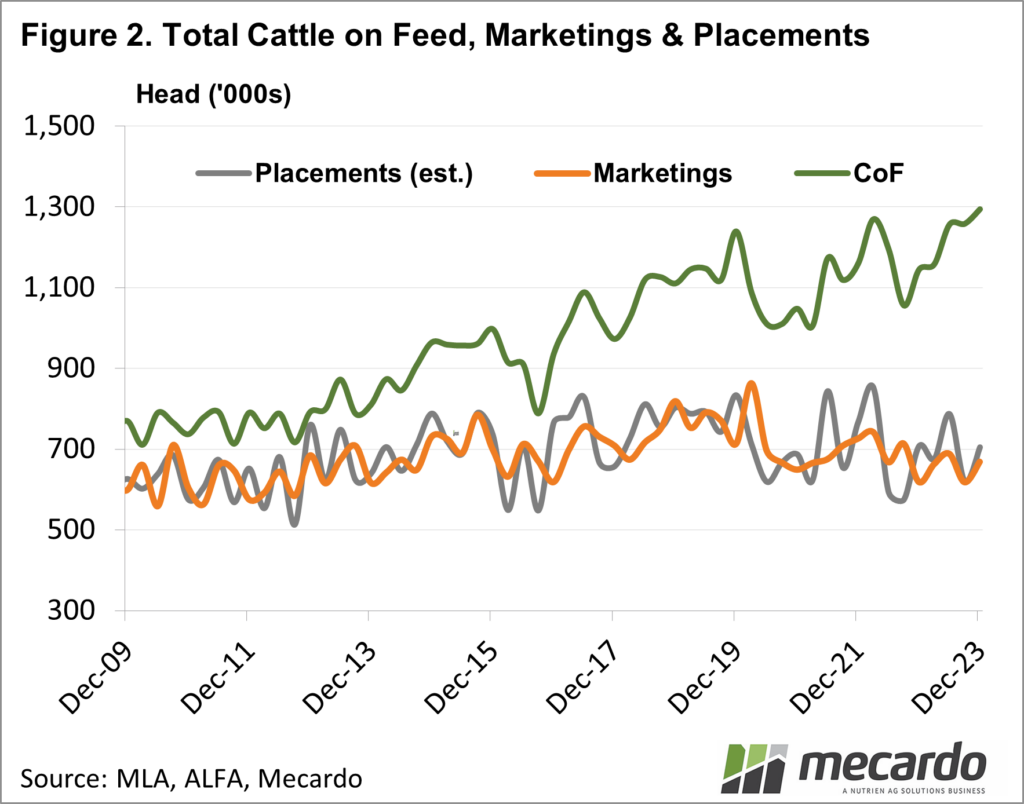

Grainfed

cattle are now a massive component of local supply. Historically, when grass conditions have been

good, as they have over the past three years, the numbers of cattle on feed

decline as feeder cattle become expensive.

Figure 2

shows a decline in cattle on feed in 2020, but this was partly due to Covid

uncertainty. Since then, the number of

cattle on feed has largely been on the rise, reaching a new high in December. Marketings have been consistent at around

700,000 head per quarter, but with the high number of cattle on feed in

December, we would expect marketing in the current quarter to have been strong.

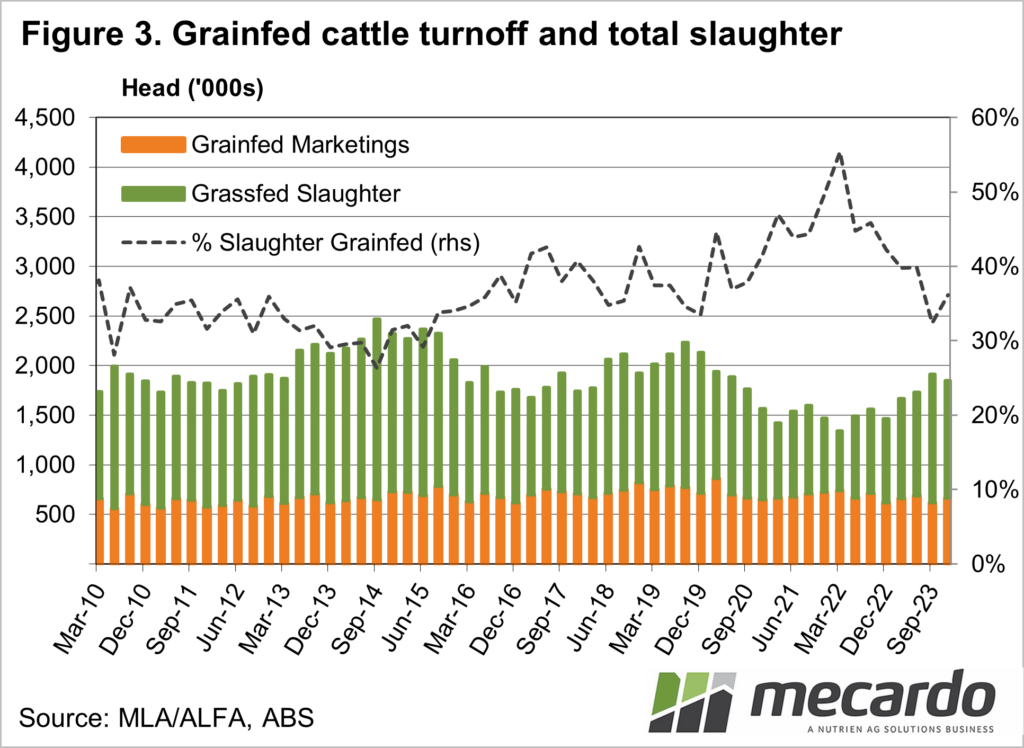

Grainfed

cattle bolstered supply during the herd rebuild, as shown in Figure 3. With grainfed cattle consistently accounting

for more than 45% of all cattle slaughtered.

The influx of grassfed cattle post-herd recovery, and the fact that grainfed

numbers remain strong are boosting supply and depressing prices.

What does it mean?

The strong cattle on feed numbers will take some time to flow through the market. This could limit winter price rises, as grainfed cattle make up for any shortfall, as we would traditionally see from June to September.

Strong price rises will require either increased slaughter space or tightening grassfed cattle supplies. With the herd at strong levels, significant supply tightening seems unlikely in the short term.

Have any questions or comments?

Key Points

- Local cattle prices are at a strong discount to international cattle and beef export prices.

- Heavy supplies of grainfed cattle appear to be keeping a lid on cattle values.

- The strong herd population will stop any significant tightening of supply.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: ABS, MLA, Mecardo